These are books in which accounting transactions are first recorded before been posted to their various accounts in the ledger. Subsidiary books are also called books of prime entries or books of original entries.

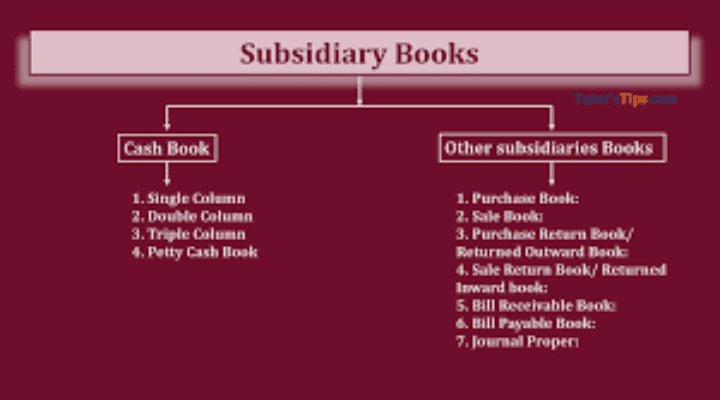

These books are not account with the exception of the cash book, but the balances from the subsidiary books are used to update accounts. The subsidiary books are:

Read Also: The Uses of Accounting Information

- Sales day book or sales journal

- Purchases journal or purchases day book

- Returns inwards journal or returns inwards day book

- Returns outwards day book or returns outwards journal

- Journal or Journal proper

- Cash book or single column cash book

- Two column cash book

- Three column cash book

- Petty cash book

The day books are used to record credit transactions in the order in which they occurred and for transactions of a similar nature. Credit transaction is that, in which goods and/or services exchange hands and payments are paid in future.

Read Also: The Nine (9) Functions of Accountants

This implies that sales and purchases on credit will be recorded in separate day book because they are not of a similar nature. Likewise, no cash transaction is recorded in the day books for whatever reason.

In summary, source documents are important because the information contains there in are used in preparing the subsidiary books of account. Accountants rely on source documents to prepare the books of accounts.

The source documents are first posted to the subsidiary books of account which include the sales day book, purchases journal, returns inwards journal and returns outwards day book.

Read Also: The Scope and Five (5) Natures of Accounting