Your Citerra Finance credit score is more than just a number; it’s a key that can open doors to various financial opportunities. In this article, we’ll take a close look at what a Citerra Finance credit score is and why it matters.

A Citerra Finance credit score, often represented as a three-digit figure, serves as a measure of your creditworthiness. This little number can wield significant influence over your financial life, affecting your ability to obtain loans, credit cards, and even impacting the interest rates you’ll be offered.

In simpler terms, it’s like your financial report card, summarizing how responsible you’ve been with your money.

Understanding how Citerra Finance calculates your credit score is essential for making informed financial decisions. Factors like your payment history, credit utilization, and the length of your credit history all play a role in determining your score.

The better you grasp these elements, the better equipped you’ll be to manage your finances.

Whether you’re looking to improve your credit score or simply want to comprehend its significance, this article will guide you through the basics and provide practical tips for maintaining a healthy financial profile.

So, let’s enter into the world of Citerra Finance credit scores and discover the keys to unlocking better financial opportunities.

Read Also: An In-Depth Exploration of Ashcroft and Oak Financing

Citerra Finance Credit Score

1. What is a Citerra Finance Credit Score?

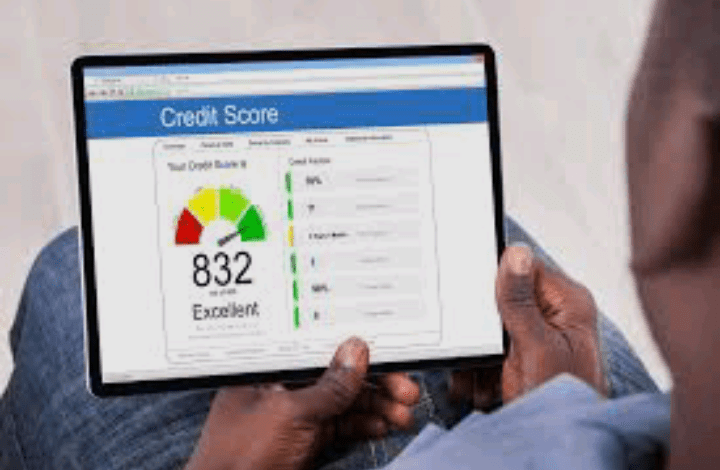

A Citerra Finance credit score is a three-digit number that reflects an individual’s creditworthiness based on their financial history and current credit activity.

This score is instrumental in determining whether you qualify for loans, credit cards, or other financial products, and it often serves as a benchmark for the interest rates you are offered.

Citerra Finance, like other financial institutions, uses credit scores to assess the risk associated with lending money. A higher score suggests a lower risk, making it easier for you to secure credit with favorable terms. Conversely, a lower score can lead to reduced credit opportunities and less favorable loan terms.

2. How is a Citerra Finance Credit Score Calculated?

Understanding the intricacies of Citerra Finance credit score calculation is essential for managing your financial health. While the exact algorithm used by Citerra Finance is proprietary, it’s generally understood to include the following factors:

i. Payment History: This is one of the most crucial components of your credit score. It examines whether you make payments on time. Consistently paying bills on time has a positive impact on your credit score, while late or missed payments can harm it.

ii. Credit Utilization: Citerra Finance considers the amount of credit you’re using relative to your total credit limit. High credit utilization can negatively affect your score, while lower utilization is seen as responsible credit management.

iii. Length of Credit History: The longer you’ve had credit accounts open, the better it is for your score. This component assesses the age of your oldest account, the average age of all your accounts, and the age of your newest account.

iv. Types of Credit: Citerra Finance evaluates the mix of credit accounts you have, including credit cards, installment loans, and mortgages. A diverse mix may positively impact your score.

v. Recent Credit Applications: Frequent credit applications can raise red flags, as they may suggest financial instability. Each credit inquiry can temporarily impact your score.

vi. Public Records: Bankruptcies, tax liens, and other public records can have a significant adverse effect on your credit score.

vii. Collections: Unpaid debts that are sent to collections can also harm your credit score.

It’s crucial to note that each of these factors carries a different weight in the overall score calculation. Payment history and credit utilization typically have the most significant impact, while recent credit inquiries have a smaller influence.

The specific weight assigned to each factor may vary among different credit scoring models used by Citerra Finance.

3. Understanding Citerra Finance Credit Score Ranges

Citerra Finance, like many other institutions, uses a standard credit score range to assess an individual’s creditworthiness. Although the exact range might vary, the following is a common representation of credit score ranges:

i. Exceptional (800-850): Individuals with scores in this range are considered highly creditworthy and pose minimal risk to lenders.

ii. Very Good (740-799): A very good credit score indicates responsible financial behavior and increases your chances of obtaining favorable credit terms.

iii. Good (670-739): Falling into this range implies solid creditworthiness, but you may not qualify for the best terms and interest rates.

iv. Fair (580-669): A fair credit score may limit your access to credit, and you may be subject to higher interest rates and less favorable terms.

v. Poor (300-579): Scores in this range often make it challenging to secure credit, and if you do, the terms may be unfavorable.

Citerra Finance, like other lenders and financial institutions, may use slightly different credit score ranges and classifications. Nevertheless, these ranges provide a general understanding of where your credit score stands and how it may affect your financial prospects.

Read Also: Stages of Play in the Pre-school Years

4. How to Access Your Citerra Finance Credit Score

Citerra Finance typically provides credit scores to their customers and members upon request. To obtain your credit score, you can follow these steps:

i. Contact Citerra Finance: Reach out to Citerra Finance through their customer service, website, or mobile app to inquire about accessing your credit score.

ii. Provide Necessary Information: Citerra Finance may require certain personal information to verify your identity. Be prepared to provide details like your full name, Social Security number, and account information.

iii. Request Your Credit Report: In addition to your credit score, it’s beneficial to request your credit report, which provides a detailed history of your credit accounts, balances, and payment history.

You are entitled to one free credit report annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion). Citerra Finance can assist you in obtaining this information.

iv. Review Your Score and Report: Once you receive your credit score and report, carefully review them to identify any discrepancies or areas for improvement.

Remember that regular monitoring of your credit score is essential for maintaining good financial health, as it allows you to catch errors and address issues promptly.

5. Improving Your Citerra Finance Credit Score

If your Citerra Finance credit score is not where you’d like it to be, there are several strategies you can employ to improve it:

i. Pay Bills on Time: Consistently making on-time payments is one of the most effective ways to boost your credit score. Set up reminders or automatic payments to avoid missing due dates.

ii. Reduce Credit Card Balances: Lower your credit card balances to improve your credit utilization ratio. Aim to keep your credit utilization below 30% of your total credit limit.

iii. Avoid Opening Too Many New Accounts: Frequent credit applications can lower your score. Only open new credit accounts when necessary, and do so strategically.

iv. Diversify Your Credit Mix: If your credit report lacks variety, consider responsibly adding different types of credit accounts over time, such as installment loans or a mortgage.

v. Monitor Your Credit Report: Regularly review your credit report for errors or inaccuracies, and dispute any discrepancies you find.

vi. Negotiate with Creditors: If you have negative items on your credit report, work with your creditors to negotiate settlements or payment plans that can result in the removal of these items.

vii. Be Patient: Improving your credit score takes time, so stay patient and committed to better financial practices.

6. The Importance of a Citerra Finance Credit Score

Your Citerra Finance credit score plays a vital role in your financial well-being. Here are some of the key reasons why it’s essential:

i. Access to Credit: A good credit score opens doors to loans, credit cards, and other financial products. It provides you with the flexibility to borrow money when needed.

ii. Interest Rates: A higher credit score often leads to lower interest rates on loans and credit cards. This means you’ll pay less in interest over time, saving you money.

iii. Housing and Rental Applications: Landlords and mortgage lenders often check your credit score to assess your reliability as a tenant or borrower.

iv. Employment Opportunities: Some employers consider an applicant’s credit history as part of their hiring process, especially for positions involving financial responsibilities.

v. Insurance Premiums: Your credit score can influence the premiums you pay for various types of insurance, including auto and homeowners insurance.

vi. Utilities and Services: Utility companies and service providers may check your credit when setting up accounts. A higher score can help you secure these services without a deposit.

Read Also: Environmental and Health Effects of Wastes