Why Gap Insurance is a Must-Have for Car Owners

Gap insurance, also known as Guaranteed Asset Protection, is a type of insurance policy that protects you from financial loss in the event of a total loss of your vehicle.

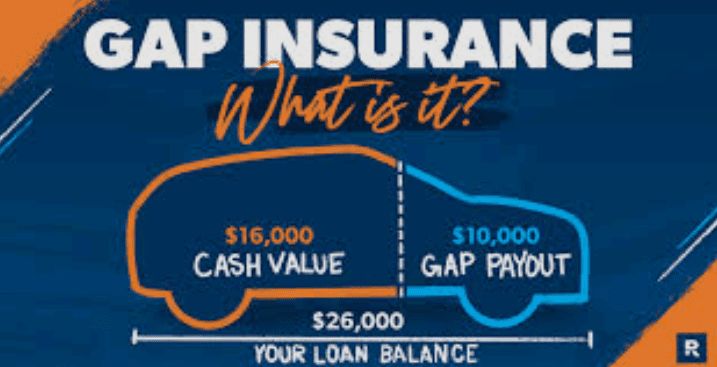

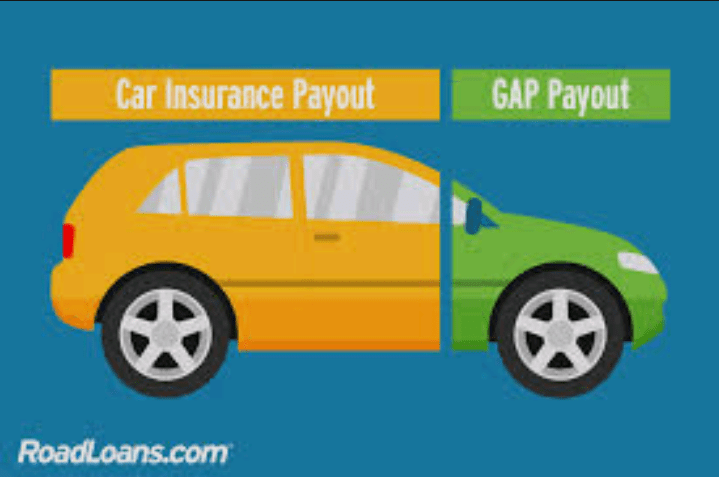

Gap insurance covers the difference between the actual cash value of your car and the amount you still owe on your auto loan. This type of coverage can be particularly helpful if you owe more on your car than it is worth, as is often the case with new cars.

Gap insurance is typically offered as an add-on to your car insurance policy, and is not required by law. However, it can provide an extra layer of protection and peace of mind if you are financing your car.

Gap insurance can be especially important if you have a long-term loan, as the value of your car can depreciate rapidly, leaving you with a gap between what you owe and what the car is worth.

So, how does gap insurance work? Let’s say you just bought a new car for $30,000 and put down a $5,000 down payment, leaving you with a loan balance of $25,000. A year later, you get into an accident and your car is totaled.

At the time of the accident, your car is worth $20,000, leaving you with a gap of $5,000 between what your car is worth and what you still owe on your loan. If you have gap insurance, your insurance company will cover the $5,000 gap, and you won’t be responsible for paying it out of pocket.

It’s important to note that gap insurance only covers the amount you owe on your car loan, not any additional expenses, such as late fees or past-due payments. Gap insurance also won’t cover any deductible you may have to pay if you file a claim.

There are a few things to consider when deciding if gap insurance is right for you. If you paid a large down payment, or if you have a short-term loan, you may not need gap insurance. Additionally, if you lease your car, gap insurance may be included in your lease agreement.

However, if you are financing a car and owe more than it is worth, gap insurance can provide valuable protection.

When shopping for gap insurance, be sure to compare rates and coverage options from different providers. Some car dealerships may offer gap insurance, but it’s often more expensive than purchasing it through your auto insurance provider.

Be sure to ask questions and understand what your policy covers and what it doesn’t, so you can make an informed decision.

Gap insurance can provide valuable protection if you are financing a car and owe more on your loan than the car is worth. It can help you avoid financial loss in the event of a total loss of your car, and provide peace of mind knowing that you are covered.

If you are considering gap insurance, be sure to do your research and compare rates and coverage options from different providers to find the policy that’s right for you.

Read Also: Want to Grow Your Business? You Need a Growth Strategy

Gap Insurance Policy

Gap insurance is a type of insurance policy that covers the difference between the amount you owe on a vehicle and its actual cash value in the event of an accident.

This type of insurance can be a smart investment for those who are financing a new or used car, as it can provide peace of mind and financial protection in the event of a total loss.

When you purchase a new or used vehicle, it begins to depreciate in value the moment you drive it off the lot.

If you are involved in an accident and your car is deemed a total loss, your insurance company will only pay out the actual cash value of the car at the time of the accident. This amount is often less than what you owe on the vehicle, particularly if you have only recently purchased it.

This is where gap insurance comes in. Gap insurance covers the difference between what you owe on the car and its actual cash value, which can save you from having to pay thousands of dollars out of pocket to pay off your car loan.

There are a few different types of gap insurance policies available, including those offered by your car dealership, your auto insurance company, and independent insurance providers.

It is important to shop around and compare policies and rates to ensure you are getting the best coverage for your needs.

Gap insurance is particularly important for those who are financing a new or used car with a small down payment or a long loan term. These factors can increase the amount you owe on the car, making it more likely that you will owe more than the car is worth in the event of an accident.

It is also worth noting that gap insurance is not required by law, but it can be a smart investment for those who want to protect their financial investment in a vehicle.

However, it is important to carefully read the terms and conditions of any gap insurance policy before purchasing it, as there may be exclusions or limitations to coverage.

Gap insurance is a type of insurance policy that can provide financial protection for those who are financing a new or used car.

It covers the difference between what you owe on the car and its actual cash value in the event of a total loss, which can save you from having to pay thousands of dollars out of pocket.

While it is not required by law, it can be a smart investment for those who want to protect their financial investment in a vehicle.

Gap Insurance Claim Processing

Gap insurance, also known as Guaranteed Asset Protection insurance, is a type of insurance coverage that pays the difference between the amount you owe on a car loan or lease and the actual cash value (ACV) of the vehicle if it is totaled or stolen.

Gap insurance can be helpful for individuals who owe more on their car than its actual value, as it can help cover any financial gaps that may arise in such situations.

When it comes to processing a Gap insurance claim, there are a few important steps that you should follow to ensure a smooth and efficient process.

Step 1: Report the Incident

The first step in processing a Gap insurance claim is to report the incident to your insurance company. This should be done as soon as possible after the incident occurs, as there may be certain time limits that apply to filing a claim.

When you report the incident, be sure to provide your insurance company with all the necessary information, including the date and location of the incident, a detailed description of what happened, and any relevant documentation, such as police reports or witness statements.

Step 2: Provide Proof of Insurance and Ownership

Once you have reported the incident, your insurance company will likely require you to provide proof of insurance and ownership of the vehicle. This may include your insurance policy documents, registration papers, and any other relevant documentation.

Be sure to provide this documentation as quickly as possible, as delays in providing this information can slow down the claims process.

Step 3: Wait for the Insurance Company’s Assessment

After you have provided all the necessary information and documentation, the insurance company will assess the claim and determine the amount of the settlement. This may involve an inspection of the vehicle, a review of the policy, and other factors.

It is important to note that the insurance company will typically only pay out the ACV of the vehicle, which may be less than the amount you owe on your loan or lease. Gap insurance will cover the difference between the ACV and the amount you owe, up to the policy limit.

Step 4: Submit the Claim to the Gap Insurance Provider

Once the insurance company has determined the amount of the settlement, you will need to submit the claim to your Gap insurance provider. This may involve providing documentation of the insurance settlement, as well as any other relevant information.

Once the claim has been submitted, the Gap insurance provider will review the information and determine the amount of the payout.

Step 5: Receive the Payout

Finally, once the Gap insurance provider has approved the claim, you will receive the payout for the amount of the gap between the ACV and the amount you owe on your loan or lease.

This payout can be used to pay off any outstanding loan or lease balances, and can help to ease the financial burden of the incident.

Processing a Gap insurance claim can be a complex process, but by following the steps outlined above, you can help to ensure a smooth and efficient claims process.

Be sure to report the incident as soon as possible, provide all the necessary documentation, and work closely with your insurance and Gap insurance providers to ensure that your claim is processed quickly and efficiently.

Read Also: How to Achieve Success as an Entrepreneur

Gap Insurance Terms and Conditions

If you’re financing a car, gap insurance can provide you with valuable protection. Essentially, gap insurance is designed to bridge the “gap” between what your car is worth and what you owe on your car loan if your car is declared a total loss due to theft, damage, or an accident.

This type of insurance can save you from having to pay out of pocket to cover the remaining balance on your loan after your car insurance company has paid out its maximum amount.

While gap insurance can be a smart investment, it’s important to understand the terms and conditions of the policy you’re considering. Here are some key things to keep in mind:

Eligibility: In general, gap insurance is only available if you’re financing a new or used car. You may also be required to have comprehensive and collision coverage on your car insurance policy.

Coverage limits: Gap insurance policies will typically cover the difference between your car’s value and the amount you owe on your loan up to a certain limit. Make sure you understand what that limit is and whether it’s enough to cover your potential losses.

Deductibles: Some gap insurance policies may include a deductible that you’ll need to pay out of pocket before the policy kicks in. Be sure to factor in the cost of the deductible when you’re considering whether gap insurance is worth it for you.

Time limits: Gap insurance policies may have time limits on when you can file a claim. For example, you may need to file a claim within 90 days of your car being declared a total loss. Make sure you understand these time limits so you don’t miss out on your coverage.

Exclusions: Like any insurance policy, gap insurance may have exclusions that limit what’s covered. For example, some policies may not cover the cost of any upgrades or modifications you’ve made to your car. Make sure you understand what’s excluded from your policy before you buy.

Payment options: Some gap insurance policies may require you to pay the entire premium up front, while others may allow you to pay in installments. Make sure you understand the payment options and whether they work for your budget.

Cancellation policy: If you decide to sell your car or pay off your loan early, you may be able to cancel your gap insurance policy. However, there may be fees or penalties for doing so. Make sure you understand the cancellation policy before you sign up.

Overall, gap insurance can be a valuable investment if you’re financing a car. However, it’s important to understand the terms and conditions of your policy so you can make an informed decision about whether it’s right for you. Be sure to read the fine print and ask any questions you have before you sign on the dotted line.

Read Also: 11 Benefits of Fitness to Your Overall Health