The documents including the purchase day book that are exchanged between buyers and sellers which are binding on both parties are called source documents in accounting. The source documents are used to prepare books of original entries. This article explains one of the subsidiary books of account, purchases day book.

Purchase Day Book

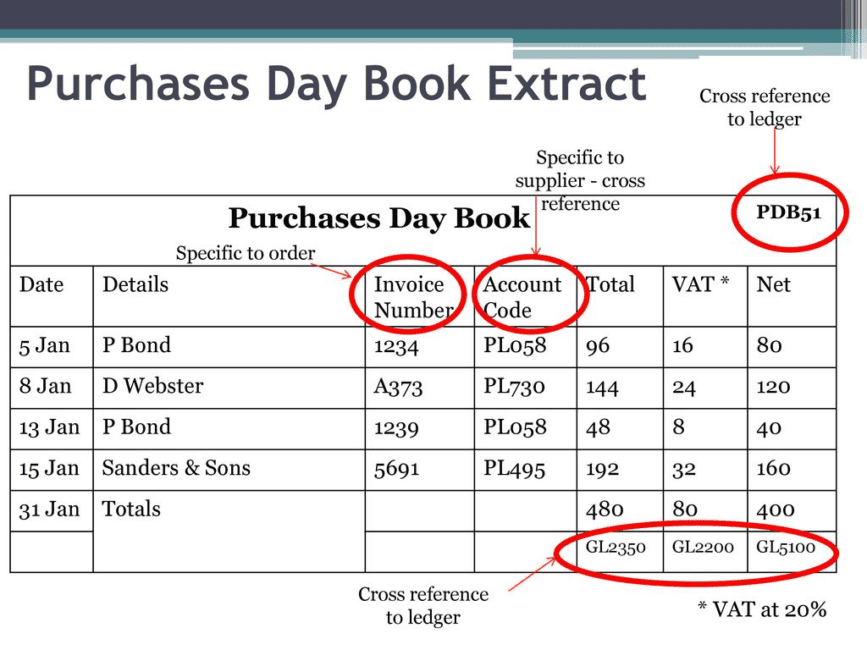

An invoice is exchanged between a buyer and seller of goods and those that render services. To the seller, the invoice is used to prepare the sales day book. But for the buyer, the same invoice serves as the source document for the preparation of purchases day book. Another name for purchases day book is purchases journal.

Purchases day book is a subsidiary book of account used to record all goods bought and services received on credit from a third party in the order in which they occurred irrespective of the amount involved.

The purchases journal is not an account because it does not have a debit or credit side, and neither can cash purchases nor other cash and bank transactions be recorded in it.

After transferring accounting information from the source documents – purchases invoice – to the purchases day book, the value of credit sales which are first recorded in the purchases day book will be transferred individually to the respective suppliers account in the ledger.

The total of all credit purchases as recorded in the purchases journal for a particular period, usually a month, is transferred to the debit side of the purchases account in the ledger.

The process of transferring from the purchases day book to the ledger is called posting. This is achieved for all credit purchases by crediting the supplier’s or seller’s (creditor) account with individual amount of each supplier, and debits the buyer’s (purchases) account.

Read Also: 11 Great Business Tips to Beat your Competition

Example 1: The credit purchases of Ball Ventures for the month of June 2015 are stated below. You are required to prepare the purchases day book of the business for the month.

| June 2 | Jesuyemisi | |

| June 5 | Mrs Imelda | |

| June 10 | Miss Tijani | |

| June 12 | Big Box Enterprises | |

| June 20 | Safiya Investment | |

| June 22 | Obioru Limited | |

| June 25 | Umaru Jude and Co. | |

| June 27 | Caleb Joshua |

Suggested Solution to Example 1

Ball Ventures Purchases Day Book

For the month of June 2015

| Date | Particular | Amount ( |

| June 2 | Jesuyemisi | 36,200 |

| June 5 | Mrs Imelda | 41,000 |

| June 10 | Miss Tijani | 63,234 |

| June 12 | Big Box Enterprises | 98,765 |

| June 20 | Safiya Investment | 123,456 |

| June 22 | Obioru Limited | 62,080 |

| June 25 | Umaru Jude and Co. | 43,000 |

| June 27 | Caleb Joshua | 465,960 |

| Total purchases for the month transferred to purchases account | 933,695 |

Example 2: Abuja and Jos International Business Limited purchased the following goods on credit for resale in the month of October 2016. You are required to prepare the company’s purchases day book for the month.

On October 1, the company received goods worth N33,750 from Lagos Ventures. On October 13, Kaduna Warri Enterprises supplied 15 pieces of calculator at N8,330 each. 22 pairs of shoe at N6,520 per pair; 15 pieces of mobile handset at N80,950 each and another starter pack costing N1,500 were received from Victoria Island Concepts Limited on October 25.

Read Also: How to Produce Pomade for Commercial Business

Suggested Solution to Example 2

Abuja and Jos International Business Limited

Purchases Day book for the month of October 2016

| Date | Particulars | Details | Amount ( |

| October 1 | Lagos Ventures | 33,750 | |

| October 13 | Kaduna Warri Enterprises 15 pieces of calculator at | 6,250 | |

| October 25 | Victoria Island Concepts Limited 22 pairs of shoe at | 143,440 1,214,250 1,500 | 1,359,190 |

| Total purchases for the month debit to purchases account | 1,399,190 |

Purchases and Discounts

The discount available for buying goods on credit at the point of purchase is trade discount. The trade discount can be stated as a percentage of the purchase price or a uniform amount that varies with purchase value.

Where trade discount is given on credit purchases, the discount value will be deducted from the purchase value in the invoice. The purchaser will owe the seller the purchase value less the trade discount. It is the net price that will be recorded in the supplier’s or seller’s account.

In summary, the invoice is the main source document used in preparing purchases day book for different organizations. The purchases day book or purchases journal record all credit purchases for goods and services irrespective of the amount involved. The purchases journal contains the name of the seller, item purchases, the price and discount received, if any.

Read Also: Latest Business Ideas with Little or No Capital To Start – Part 1

Read Also: The Concept and Principles of Environmental Planning