Price is an important element of the marketing mix. It can be used as a strategic marketing variable to meet competition. It is also a direct source of revenue for the firm. It must not only cover the costs but leave some margin to generate profit for the firm. However, the price should not be so high as to frighten the customers.

Price is also an element, which is highly perceptible to customers and significantly affects their decisions to buy a product. In general, price directly determines the quality to be sold. That is why electric fans are sold at lower prices and hotels reduce their tariffs during off-season periods to attract customers.

Determinants of Pricing

Pricing decisions are usually determined by cost, demand, and competition. We shall discuss each of these factors separately. We take demand first.

Demand

The popular ‘Law of Demand’ states that “the higher the price; the lower the demand, and vice versa, other things remaining the same”. In season, due to plentiful supplies of certain, agricultural products, the prices are low and because of low prices, the demand for them increases substantially.

You can test the validity of this law yourself in your daily life. There is an inverse relationship between price and quantity demanded. If the price rises, demand falls and if the price falls, the demand goes up.

Of course, the law of demand assumes that there should be no change in the other factors influencing demand except price.

If any one or more of the factors, for instance, income, the price of the substitutes, taste, and preferences of the consumers, advertising, expenditures, etc. vary, the demand may rise in spite of a price rise, or alternatively, the demand may fall in spite of a fall in price. However, there are important exceptions to the law of demand.

There are some goods, which are purchased mainly for their ‘snob appeal. When prices of such goods rise, their snob appeal increases, and they are purchased in larger quantities; therefore, their demand falls. Diamonds provide a good example.

In the speculative market, a rise in price is frequently followed by larger purchases and a fall in prices by smaller purchases. This is especially applicable to purchases of industrial raw materials.

More important than the law of demand is the elasticity of demand. While the law of demand tells us the direction of change in demand, the elasticity of demand tells us the extent of change in demand. The elasticity of demand refers to the response of demand to a change in price.

It is necessary for the marketer to know what would be the reaction of the consumers to the change he wishes to make in the price. Let us take some examples.

Smokers are usually so addicted to smoking that they will not give up smoking even if the prices of cigarettes increase. So also the demand for salt or for that wheat is not likely to go down even if the prices increase.

Another example of inelastic demand is the demand for technical journals, which are sold mainly to libraries. On the other hand, a reduction in the price of television will bring in more than a proportionate increase in demand.

Read Also: Classes of Wholesalers in Marketing

Some of the factors determining the price elasticity of demand are the nature of the commodity, whether it is a necessity or luxury, the extent of use, the range of substitutes, the urgency of demand, and the frequency of purchase of the product.

The concept of elasticity of demand becomes crucial when a marketer is thinking of lowering his price to increase the demand for his product and to get a larger market share. If the increase in sales is more than proportionate to the decline in price, his total sale proceeds and his profits might be higher.

If the increase in sales is less than proportionate, his total sales proceeds will decline and his profits will definitely be less. Thus, knowledge of the elasticity of demand for his products will help a marketer to determine whether and to what extent he can cut the price or pass on the increase in cost to the consumer.

It may also be noted that the price elasticity of demand for a certain commodity and the price elasticity of demand for a certain brand of that commodity may be radically different.

For example, while cigarettes as such, may be highly inelastic, the price elasticity of demand for ‘Capstan’ or ‘Charms’ may be highly elastic. The reasons for these are weak brand loyalty and the availability of substitutes.

Competition

The degree of control over prices, which the sellers may exercise, varies widely with the competitive situation in which they operate. Sellers operating under conditions of pure competition do not have any control over the prices they receive.

A monopolist, on the other hand, may have some pricing discretion. The marketer; therefore, needs to know the degree of pricing discretion enjoyed by him. Let us take up each of these cases individually.

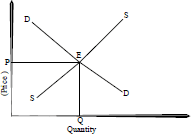

DD = Demand Curve SS = Supply Curve

E = Point of Equilibrium

In pure competition, all that the individual seller can do is accept the price prevailing in the market i.e. he is in the position of a price taker. If he wants to charge a higher price, buyers will purchase from other sellers. And he need not charge less since he can sell his small supply at the going market price.

Under a monopoly, a single producer has complete control of the entire supply of a certain product. Railways and telephones are examples of monopolies.

The main features of a monopoly are;

- There is only one seller of a particular good or service and

- Rivalry from the producers of substitutes is so remote that it is almost insignificant.

- As a result, the monopolist is in a position to set the price himself. Thus, he is in the position of a price setter.

However, even in the case of a monopolist, there are limits to the extent to which he can increase his prices. Much depends on the elasticity of demand for the product. This, in turn, depends on the extent of availability of substitutes for the products. And in most cases, there is rather an infinite series of closely competing substitutes.

Read Also: The Role of Middlemen in Marketing

Even railways and telephone organizations must take into account potential competition by alternative services – railways may be substituted by motor transport and telephone calls by telegrams.

The closer the substitute and greater the elasticity of the demand for a monopolist’s product, the less he can raise his price without frightening away his customers. The high price of oil has led to the development of alternative sources of energy, such as solar energy.

Monopolies are constantly reducing due to the following reasons:

Shifts in consumer demand

- A continuous process of innovation and technological developments leads to the development of substitutes

- Lack of stimulus to efficiency provided by competition

- Entry of new competitors Intervention by governments.

An oligopoly is a market situation characterized by a few sellers, each having an appreciable share in the total output of the commodity. The automobile, cement, tire, infant food, dry batter, tractor, cigarette, aluminum, and razor blade industries provide examples of oligopolies. In each of these industries, each seller knows his competitors individually in each market.

Each oligopolist realizes that any change in his price and advertising policy may lead rivals to change their policies. Hence, an individual firm must consider the possible reactions of the other firms to its own policies. In such cases, there is a strong tendency towards close collaboration in policy determination in regard to both production and prices. Thus, oligopolists follow the philosophy of ‘live and let live.

Oligopolistic industries are usually characterized by what is known as price leadership

– A situation where firms fix their price in a manner dependent upon the price charged by one of the firms in the industry, is called the price leader. The price leader has lower costs and adequate financial resources, a substantial share of the market, and a reputation for sound pricing decisions.

Price leaders with the strongest position in the market may often increase their prices with the hope that competitors will follow suit. Price followers may delay raising their prices in the hope of snatching a part of the market share away from the leader.

Monopolistic competition is a market situation, in which there are many sellers of a particular product, but the product of each seller is in some way differentiated in the minds of consumers from the product of every other seller.

None of the sellers is in a position to control a major part of the total supply of the commodity, but every seller so differentiates his/her portion of the supply from the portions sold by others, that buyers hesitate to shift their purchases from his/her product to that of another in response to price differences. At times, one manufacturer may differentiate his/her own products.

For example, a blade manufacturer may manufacture more than 25 brands of blades. This differentiation of products by each manufacturer by giving it a brand name gives him some amount of monopoly if he is able to create goodwill for his products and he may therefore be able to charge higher prices to some extent.

Read Also: The Product Life Cycle Concept and Marketing Mix at Different Stages

Still, his product will have to compete with similar products of other manufacturers, which puts a limit on his pricing discretion. If he charges too high a price, consumers may shift their loyalty to other competing suppliers.

You can find it out yourself by going to the market, to see that a large number of consumer goods like toothpaste, soap, cigarettes; radios, etc. are subject to a large degree of product differentiation as a means of attracting customers.

As long as a consumer has an impression that a particular product brand is different and superior to others, he/she will be willing to pay more for that brand than for any other brand of the same commodity.

The differences, real or illusory, may be built up in his or her mind by:

- Recommendations by friends,

- Advertising and

- His own experience and observation.

- The producer gains and retains his customers by;

- Competitive advertising and sales promotion,

- The use of brand names, quite as much as by

- Price competition.

Product differentiation is more typical of the present-day economic system than either pure competition or monopoly. And, in most cases, an individual firm has to face monopolistic competition. It tries to maintain its position and promote its sales by either:

- Changing its price and indulging in price competition, or

- Intensifying the differentiation of its product, and /or

- Increasing its advertisement and sales promotion efforts.

There is a popular belief that costs determine the price. It is because the cost data constitute the fundamental element in the price-setting process.

However, their relevance to the pricing decision must neither be underestimated nor exaggerated. For setting prices, apart from costs, a number of other factors have to be taken into consideration. Demand is equal, and in some cases of greater importance than costs. An increase in price is possible, even without any increase in costs.

Very often, price determines the cost that may be incurred. The product is tailored to the requirements of the potential consumers and their capacity to pay for it.

For example, radio manufacturers in India realized that if they had to capture the mass market prevailing in India, they had to price it low, which could be done only by reducing the cost – reducing the number of wave bands in the radio. And now a single wave band radio is available at about N100.

If costs were to determine prices, why do so many companies report losses? There are marked differences in costs between one producer and another. Yet the fact remains that the prices are quite close for a somewhat similar product. This is the best evidence that costs are not the determining factor in pricing.

Price decisions cannot be based merely on cost because it is very difficult to measure costs accurately. Costs are affected by volume, and volume is affected by price. The management has to assume some desired price and volume relationship for determining costs.

That is why costs play even a less important role in the case of new products as compared to existing products. It is not possible to determine costs without having an idea of what volumes or numbers can be sold. But, since there is no experience with volumes, costs, and prices, one starts with the going market price for similar products.

All this discussion does not purport to show that costs should be ignored altogether while setting prices. Costs have to be taken into consideration. In fact, in the long run, if costs are not covered, manufacturers will withdraw from the market and supply will be reduced which, in turn, may lead to higher prices.

The point that needs emphasis is that cost is not the only factor in setting prices. The cost must be regarded only as an indicator of the price, which ought to be set after taking into consideration the demand, the competitive situation, and other factors.

Costs determine the profit consequences of the various pricing alternatives. Cost calculations may also help in determining whether the product, whose price is determined by its demand, is to be included in the product line or not.

Read Also: New Product Development Strategy and Generation of New Product Ideas