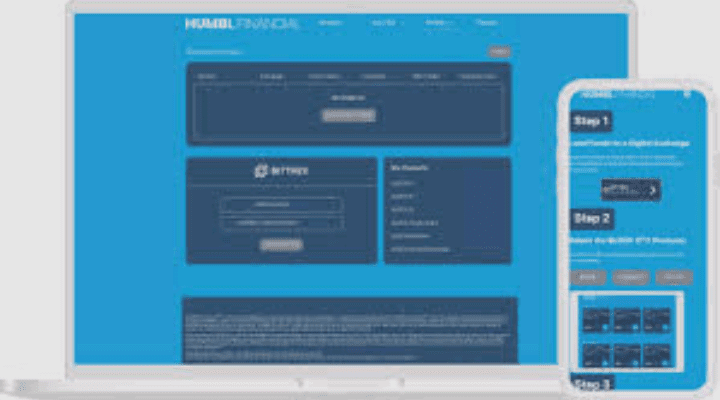

Humbl Financial is a fintech company that offers a suite of digital payment and financial services to consumers and businesses around the world. The company’s mission is to provide financial services that are accessible, affordable, and secure for everyone.

Founded in 2017, Humbl Financial is based in Austin, Texas, and is led by experienced executives with a background in fintech, payments, and blockchain technology. The company has developed a mobile app that allows users to send and receive money, make payments, and manage their finances from anywhere in the world.

One of the key features of the Humbl Financial app is its ability to conduct transactions in multiple currencies, making it an ideal platform for users who need to send money internationally. The app also offers real-time exchange rates and low transaction fees, making it a cost-effective option for users who frequently send money overseas.

In addition to its payment services, Humbl Financial offers a range of financial products, including credit and debit cards, savings accounts, and investment opportunities.

The company’s investment products are particularly notable, as they offer users the opportunity to invest in a range of assets, including cryptocurrencies, stocks, and commodities, all from within the app.

Humbl Financial also offers a range of merchant services, including payment processing and point-of-sale systems. The company’s payment processing services are designed to be flexible and adaptable, allowing merchants to accept payments in a range of currencies and payment methods.

Overall, Humbl Financial is an innovative fintech company that is disrupting the traditional financial industry. By offering a range of digital payment and financial services that are accessible, affordable, and secure, the company is empowering users around the world to take control of their finances and conduct transactions with ease.

As the company continues to grow and expand its services, it is likely to become an increasingly important player in the global financial landscape.

Read Also: Unleashing the Power of Python with Yahoo Finance

Financial Services

Financial services are essential for any economy to function smoothly. They encompass a broad range of activities, including banking, insurance, investments, and lending, among others. Financial services are designed to help individuals, businesses, and governments manage their finances efficiently and effectively.

One of the most fundamental financial services is banking. Banks provide a safe and secure place for people to deposit their money, and they also offer a range of other financial products and services, such as loans, credit cards, and savings accounts.

Banks are also important intermediaries between savers and borrowers, and they play a critical role in the overall functioning of the economy.

Another critical financial service is insurance. Insurance companies offer protection against various risks, such as accidents, illness, or natural disasters. Individuals and businesses can purchase insurance policies to transfer these risks to the insurer, which helps to manage and mitigate financial losses in the event of an unexpected event.

Investments are also an important financial service, as they provide individuals and businesses with the opportunity to grow their wealth. Investment services can include the purchase of stocks, bonds, mutual funds, and other financial instruments.

Investment professionals can help people make informed decisions about where to invest their money, and they can provide guidance on how to manage risk and maximize returns.

Lending is another crucial financial service that helps businesses and individuals finance their operations and projects. Banks and other financial institutions provide loans to borrowers, which can be used for a variety of purposes, such as starting a business, buying a home, or investing in real estate.

Financial services are essential for economic growth and stability. They help individuals and businesses manage their finances and investments, and they provide critical support for various economic activities.

As technology continues to evolve, financial services are becoming more accessible and convenient, and they are playing an increasingly important role in the lives of people around the world.

Mobile Payment Revolution

Mobile payment has revolutionized the way we make payments today. With the widespread use of smartphones, mobile payments have become an increasingly popular option for consumers who are looking for a quick and easy way to pay for goods and services.

Mobile payment, as the name suggests, is a payment made using a mobile device such as a smartphone or a tablet. It allows consumers to pay for goods and services using their mobile devices without the need for cash or a physical credit card. There are two main types of mobile payments – remote payments and proximity payments.

Remote payments are made using mobile apps or websites, while proximity payments are made using near-field communication (NFC) technology that allows two devices to communicate with each other when they are close to each other.

One of the key benefits of mobile payment is convenience. With mobile payment, consumers can make payments on-the-go, without the need to carry cash or credit cards. This means that they can pay for goods and services from anywhere, at any time, as long as they have a mobile device with internet connectivity.

This is particularly useful for those who do not want to carry large amounts of cash or who are in a rush and do not want to wait in line at a checkout counter.

Another benefit of mobile payment is security. Mobile payment systems use encryption technology to protect consumers’ personal and financial information. This means that the risk of fraud and identity theft is significantly reduced when using mobile payment.

Additionally, mobile payment systems often require authentication before a payment can be made, such as a fingerprint or a PIN, which adds an extra layer of security.

Mobile payment has also had a significant impact on the retail industry. With the rise of mobile payment, retailers are now able to offer a more seamless and convenient shopping experience for their customers.

They can accept payments from anywhere in the store, including from mobile devices, which can help to reduce long lines and wait times at checkout counters. This can also help to increase sales, as customers are more likely to make a purchase if the payment process is quick and easy.

Despite these benefits, there are still some concerns about mobile payment. One of the main concerns is the security of personal and financial information. While mobile payment systems use encryption technology to protect consumers’ information, there is still a risk that this information could be compromised if a mobile device is lost or stolen.

Additionally, some consumers may be hesitant to use mobile payment because they are unfamiliar with the technology or because they do not trust it.

Mobile payment has revolutionized the way we make payments today. It offers a convenient, secure, and efficient way to pay for goods and services, and has had a significant impact on the retail industry.

While there are still some concerns about mobile payment, it is likely that it will continue to grow in popularity as more consumers become comfortable with the technology. As mobile payment systems continue to evolve, we can expect to see even more benefits in the future.

Digital Wallet

A digital wallet, also known as an e-wallet or mobile wallet, is a software application that stores payment information, such as credit or debit card details, bank account information, and other payment methods in a secure digital format. It enables users to make online transactions, send and receive money, and store digital currency.

Digital wallets have become increasingly popular due to their convenience, ease of use, and security. With a digital wallet, users can make payments without having to carry cash or physical cards. They can also manage their finances from their mobile device, making it easier to track expenses and stay on top of their budget.

One of the key benefits of using a digital wallet is its security features. Most digital wallets use encryption technology to protect sensitive payment information, and many require users to authenticate themselves using biometric authentication, such as fingerprint or face recognition.

This makes digital wallets a safer option than traditional payment methods, as they can help protect against fraud and unauthorized transactions.

Another advantage of using a digital wallet is its versatility. Digital wallets can be used for a wide range of transactions, including online shopping, bill payments, and peer-to-peer payments. They can also be used to store loyalty cards, gift cards, and other forms of digital currency, making it easier for users to access and redeem rewards.

Digital wallets can also be integrated with other technologies, such as Near Field Communication (NFC), which allows users to make contactless payments using their mobile device. This feature is particularly useful for in-store purchases, as it eliminates the need to physically hand over a payment card or cash.

Despite the many benefits of using a digital wallet, there are also some drawbacks to consider. For example, some merchants may not accept digital wallets as a form of payment, which can limit their usefulness in certain situations.

Additionally, digital wallets may be vulnerable to hacking or other forms of cyberattacks, which can compromise user data and put users at risk.

Overall, digital wallets offer a convenient and secure way to manage your finances and make payments online. With their ease of use, versatility, and security features, they are quickly becoming a popular alternative to traditional payment methods.

Whether you’re shopping online or making a purchase in-store, a digital wallet can help simplify your financial transactions and streamline your financial management.

Read Also: Yahoo Finance: Understanding the Latest Developments and Trends

Online Payment

Online payment has become an increasingly popular method of transaction for individuals and businesses alike. It has revolutionized the way we pay for goods and services, making it easier and more convenient than ever before.

Benefits of Online Payment

One of the primary benefits of online payment is convenience. With online payment, you can make a transaction from anywhere at any time, as long as you have an internet connection.

You no longer have to wait in line at a physical store or carry cash with you. This makes online payment ideal for people who have busy lifestyles and want to save time.

Another benefit of online payment is security. Online payment methods use encryption technology to protect your personal and financial information. This means that your information is safe from fraudsters and hackers who may attempt to steal your identity or use your financial details for fraudulent activities.

In addition, online payment is often faster and more efficient than traditional payment methods. With online payment, transactions are processed in real-time, which means that funds are transferred immediately.

This is especially important for businesses that rely on timely payments to keep their operations running smoothly.

Types of Online Payment Methods

There are several types of online payment methods available, including:

Credit and Debit Cards: Credit and debit cards are one of the most popular types of online payment methods. They allow you to make payments using your card details, which are securely stored by the payment processor.

E-wallets: E-wallets are a type of digital wallet that allows you to store your payment information and make payments online. Some popular e-wallets include PayPal, Skrill, and Apple Pay.

Bank Transfers: Bank transfers allow you to transfer money from your bank account to another account. This is a secure and efficient way to make payments online.

Cryptocurrency: Cryptocurrency is a digital currency that uses encryption techniques to secure transactions and control the creation of new units. It is a decentralized form of currency that is not regulated by any central authority.

Online payment has transformed the way we pay for goods and services. It is convenient, secure, and efficient, making it the preferred method of payment for many people and businesses.

With the different types of online payment methods available, there is something for everyone. Whether you prefer to use your credit card, e-wallet, bank transfer, or cryptocurrency, online payment has made it easier than ever to make transactions online.

Read Also: Health Benefits and Uses of Potash