The Securities Financing Transactions Regulation (SFTR) is a European Union (EU) regulation that was introduced to increase transparency and reduce risks in the securities financing market.

It came into effect in April 2016, with different phases of implementation spread over several years. SFTR aims to provide regulators with a comprehensive view of the securities financing market, including transactions such as repurchase agreements (repos), securities lending, and margin lending, which are commonly used by financial institutions for short-term funding and investment purposes.

SFTR was introduced in response to the 2008 global financial crisis, which revealed significant gaps in the regulation and oversight of securities financing transactions. These transactions were identified as potential sources of systemic risk due to their complexity, interconnectedness, and potential for contagion in times of financial stress.

SFTR aims to address these issues by imposing reporting requirements on market participants engaging in securities financing transactions and providing regulators with better access to data to monitor and mitigate risks.

Key Objectives of SFTR

SFTR has several key objectives, including:

Increased Transparency: SFTR requires market participants to report details of securities financing transactions to registered trade repositories. This includes information on the parties involved, the securities used, the terms of the transaction, and collateral details.

This increased transparency allows regulators to better monitor and understand the size, nature, and risks associated with securities financing transactions.

Risk Mitigation: SFTR introduces requirements for risk mitigation techniques, such as collateral management, to reduce counterparty credit risk and operational risks associated with securities financing transactions.

It also imposes additional disclosure requirements on participants engaging in reuse of collateral, which helps to manage risks associated with the rehypothecation of collateral.

Harmonization of Reporting Standards: SFTR aims to harmonize reporting standards across the EU to ensure consistent and comparable reporting of securities financing transactions. This helps regulators to have a clear and comprehensive view of the market and enables better coordination of regulatory efforts at the EU level.

Enhanced Supervision: SFTR provides regulators with greater supervisory powers, including the ability to monitor and assess the risks associated with securities financing transactions. It also enhances the coordination among regulatory authorities to ensure a consistent approach to supervision across the EU.

Who is Affected by SFTR?

SFTR applies to a wide range of market participants, including financial and non-financial counterparties, such as banks, investment firms, pension funds, and corporations, engaging in securities financing transactions. It also includes third-party service providers, such as trade repositories, who are responsible for receiving and processing transaction reports.

Read Also: Managing Business Growth Strategies

SFTR Reporting Requirements

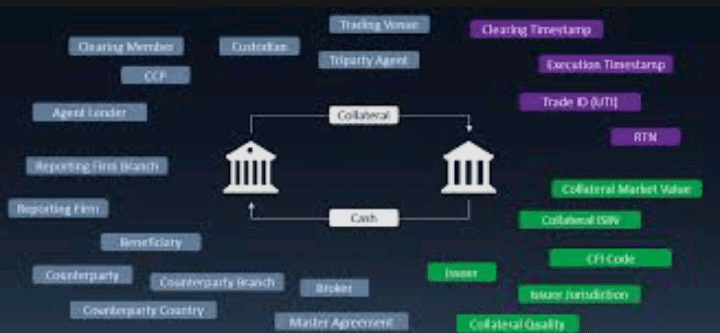

SFTR imposes reporting requirements on market participants, which vary depending on their classification as financial or non-financial counterparties, and the type and volume of their securities financing transactions. Generally, SFTR requires the reporting of the following information to registered trade repositories:

Unique Trade Identifier (UTI): A unique identifier assigned to each securities financing transaction.

Counterparty Information: Information on the parties involved in the transaction, including their Legal Entity Identifier (LEI) code, if applicable.

Transaction Details: Information on the terms of the transaction, such as the type of transaction, maturity date, currency, and interest rate.

Collateral Details: Information on the collateral used in the transaction, including its type, value, and haircut.

Reuse of Collateral: Information on the reuse of collateral, including the identity of the receiving counterparty.

SFTR Reporting Challenges

The implementation of SFTR has posed several challenges for market participants. Some of the key challenges include:

Complexity of Reporting Requirements: SFTR reporting requires market participants to report a significant amount of data related to SFTs, including trade details, collateral information, and counterparty information, among others.

The reporting requirements are complex and may vary depending on the type of SFT, the counterparty, and the collateral used. This complexity can pose challenges in accurately capturing, validating, and reporting the required data, especially for market participants with diverse portfolios of SFTs.

Data Quality and Accuracy: Reporting accurate and high-quality data is critical under SFTR. However, obtaining accurate data can be challenging, as it requires comprehensive and consistent data capture across various systems and processes.

Data quality issues, such as missing, inconsistent, or incomplete data, can result in reporting errors and non-compliance with SFTR requirements, leading to regulatory penalties and reputational risks.

Data Standardization and Harmonization: SFTR reporting requires adherence to data standards such as ISO 20022 and Financial products Markup Language (FpML).

However, achieving data standardization and harmonization across different market participants, systems, and jurisdictions can be challenging. Differences in data formats, data definitions, and data mapping can result in inconsistencies and discrepancies in SFTR reporting, making it difficult to achieve accurate and meaningful data aggregation and analysis.

Operational and Technical Challenges: Implementing the necessary infrastructure and systems to capture, validate, and report SFT data can be operationally and technically complex.

Market participants may need to invest in new technology solutions, data management processes, and reporting workflows to meet SFTR requirements. Integrating data from different sources, managing large volumes of data, and ensuring data accuracy and timeliness can be operationally challenging, requiring significant resources and expertise.

Legal and Contractual Considerations: SFTR reporting may involve legal and contractual challenges, including issues related to data ownership, data sharing, confidentiality, and consent requirements.

Market participants need to carefully review their contractual agreements, ensure compliance with data protection regulations such as GDPR, and establish appropriate data sharing mechanisms with counterparties and trade repositories to meet SFTR reporting obligations.

Cross-Border Reporting: SFTR applies to SFTs conducted within the EU, as well as SFTs involving EU counterparties or EU-issued securities, regardless of the location of the trade.

This presents challenges for market participants engaging in cross-border SFTs outside the EU, as they may need to navigate different regulatory regimes and reporting requirements, and ensure compliance with both SFTR and local regulations.

Timelines and Deadlines: SFTR has phased reporting requirements, with different timelines for different types of market participants.

Meeting the reporting deadlines and keeping up with evolving regulatory requirements can be challenging, requiring effective coordination among various internal and external stakeholders, including trade repositories, regulators, IT teams, and operations teams.

SFTR reporting presents various challenges related to complexity of reporting requirements, data quality and accuracy, data standardization and harmonization, operational and technical considerations, legal and contractual considerations, cross-border reporting, and timelines and deadlines.

Market participants need to carefully address these challenges to ensure compliance with SFTR requirements and effectively manage their reporting obligations.

Read Also: Analyzing Walmart’s Financial Performance: A Retail Giant’s Success Story

Securities Financing Transparency & Risk Management

Securities financing is a crucial aspect of the global financial markets, enabling market participants to obtain short-term funding or optimize their portfolio holdings.

However, this practice also comes with inherent risks that can impact market stability and pose challenges to regulatory oversight. This is where securities financing data plays a vital role in enhancing transparency and risk management.

Securities financing includes a range of transactions, such as repurchase agreements (repos), securities lending, and margin lending, among others. These transactions involve the temporary exchange of securities for cash or other assets, with an agreement to reverse the transaction at a later date.

Securities financing activities are widely used by financial institutions, including banks, broker-dealers, asset managers, and hedge funds, to access funding, manage liquidity, or generate additional returns on their investments.

The importance of securities financing data cannot be overstated, as it provides critical information for market participants, regulators, and policymakers to assess the health of financial markets, monitor risks, and make informed decisions. Here are some key aspects of securities financing data and why it matters:

Enhancing Transparency: Securities financing data promotes transparency in financial markets by shedding light on the volume, types, and terms of securities financing transactions. This information allows market participants to understand the extent of securities financing activities, assess market dynamics, and identify potential risks.

Transparency in securities financing data is crucial for regulatory oversight, as it helps regulators to monitor market activities, identify potential systemic risks, and take appropriate measures to safeguard financial stability.

Risk Management: Securities financing data enables market participants to assess and manage risks associated with securities financing activities. This includes risks related to counterparty credit, collateral valuation, liquidity, operational processes, and legal and regulatory compliance.

Accurate and comprehensive securities financing data helps market participants to evaluate the creditworthiness of counterparties, assess the quality and adequacy of collateral, and monitor the concentration of risk.

It also enables market participants to conduct stress testing and scenario analysis to assess the potential impact of adverse market conditions on their securities financing activities.

Pricing and Valuation: Securities financing data provides critical information for pricing and valuing securities financing transactions. Pricing and valuation of securities financing transactions depend on factors such as the type of securities, duration of the transaction, counterparty credit risk, and collateral quality.

Accurate and reliable securities financing data allows market participants to determine fair prices for securities financing transactions, assess the risk-reward profile of different transactions, and make informed investment decisions.

Regulatory Reporting: Securities financing data is a key component of regulatory reporting requirements for financial institutions. Many jurisdictions require financial institutions to report their securities financing activities to regulatory authorities for monitoring and risk assessment purposes.

Accurate and timely securities financing data is essential for regulatory reporting compliance and helps regulators to assess the overall stability and resilience of financial markets.

Market Research and Analysis: Securities financing data provides valuable insights for market research and analysis. Researchers, analysts, and market participants use securities financing data to conduct studies on market trends, liquidity conditions, and risk dynamics.

Securities financing data also helps market participants to evaluate the effectiveness of regulatory policies and market practices related to securities financing.

In recent years, there have been efforts to improve the transparency and quality of securities financing data.

For example, initiatives such as the Global Master Securities Lending Agreement (GMSLA) and the Global Reporting Instructions for Securities Financing Transactions (SFTR) have been introduced to standardize reporting requirements and promote transparency in securities financing activities.

These efforts aim to enhance the availability, accuracy, and timeliness of securities financing data, which can contribute to improved risk management, market stability, and regulatory oversight.

Securities Lending Benefits

Securities lending is a practice that has gained significant attention in the world of finance in recent years. It involves the temporary transfer of securities from one party, the lender, to another party, the borrower, in exchange for a fee or other form of compensation.

This seemingly simple transaction has far-reaching implications and can unlock hidden value in the financial markets, benefiting various market participants. In this article, we will explore the concept of securities lending, how it works, and its significance in today’s financial landscape.

What is Securities Lending?

Securities lending is a process through which institutional investors, such as asset managers, pension funds, and insurance companies, temporarily lend their securities to other market participants, typically broker-dealers or other financial institutions. The securities can include stocks, bonds, ETFs, and other types of securities.

The borrower uses these securities for various purposes, such as short selling, market making, arbitrage, or hedging, with the obligation to return the securities at a later date.

The lending of securities is facilitated by intermediaries known as securities lending agents, which act as intermediaries between the lenders and borrowers. These agents help facilitate the transaction by managing the legal, operational, and administrative aspects of the securities lending process, including collateral management, settlement, and reporting.

How Does Securities Lending Work?

Securities lending transactions typically involve a securities lending agent, a lender, and a borrower. The securities lending agent acts as an intermediary and facilitates the transaction by connecting lenders and borrowers, managing the legal and operational aspects, and ensuring compliance with applicable regulations.

The lender, who owns the securities, agrees to lend them to the borrower for a specified period of time, usually in exchange for a fee or other forms of compensation, such as interest payments or a share of the borrower’s trading profits.

The borrower provides collateral, which serves as security against the borrowed securities, and typically posts collateral in the form of cash, government securities, or other high-quality securities.

The borrower uses the borrowed securities for its own purposes, such as short selling or market making, and has the obligation to return the same securities or equivalent securities of the same quantity and quality to the lender at the end of the lending period.

During the lending period, the borrower retains any income or other distributions from the borrowed securities, such as dividends or interest payments.

Why is Securities Lending Significant?

Securities lending plays a crucial role in the functioning of the financial markets and provides several benefits to different market participants.

Enhancing Market Liquidity: Securities lending can improve market liquidity by increasing the availability of securities for short selling, market making, and other trading activities.

Short selling, for example, involves borrowing securities and selling them with the expectation of buying them back at a lower price in the future, thereby providing liquidity and facilitating price discovery in the market.

Generating Additional Revenue for Lenders: Securities lending allows institutional investors to generate additional revenue from their existing securities holdings. By lending their securities, lenders can earn fees or other forms of compensation, which can help offset costs, enhance returns, or fund other investment strategies.

Lowering Borrowing Costs for Borrowers: Borrowers can benefit from securities lending by obtaining access to securities for short selling or other trading activities at a lower cost than if they were to purchase the securities outright. This can help reduce the cost of borrowing and improve the profitability of their trading strategies.

Diversifying Collateral for Collateralized Transactions: Collateral is a key element in many financial transactions, such as repurchase agreements (repos) and derivatives trades. Securities lending provides borrowers with a diversified pool of high-quality collateral that can be used to secure these transactions, reducing concentration risk and improving risk management.