Iron-ore giant Fortescue Metals Group Ltd. sold $1.5 billion in bonds that include a portion earmarked to benefit the environment, the latest effort by its billionaire founder Andrew Forrest to pivot into the booming green market.

The Australian miner, through its FMG Resources (August 2006) Pty Ltd. unit, tapped the U.S. high-yield market with a two-part bond deal on Wednesday, according to a person with knowledge of the matter.

The 10-year tranche is a $800 million green bond, said the person, who asked not to be identified as the details are private. It’s the first such debt from the company and the biggest dollar-denominated green junk bond tranche since early December, according to data compiled by Bloomberg.

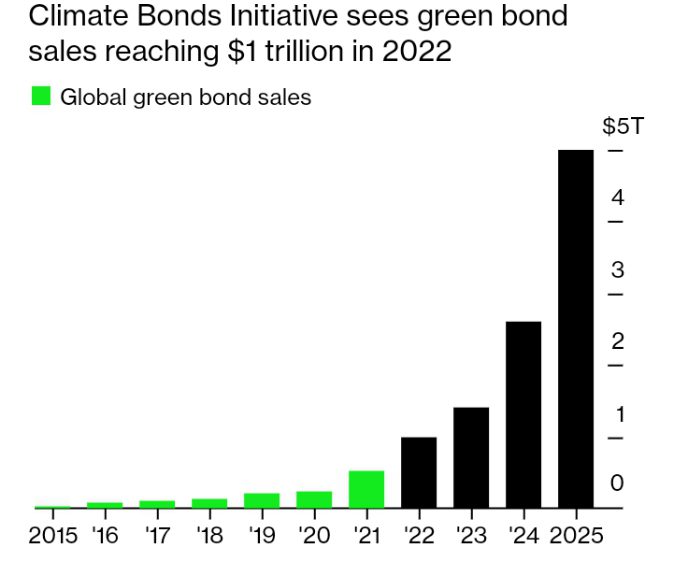

Climate Bonds Initiative, a London-based organization that sets green-bond standards, estimates annual sales could reach fresh highs of between $900 billion and $1 trillion by the end of this year — and as much as $5 trillion by 2025.

Read Also: Germany to buy Israeli or US Missile Defence System

This site has an abundance of useful information that is easy to understand. Thanks for all that you do.

Thank you so much and we are glad that you find our article very helpful