Why Guardian Anytime is the Future of Employee Benefits

Guardian Anytime is an online portal designed to provide easy access to Guardian Life Insurance’s products and services. It is a convenient platform that offers a range of tools to help users manage their insurance policies and accounts.

Guardian Anytime is available to both individuals and employer groups, making it a versatile platform for anyone looking to secure their financial future.

One of the key features of Guardian Anytime is its ability to help users manage their insurance policies. Through the portal, users can view their policy details, update their personal information, and make changes to their coverage. This makes it easy for individuals to keep their policies up-to-date and ensure that they are adequately protected.

For employer groups, Guardian Anytime offers a suite of tools to help manage employee benefits. Employers can use the platform to enroll employees in insurance plans, manage employee information, and track employee coverage.

This helps to streamline the benefits management process and makes it easier for both employers and employees to access the information they need.

Another useful feature of Guardian Anytime is its ability to provide users with access to important documents and resources. Users can access policy documents, forms, and other important information directly through the portal, making it easy to stay informed about their coverage.

Additionally, Guardian Anytime offers a variety of educational resources, including articles and videos, to help users better understand their insurance policies and make informed decisions.

One of the advantages of using Guardian Anytime is the flexibility it offers in terms of payment options. Users can make payments directly through the portal, and can choose from a variety of payment methods, including credit card, bank account, and automatic withdrawal. This makes it easy to stay on top of payments and ensure that coverage remains active.

Guardian Anytime also offers a mobile app, making it easy to access policy information and make changes on-the-go. The app is available for both iOS and Android devices, and provides all of the same features and functionality as the desktop version of the portal.

Overall, Guardian Anytime is a powerful tool for managing insurance policies and benefits. It offers a range of features and resources to help users stay informed and make informed decisions about their coverage.

Whether you are an individual looking to secure your financial future, or an employer seeking to manage employee benefits, Guardian Anytime is a valuable platform that can help you achieve your goals.

IUL Policies

Indexed universal life insurance (IUL) is a type of life insurance policy that offers a death benefit along with the potential for cash value accumulation. It’s a popular option for those looking for a combination of life insurance protection and investment opportunities.

How IUL Works

An IUL policy is structured similarly to other permanent life insurance policies, such as whole life insurance.

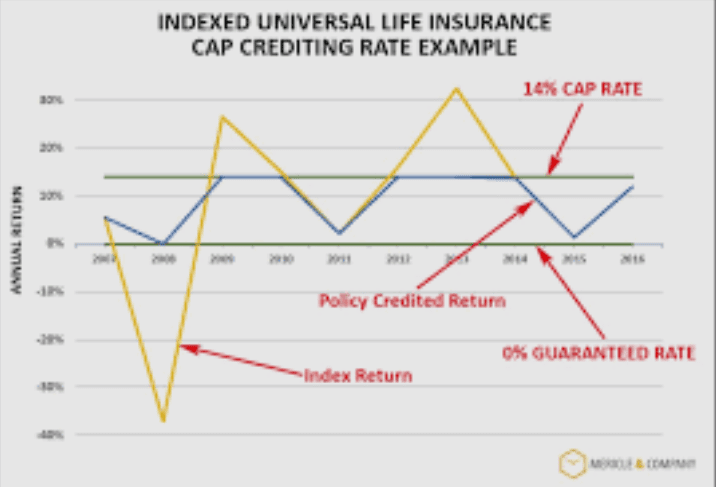

However, instead of a guaranteed interest rate, the policy’s cash value growth is linked to the performance of a market index, such as the S&P 500. This means that the cash value of the policy has the potential to grow faster than a traditional fixed-rate policy.

IUL policies also offer flexible premiums, allowing policyholders to adjust their premium payments as their financial situation changes. The death benefit is also flexible and can be adjusted over time.

Benefits of IUL

One of the primary benefits of an IUL policy is the potential for higher returns on the cash value compared to other types of permanent life insurance policies. Additionally, the policy’s death benefit is tax-free, and the cash value can be withdrawn tax-free as well.

IUL policies also offer the flexibility to adjust premium payments and death benefits as needed. This can be especially useful for individuals with variable income or changing financial needs.

Risks of IUL

While IUL policies offer the potential for higher returns, they also come with higher risks. The policy’s cash value is linked to the performance of a market index, which means that if the index performs poorly, the cash value of the policy may also decrease.

Additionally, some IUL policies come with high fees and charges, which can eat away at the policy’s returns.

It’s important to understand the risks and benefits of IUL before purchasing a policy. Working with a financial advisor can help individuals determine if an IUL policy is the right choice for their financial situation and goals.

IUL policies offer a unique combination of life insurance protection and investment opportunities. While they come with higher risks compared to traditional fixed-rate policies, they also offer the potential for higher returns. As with any financial decision, it’s important to weigh the risks and benefits and work with a professional to make an informed choice.

Read Also: Understanding Mortgage Insurance: What You Need to Know

Term Life Insurance Basics

Term life insurance is a type of life insurance that provides coverage for a specified period of time, usually ranging from one to thirty years. Unlike permanent life insurance policies, term life insurance policies do not accumulate cash value, making them a more affordable option for those who need coverage for a limited period of time.

How Does Term Life Insurance Work?

Term life insurance policies work by paying a death benefit to the policyholder’s beneficiaries if the policyholder dies during the term of the policy.

The policyholder pays regular premiums to keep the policy in force, and if they die during the term of the policy, their beneficiaries receive the death benefit. If the policyholder outlives the term of the policy, the policy expires and no death benefit is paid.

Types of Term Life Insurance

There are two main types of term life insurance policies: level term and decreasing term. Level term policies provide a consistent death benefit throughout the term of the policy, while decreasing term policies have a death benefit that decreases over time.

Level term policies are the most common type of term life insurance, and they are often purchased for a period of 10, 15, 20, or 30 years. The premiums for level term policies remain the same throughout the term of the policy, which can make them an attractive option for those who want predictable costs.

Decreasing term policies, on the other hand, are often purchased to cover specific debt obligations, such as a mortgage or a business loan.

The death benefit of a decreasing term policy decreases over time, typically in line with the amount owed on the debt being covered. Decreasing term policies are typically less expensive than level term policies, but they provide less coverage over time.

Advantages of Term Life Insurance

One of the main advantages of term life insurance is its affordability. Because term life insurance policies do not accumulate cash value, they are typically less expensive than permanent life insurance policies.

This can make term life insurance an attractive option for those who need coverage for a specific period of time, such as to provide for their children until they reach adulthood or to pay off a mortgage.

Another advantage of term life insurance is its simplicity. Term life insurance policies are straightforward and easy to understand, with no complex investment or savings components. This can make it easier for people to purchase the coverage they need without getting bogged down in complicated insurance jargon.

Disadvantages of Term Life Insurance

One of the main disadvantages of term life insurance is that it does not provide coverage for the policyholder’s entire life. If the policyholder outlives the term of the policy, they will not receive any death benefit. Additionally, once the policy expires, the policyholder may have difficulty qualifying for a new policy due to age or health issues.

Another disadvantage of term life insurance is that the premiums can increase significantly when the policy is renewed. If the policyholder wants to continue coverage after the initial term of the policy expires, they may need to pay significantly higher premiums to renew the policy.

Term life insurance is an affordable and straightforward option for those who need coverage for a specific period of time. While it does not provide coverage for the policyholder’s entire life and premiums can increase when the policy is renewed, it can be an effective way to provide for loved ones or pay off debts.

Before purchasing a term life insurance policy, it’s important to understand the terms of the policy and consider all available options to ensure the best possible coverage for your individual needs.

Group Life Insurance

Group life insurance is a type of life insurance policy that is designed to provide coverage to a group of people, such as employees of a company, members of a union, or members of an association. This type of insurance policy is purchased by a group sponsor, who is typically an employer or organization, and the coverage is provided to all eligible members of the group.

Group life insurance policies can be structured in several ways. The most common form of group life insurance is term life insurance, which provides coverage for a specified period of time, such as one year. Group term life insurance policies typically offer coverage amounts based on a multiple of an employee’s salary, such as one or two times their annual salary.

Another form of group life insurance is permanent life insurance, which provides coverage for the life of the insured.

Permanent group life insurance policies typically offer coverage amounts based on a flat dollar amount, rather than a multiple of an employee’s salary. This type of policy can also include an investment component, allowing policyholders to build cash value over time.

There are several advantages to group life insurance policies. One of the most significant advantages is that they are typically less expensive than individual life insurance policies.

This is because the risk of death is spread across a large group of people, which makes it easier for insurance companies to manage their risk and offer lower premiums.

Group life insurance policies are also often easier to qualify for than individual life insurance policies. This is because group policies typically do not require a medical exam or underwriting, and coverage is often guaranteed issue.

This can be particularly beneficial for individuals who may have pre-existing health conditions that could make it difficult or expensive to obtain individual life insurance coverage.

Employers or organizations may also choose to offer group life insurance as part of their employee benefits package. This can help to attract and retain employees, as well as provide financial security for their families in the event of their death.

Additionally, group life insurance policies can often be customized to meet the specific needs of the group, such as offering additional coverage for key employees or executives.

However, there are also some potential drawbacks to group life insurance policies. One of the main drawbacks is that coverage is typically only provided for as long as the individual remains a member of the group. If an employee leaves the company or organization, they may no longer be eligible for coverage under the group policy.

Another potential drawback is that group life insurance policies often have limited coverage amounts. While this may be sufficient for many individuals, those with higher earning potential or more significant financial obligations may need to supplement their group coverage with additional individual life insurance policies.

Group life insurance can be a valuable benefit for employees or members of an organization, providing financial protection for their loved ones in the event of their death.

However, it is important to carefully consider the specific terms and coverage amounts of any group life insurance policy, as well as supplementing coverage as needed with individual life insurance policies.

Read Also: Choosing UMR Insurance: Benefits and Features You Need to Know

Personal Insurance

Personal insurance is a crucial tool for safeguarding yourself and your loved ones against financial hardship in the event of an unexpected life event. There are several types of personal insurance policies available, and it’s important to understand what they cover and how they can protect you.

Life insurance: Life insurance provides a death benefit to your beneficiaries in the event of your death. This benefit can help pay for funeral expenses, outstanding debts, and provide financial support for your family after you’re gone.

There are two types of life insurance policies: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, usually 10 to 30 years, while permanent life insurance provides coverage for your entire life.

Disability insurance: Disability insurance provides income replacement if you become disabled and can no longer work. This coverage is essential if you rely on your income to support yourself and your family.

Disability insurance can help pay for medical bills, living expenses, and other costs associated with a disability.

Health insurance: Health insurance covers the cost of medical expenses, including doctor visits, hospital stays, and prescription medications. Having health insurance is critical for staying healthy and managing medical costs.

Many employers offer health insurance as a benefit, but individuals can also purchase coverage through the Affordable Care Act or private insurance companies.

Long-term care insurance: Long-term care insurance provides coverage for the costs associated with long-term care, such as nursing home care or in-home care. This coverage is essential for individuals who may need ongoing assistance with daily activities as they age.

Auto insurance: Auto insurance provides coverage for damages and injuries resulting from car accidents. This coverage is required by law in most states and is essential for protecting yourself and others while driving.

Homeowners insurance: Homeowners insurance provides coverage for damages to your home and personal property resulting from natural disasters, theft, and other events. This coverage is essential for protecting your investment in your home and personal belongings.

Personal insurance policies are critical for protecting yourself and your loved ones against financial hardship resulting from unexpected life events. It’s essential to understand what each policy covers and how it can benefit you. Work with an insurance agent to determine which policies are right for you and your unique needs.

Read Also: Some Tips to Observe in Snail Farming