National Insurance (NI) is a social security system in the United Kingdom that provides individuals with benefits, such as unemployment and sickness benefits, and a state pension upon retirement.

It is a mandatory contribution scheme that is paid by individuals who earn above a certain amount of income and employers who hire them. This article will explore what National Insurance is, how it works, and its importance in the UK.

What is National Insurance?

National Insurance is a tax that is paid by workers and employers in the UK. The tax is used to fund the country’s social security system, which includes the provision of benefits, such as the state pension, unemployment and sickness benefits, maternity pay, and other related benefits.

The amount of National Insurance paid by individuals and employers depends on the individual’s earnings and the employer’s payroll. The system is designed to provide a safety net for individuals who are unable to work due to illness, disability, or unemployment.

How Does National Insurance Work?

National Insurance is paid by both employees and employers in the UK. Employees pay Class 1 National Insurance contributions on their earnings, while employers pay Class 1 National Insurance contributions on their employees’ earnings. Self-employed individuals pay Class 2 and Class 4 National Insurance contributions on their profits.

Class 1 National Insurance contributions are made up of two parts: the primary contribution and the secondary contribution. The primary contribution is paid by the employee, while the secondary contribution is paid by the employer.

The primary contribution is based on the employee’s earnings, and the secondary contribution is based on the employee’s earnings and the employer’s payroll.

Class 2 National Insurance contributions are paid by self-employed individuals who earn above a certain threshold, and Class 4 National Insurance contributions are paid on profits above a certain threshold. The amount of National Insurance paid by self-employed individuals depends on their profits.

The Importance of National Insurance

National Insurance plays a crucial role in the UK’s social security system. It provides individuals with financial support when they are unable to work due to illness, disability, or unemployment. It also provides individuals with a state pension upon retirement, which is a form of financial security in old age.

National Insurance also helps to fund the National Health Service (NHS), which is the UK’s publicly funded healthcare system. The NHS provides healthcare services to all UK residents, regardless of their ability to pay. National Insurance contributions help to fund the NHS and ensure that it remains free at the point of use.

National Insurance is an essential part of the UK’s social security system. It provides individuals with financial support when they are unable to work due to illness, disability, or unemployment, and it provides individuals with a state pension upon retirement.

National Insurance contributions also help to fund the National Health Service (NHS), which is the UK’s publicly funded healthcare system. Overall, National Insurance plays a crucial role in ensuring the financial security and well-being of UK residents.

Read Also: iMarketing Strategies You Need to Know

AD & D Insurance

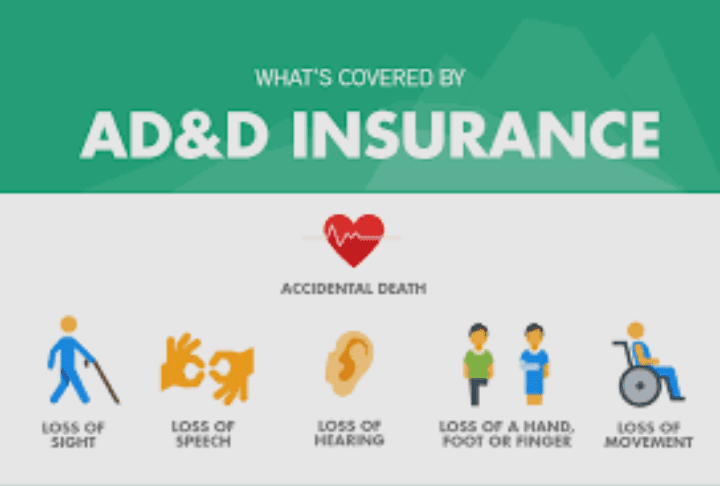

Accidental Death and Dismemberment (AD&D) insurance is a type of insurance coverage that provides financial protection to individuals and their families in the event of accidental death or serious injury.

This type of insurance policy is designed to pay out a lump sum benefit to the policyholder or their beneficiaries if they experience an accident that results in the loss of a limb, sight, speech, or hearing, or if they pass away due to accidental causes.

AD&D insurance is often purchased as an add-on to an existing life insurance policy, or as a standalone policy. It is important to note that AD&D insurance is different from traditional life insurance in that it only pays out in the event of an accidental death, as opposed to natural causes or illness.

One of the main benefits of AD&D insurance is that it provides an extra layer of protection for individuals who work in high-risk professions or participate in risky activities.

For example, individuals who work in construction, mining, or transportation may be more likely to experience a serious accident on the job, making AD&D insurance a valuable investment. Similarly, individuals who participate in extreme sports, such as skydiving or rock climbing, may also benefit from AD&D coverage.

Another benefit of AD&D insurance is that it can provide financial support to an individual’s family in the event of an unexpected loss.

The lump sum payout provided by an AD&D policy can help cover funeral expenses, outstanding debts, and provide ongoing financial support to dependents. This can help alleviate some of the financial stress that can accompany the loss of a loved one.

When considering purchasing AD&D insurance, it is important to carefully review the terms and conditions of the policy. Some policies may exclude certain types of accidents or injuries, while others may only pay out a portion of the benefit if the individual is injured but does not lose a limb or suffer a permanent disability.

It is also important to review the coverage amount and ensure that it is sufficient to provide the necessary financial support in the event of an accident.

AD&D insurance is a valuable form of coverage for individuals who are at risk of experiencing serious accidents or injuries. It can provide financial support to individuals and their families in the event of an unexpected loss, and offer peace of mind knowing that there is an extra layer of protection in place.

As with any insurance policy, it is important to carefully review the terms and conditions of the policy and ensure that the coverage is appropriate for your individual needs.

E & O Insurance

Errors and omissions (E&O) insurance is a type of professional liability insurance that helps protect businesses and individuals from claims of negligence or mistakes made in the course of providing professional services. This insurance is particularly relevant for professionals in industries such as law, accounting, engineering, architecture, and real estate.

E&O insurance can help protect professionals from claims related to errors or omissions that may occur while performing their professional duties.

For example, if a client alleges that an architect failed to properly design a building, resulting in structural damage, the architect’s E&O insurance can help cover the costs of legal fees and any settlements or damages awarded.

In addition to protecting professionals from claims of negligence or mistakes, E&O insurance can also help protect their reputations. Even if a claim is unfounded, the mere accusation of professional negligence can damage a professional’s reputation and business.

E&O insurance can help cover the costs of defending against such claims and can provide peace of mind to professionals and their clients alike.

E&O insurance policies are typically customized to the specific needs of the professional and their industry. Coverage limits can vary depending on the level of risk involved in the professional’s work and the size of their business. Policies may also include coverage for damages resulting from breaches of confidentiality or intellectual property infringement.

It’s important for professionals to carefully review their E&O insurance policies to ensure they have adequate coverage for their specific needs. Some policies may exclude certain types of claims, such as intentional wrongdoing or criminal acts, so it’s important to understand what is and isn’t covered.

Professionals may also want to consider purchasing excess coverage, which can provide additional protection beyond the limits of their primary policy.

In addition to purchasing E&O insurance, professionals can also take steps to reduce their risk of claims. This may include implementing strong quality control processes, maintaining accurate and up-to-date records, and communicating clearly with clients about the scope of their services and any limitations.

E&O insurance is an important tool for professionals to protect themselves from claims of negligence or mistakes made in the course of providing professional services. By carefully reviewing their policies and taking steps to reduce their risk, professionals can help ensure they have the protection they need to do their work with confidence.

Read Also: 16 Tips for Starting and Succeeding in Your Own Business

PHCS Insurance

PHCS (Private Healthcare Systems) is a subsidiary of MultiPlan, which is one of the largest network-based health care cost management companies in the United States. PHCS Insurance is a provider of PPO (Preferred Provider Organization) network services, which enables its members to have access to a wide range of healthcare providers and facilities.

PPO plans are popular because they allow policyholders to choose from a wide range of healthcare providers and facilities, including hospitals, doctors, and specialists. PHCS Insurance PPO plans offer many advantages, such as cost savings, flexibility, and convenience.

One of the most significant advantages of PHCS Insurance is the cost savings that members can enjoy. PPO plans typically offer lower co-pays and deductibles than traditional health insurance plans, which can be a significant cost-saving benefit for families and individuals.

Additionally, PHCS Insurance’s network of healthcare providers and facilities have pre-negotiated rates with the insurance company, which can result in further cost savings for members.

Another advantage of PHCS Insurance is the flexibility it offers. Members are free to choose any healthcare provider or facility within the PPO network, without the need for a referral from a primary care physician.

This flexibility can be especially beneficial for people who have established relationships with healthcare providers outside of their insurance plan or those who require specialized medical care.

PHCS Insurance also offers convenient online tools and resources to help members manage their healthcare. Members can access their plan information, view claims, and find healthcare providers within the PPO network through the PHCS Insurance website or mobile app.

Overall, PHCS Insurance is a popular choice for individuals and families who want access to a wide range of healthcare providers and facilities while enjoying cost savings and flexibility. By providing PPO plans, PHCS Insurance has established itself as a reliable and trusted provider of healthcare services to its members.

Read Also: Ways to Prevent Vaccine Failure on your Poultry Farm