Making a household budget is a key piece of a strong financial foundation because every great financial plan starts with a sound budget.

Having a budget helps you manage your money, control your spending, save more money, pay off debt, or stay out of debt.

This literally means that a budget is your first step towards making your financial goals a reality.

Often times, It’s not about how much you make, but about what you do with what you’ve got since proper money management does not involve a magic formula to find more money rather it simply means getting the most from the money you do have.

Research has shown that someone who manages their finances responsibly has peace of mind and knows how to:

- Pay their living expenses

- Keep debts to a manageable level

- Save for the extras that make life enjoyable

- Avoid constant money anxiety

Many people experience the usual emotions that occur when they don’t know how to do something well especially when money is involved. Some of these feelings may include:

- Frustration

- Guilt

- Envy

- Anger

- Shame

- Disappointment

You can create your budget worksheet or even use a paper and pen to outline your budget as long as every necessary information is being captured for a guide on the budget created.

Now let us discuss in detail how you can overcome these feelings through proper money management starting with setting a budget:

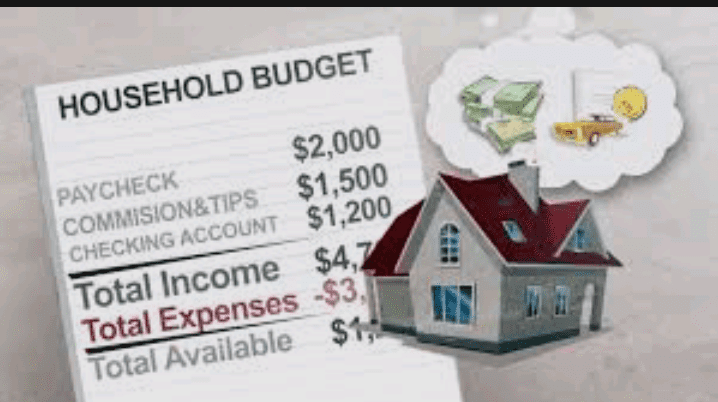

1. Outline your Income and their Sources

The first place to start from is to listing your income and its sources. Here is where questions like:

1) How much do I actually earn at the end of every day, week, month, or year? depending on how your payment comes in but on this article, we will be using “Monthly income” as a case study.

2) What are the sources of those incomes, are they regular or irregular income sources?

3) How much will I be willing to spend from my monthly income to clear my debits without being affected?

Meanwhile, when making a budget it is strongly advisable to only add up all reliable sources of income: wages from a job, alimony, child support, and more.

Notice that word reliable. If you sometimes get cash from outside jobs or hobbies, but it’s not on a regular basis, don’t put the money down as income in your budget. Your budget should be a document you can depend on.

If you’re self-employed or have a fluctuating income, use an average monthly income or an estimate of the income you expect to receive in a particular month.

Read Also: How Lack of Working Capital Hurts your Business

2. Calculate your Expenses for your Household Budget

Now here is where all your expenses both for your household budget and other expenses are being analyzed and calculated. Some of your monthly expenses are fixed like: mortgage/rent, property taxes, child support, etc. while others may vary, such as electricity, water, and groceries. List all the fixed expenses and the amount of the expense.

Because some expenses are intermittent, such as insurance payments, you’ll get the most accurate financial picture if you calculate an average for six months to a year.

Add up everything you spent for the last six to 12 months and then divide by the amount of months, which will give you your average monthly expenses.

You must also factor unexpected bills as to be thorough when adding up your in order to enable you create a realistic budget. A forgotten bill really throws a wrench into your savings plan.

Therefore, when calculating your expenses, also factor in unexpected bills, such as unplanned car repairs. You can add an extra 10% – 15% as miscellaneous in-case of these unexpected expenses.

So if you’ve determined that you spend $1,250 a month for instance, add $125 to $187.5 to the total amount.

3. Calculate your Net Income

Your net income is the total amount you have left over after all the bills are paid. If your result shows that you’re making more money than you’re spending, congratulations.

This amount can be earmarked for savings and to pay off debt. You can calculate your net income by subtracting your expenses from your monthly income and write down the number, even if it’s negative…..Smiles!

But if your result shows that you’re spending more than you’re making, it’s time to do some cutting so you have something to save and don’t go further into debt.

4. Adjust your Expenses

If your previous result was negative, this is your next line of action. You need to adjust your expenses to suit your income and even have some amount left for savings.

Try to identify which of those items you have previously listed is insignificant by differentiating your “Needs” from your “Wants” and reduce or eliminate spending in those “want” areas to make more room for the things you “need” to spend money on.

Variable expenses are typically the first places you can adjust spending, e.g., eating out, hobbies, and entertainment. Even some of your fixed expenses can be adjusted, e.g., by reducing your cable or phone bill, canceling your gym membership, or not taking a vacation this year.

Read Also: 10 Smart Ways to Advertise your Business

Once you have a clear picture of where all of your money goes, be merciless in cutting expenses until your budget is in the black. Cut enough so that you have 10 percent to 20 percent of your income left over each month to add to your savings account.

And in a situation where you are unable to cut a sufficient amount from your budget, consider ways you can increase your income.

5. Record and Track Spending Progress

The best way to stay on top of your budget is to record all of your expenses and income. Having to input expenses will cause you to think twice before splurging, and it’s especially satisfying and motivating to record when you’ve met a savings goal.

Throughout the month, track your actual spending against what you budgeted. If you go over household budget from time to time, it will help you figure out where you spent more money.

In the future, you can take greater care not to overspend in that area. Or you may need to adjust your budget to compensate for the additional spending. If you increase your household budget in one area, decrease it in another area to keep your budget balanced.

Be realistic and aim for sticking to your budget most of the time, and you’re bound to reach your financial goals. Breaking your household budget occasionally is OK, providing you get right back on track as soon as possible.

Related: Golden Rules of Goal Setting: – Five Rules to Set Yourself Up for Success