Are you considering how to start a business in Montana? Known for its stunning landscapes, vibrant communities, and business-friendly environment, Montana offers numerous opportunities for entrepreneurs.

From the majestic Rocky Mountains to the bustling cities like Billings and Missoula, Montana provides a unique backdrop for your business venture. If you’re ready to embark on this exciting journey, here’s a step-by-step guide on how to start a business in Montana.

Develop a Business Idea and Plan

The first step towards starting a successful business is to develop a solid idea and create a comprehensive business plan. Consider your passions, skills, and market demand to identify a product or service that you can offer.

Your business plan should outline your goals, target audience, marketing strategies, financial projections, and operational details. A well-crafted plan will serve as a roadmap for your business’s future.

Choose a Business Structure: Next, you’ll need to select a suitable legal structure for your business. Common options include sole proprietorship, partnership, limited liability company (LLC), and corporation.

Each structure has its own advantages and considerations regarding liability, taxes, and management. Consult with an attorney or a business advisor to determine the best structure for your specific circumstances.

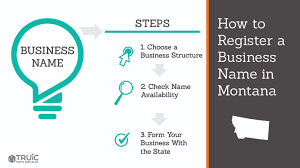

Register Your Business: To operate legally in Montana, you’ll need to register your business with the appropriate authorities. Begin by choosing a unique name for your company and conducting a search to ensure it’s available.

Then, register your business name with the Montana Secretary of State. Depending on your chosen structure, you may need to file additional documents, such as Articles of Organization for an LLC or Articles of Incorporation for a corporation.

Obtain Necessary Licenses and Permits: Depending on your business type and location, you may need to obtain certain licenses and permits to comply with local, state, and federal regulations.

Visit the Montana Business Licensing Center website or consult with the Montana Department of Labor and Industry to determine the specific permits required for your industry. This may include professional licenses, sales tax permits, health and safety permits, and more.

Understand Tax Obligations: Familiarize yourself with the tax obligations for businesses in Montana. Register for an Employer Identification Number (EIN) with the Internal Revenue Service (IRS), even if you don’t have employees.

This unique identifier will be necessary for tax purposes, opening a business bank account, and hiring employees in the future. Additionally, learn about state and local taxes, sales tax collection, and any other relevant tax regulations to ensure compliance.

Secure Financing: Consider your funding options to launch or grow your business. This may involve using personal savings, seeking loans from banks or credit unions, or attracting investors.

Explore small business grants, incentives, and resources available in Montana, such as the Montana Small Business Development Center or the Montana Department of Commerce. A solid financial plan will help you secure the necessary funds to get your business off the ground.

Set Up Your Business Operations: Once you’ve completed the legal and financial aspects, focus on setting up your business operations. Secure a physical location, if applicable, and equip it with the necessary equipment and supplies.

Establish a reliable system for inventory management, bookkeeping, and customer relationship management. Additionally, consider building an online presence through a website and social media platforms to reach a broader audience.

Promote and Launch Your Business: Develop a comprehensive marketing strategy to promote your business and attract customers. Utilize both traditional and digital marketing techniques to create brand awareness and generate interest.

Leverage social media advertising, content marketing, search engine optimization (SEO), and local partnerships to spread the word about your products or services. Plan a grand opening event or launch campaign to create excitement and buzz around your business.

Maintain Compliance and Seek Support: As your business grows, it’s important to stay compliant with all applicable laws and regulations. Keep accurate financial records, file tax returns on time, and renew any necessary licenses or permits.

Stay updated on changes in industry regulations and seek professional advice when needed. Consider joining local business associations or networking groups to connect with other entrepreneurs and gain valuable support and insights.

Starting a business in Montana can be an enriching and fulfilling experience. By following these steps and staying committed to your goals, you’ll be well on your way to building a successful venture in the Treasure State. Embrace the entrepreneurial spirit, tap into the supportive business ecosystem, and make your mark on Montana’s thriving economy.

Read Also: Guide to Startup Marketing Book

Montana Business Laws

Montana, known as “The Treasure State,” offers a wealth of opportunities for entrepreneurs and business owners. From its stunning landscapes to a thriving economy, the state provides an attractive environment for establishing and growing a business.

However, like any jurisdiction, Montana has its own set of laws and regulations that govern business operations. In this article, we will delve into the key aspects of business laws in Montana, equipping you with the knowledge necessary to navigate the legal landscape and ensure compliance.

Business Formation and Registration: Before launching a business in Montana, it is important to understand the different business entity types and their respective requirements. The most common forms of business entities in Montana include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations.

For sole proprietorships and partnerships, no formal registration with the Montana Secretary of State is required. However, it is advisable to file a “Doing Business As” (DBA) form if the business operates under a name different from the owner’s legal name.

LLCs and corporations must file articles of organization or incorporation with the Secretary of State. This process establishes the legal existence of the entity and ensures compliance with Montana law. Additionally, businesses with employees must register for state and federal taxes and obtain necessary licenses and permits.

Licenses, Permits, and Regulations: Depending on the nature of your business, you may need to obtain specific licenses and permits to operate legally in Montana. Industries such as healthcare, construction, finance, food services, and transportation often require additional permits and certifications.

To determine the necessary licenses, business owners can consult the Montana Business Licensing Assistant, an online tool that provides a comprehensive list of occupations and associated licensing requirements.

Moreover, businesses must comply with regulations relating to zoning, environmental protection, advertising, consumer protection, and employment. Familiarize yourself with federal laws, such as the Fair Labor Standards Act (FLSA) and the Occupational Safety and Health Act (OSHA), which also apply in Montana.

Taxation: Montana has a unique tax system that impacts businesses. It is crucial to understand the various taxes imposed by the state, including:

Corporate Income Tax: Corporations operating in Montana are subject to a flat tax rate on their net income.

Individual Income Tax: If you operate a sole proprietorship or a pass-through entity, such as an LLC, you must report business income on your personal income tax return.

Sales Tax: Montana is one of the few states that does not impose a general sales tax. However, certain local jurisdictions may impose local-option sales taxes.

Property Tax: Businesses that own real property or personal property, such as equipment and inventory, are subject to property tax.

It is recommended to consult a tax professional or the Montana Department of Revenue to ensure compliance with the state’s tax obligations.

Employment Laws: Montana’s employment laws protect workers’ rights and dictate employer obligations. Key areas to consider include minimum wage, overtime, employee classification (exempt vs. non-exempt), workplace safety, discrimination, and family leave.

Montana has its own minimum wage, which is adjusted annually based on inflation. Employers must adhere to the state’s minimum wage requirements, and certain exceptions may apply depending on the industry and the employee’s age.

Moreover, Montana law requires employers to provide workers’ compensation coverage for their employees, ensuring protection in case of work-related injuries.

Navigating business laws in Montana is a crucial aspect of running a successful venture in the state. Understanding the legal requirements and ensuring compliance not only safeguards your business from legal issues but also helps establish a solid foundation for growth.

By familiarizing yourself with business formation procedures, licensing requirements, taxation obligations, and employment laws, you can confidently embark on your entrepreneurial journey in “The Treasure State” and seize the opportunities it offers.

Remember, seeking professional legal and accounting advice specific to your business is always a wise decision to ensure compliance with the latest regulations and best practices.

Business in Montana Funding

Montana’s business funding landscape is ripe with opportunities for entrepreneurs and businesses at all stages. From SBA loans to angel investors, community development organizations to government grants, the state provides a diverse range of resources to fuel business growth.

Aspiring entrepreneurs and established business owners in Montana should take advantage of these funding options and leverage the available support networks to turn their dreams into reality. With the right financial backing, Montana’s business community is poised to flourish and contribute to the state’s continued economic success.

Small Business Administration (SBA) Loans: The U.S. Small Business Administration plays a crucial role in supporting entrepreneurs across the country, and Montana is no exception. The SBA offers various loan programs, including the popular 7(a) loan, which provides funding for general business purposes.

Additionally, the SBA’s 504 loan program focuses on financing fixed assets such as land, buildings, and equipment. These loan programs offer favorable terms and lower down payment requirements, making them attractive options for businesses seeking long-term financing.

Montana Small Business Development Center (SBDC): The Montana SBDC is a statewide network that provides expert guidance and resources to small business owners and aspiring entrepreneurs.

The SBDC offers personalized consulting services, business training programs, and access to capital resources. Through partnerships with financial institutions and community lenders, the SBDC helps businesses navigate the loan application process and identify appropriate funding opportunities.

Montana Board of Investments (BOI): The Montana BOI is a valuable resource for businesses seeking financing. The board manages several investment programs, including the Montana Loan Participation Program (MLPP) and the Montana Capital Company (MCC).

The MLPP encourages lenders to finance small businesses by providing a partial loan guarantee, mitigating risk for lenders. The MCC program supports venture capital funds that invest in Montana-based businesses, fostering innovation and growth in key industries.

Montana Community Development Financial Institutions (CDFIs): Community Development Financial Institutions are nonprofit organizations that focus on providing affordable financing to underserved communities and businesses. Montana has several CDFIs dedicated to supporting economic development in the state.

Organizations like Montana Community Finance Corporation and Glacier Community Development Fund offer flexible loan options, technical assistance, and business development services tailored to meet the unique needs of Montana entrepreneurs.

Angel Investors and Venture Capital: Montana’s entrepreneurial landscape has attracted a growing number of angel investors and venture capital firms interested in supporting innovative startups. These investors often provide early-stage funding in exchange for equity ownership.

Montana’s vibrant startup ecosystem, particularly in sectors like technology, agriculture, and outdoor recreation, has garnered attention from investors seeking high-potential opportunities. Organizations like Frontier Angels and Montana Manufacturing Extension Center (MMEC) can help connect entrepreneurs with investors looking to fund promising ventures.

Grants and Incentive Programs: Montana offers various grants and incentive programs to encourage business growth and job creation. The Big Sky Economic Development Trust Fund (BSTF) provides grants to businesses that promote long-term job creation.

Additionally, the Montana Department of Commerce offers specialized grants, such as the Innovate Montana Program and the ExportMontana Program, to support innovation, research and development, and export activities.

Montana, known as the “Treasure State,” offers more than just its breathtaking landscapes and outdoor adventures. The state’s business ecosystem is vibrant and supportive, with a range of funding opportunities available to entrepreneurs and startups.

Whether you’re launching a new venture or expanding an existing business, Montana provides a wealth of resources to help you secure the necessary capital.

Read Also: Step by Step How to Start a Business

Business in Montana Networking

Business networking in Montana is a gateway to unlocking a wealth of opportunities. By actively participating in networking events, fostering meaningful relationships, and leveraging the supportive business ecosystem, entrepreneurs and professionals can propel their ventures to new heights. One key ingredient that fuels business growth and success in Montana is networking.

The Power of Business Networking in Montana

Networking is a crucial aspect of building and expanding a successful business anywhere, and Montana is no exception.

The state’s close-knit business community provides ample opportunities for entrepreneurs, professionals, and aspiring individuals to connect, collaborate, and create synergies. Here’s why business networking plays a pivotal role in Montana’s thriving economic landscape:

Building Relationships: Networking is about building meaningful relationships with like-minded professionals, potential clients, mentors, and industry experts.

Montana’s business community values personal connections and often operates on a foundation of trust and integrity. By actively engaging in networking events, you can forge strong alliances that can lead to lucrative partnerships and business opportunities.

Local Expertise and Knowledge Sharing: Montana’s business networking events bring together individuals from various industries, allowing for the exchange of valuable insights, best practices, and local knowledge.

Whether you’re a seasoned entrepreneur or a budding professional, networking enables you to tap into the collective wisdom of the community, gaining fresh perspectives and innovative ideas to enhance your business strategies.

Access to Resources and Support: Montana’s tight-knit business network offers access to a wide range of resources, including funding opportunities, business development programs, and government initiatives.

Networking provides a gateway to connect with influential individuals, investors, and organizations that can offer support, advice, and assistance, propelling your business towards growth and success.

Enhancing Visibility and Branding: Participating in networking events and engaging in relevant discussions allows you to showcase your expertise, demonstrate your value proposition, and strengthen your personal and professional brand.

In Montana’s business community, word-of-mouth referrals and recommendations hold significant weight. By actively networking, you can expand your visibility and enhance your reputation, attracting new clients, customers, and business opportunities.

Tips for Effective Business Networking in Montana

To make the most of the business networking opportunities in Montana, consider the following tips

Attend Local Events: Regularly participate in business conferences, seminars, trade shows, and networking meetups specific to your industry or interests. Keep an eye on local business organizations, chambers of commerce, and professional associations for upcoming events that align with your goals.

Be Genuine and Authentic: Montana’s business community values authenticity and sincerity. When networking, focus on building genuine connections rather than simply exchanging business cards. Show a sincere interest in others, actively listen, and be open to learning from their experiences.

Leverage Digital Platforms: In addition to attending physical events, utilize digital platforms such as LinkedIn, industry forums, and online communities to expand your network. Actively engage in conversations, share insights, and connect with professionals in your field.

Follow Up and Stay Engaged: After networking events, follow up with the individuals you connected with. Send personalized messages or emails, express your gratitude, and explore opportunities for further collaboration. Remember to maintain relationships by staying engaged through regular communication.

The power of networking in Montana lies in its ability to forge connections, share knowledge, and open doors to collaborations that lead to mutual growth and success. So, embrace the vibrant business community in Montana, network with purpose, and unleash the limitless possibilities that await you.

Read Also: Tomatoes Farming: 9 Factors that Hinders High Yield for Profit