SR22 insurance is a type of auto insurance that is required by law in certain states for drivers who have been deemed high-risk. This type of insurance is often required after a driver has been convicted of a serious driving offense, such as a DUI or reckless driving. In this article, we will discuss what SR22 insurance is, who needs it, and how to obtain it.

What is SR22 Insurance?

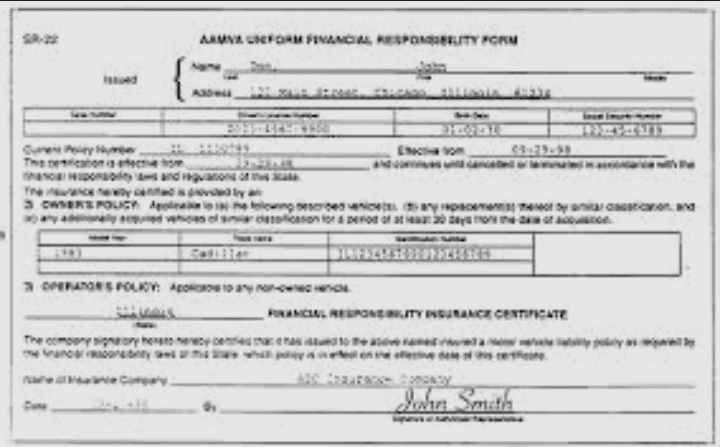

SR22 insurance is not actually a type of insurance policy. Instead, it is a document that proves a driver has met the minimum liability insurance requirements for their state. This document is often required by the state’s department of motor vehicles (DMV) as a condition of reinstating a driver’s license after it has been suspended or revoked.

The document is filed by the insurance company with the state DMV and must be kept current for a certain period of time, which varies by state.

Who Needs SR22 Insurance?

Not all drivers are required to have SR22 insurance. In fact, it is typically only required for drivers who have been convicted of certain driving offenses or who have had their license suspended or revoked.

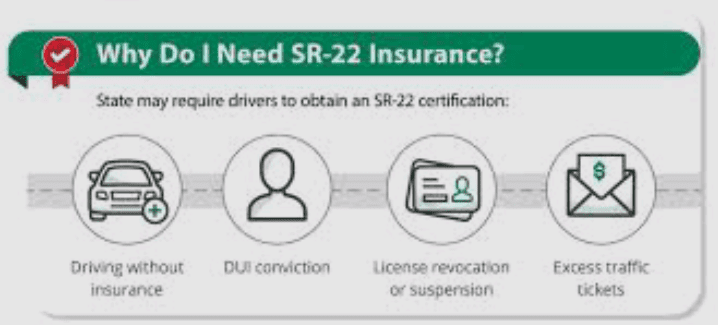

Some of the most common reasons a driver may be required to have SR22 insurance include:

- DUI or DWI conviction

- Reckless driving conviction

- Driving without insurance

- At-fault accidents while uninsured

- Accumulating too many points on their driving record

It’s important to note that not all states require SR22 insurance, and the requirements for obtaining it can vary depending on the state. Drivers who are unsure if they need SR22 insurance should contact their state DMV or an insurance agent to find out.

How to Obtain SR22 Insurance

Obtaining SR22 insurance is a relatively straightforward process. The first step is to contact an insurance company that offers this type of coverage.

The driver will need to provide some basic information, such as their name, address, and driver’s license number. The insurance company will then file the SR22 document with the state DMV on the driver’s behalf.

It’s important to note that SR22 insurance is often more expensive than traditional auto insurance, as drivers who need it are considered high-risk. The cost of the insurance will depend on a number of factors, including the driver’s age, driving record, and location.

SR22 insurance is a document that is required by law in certain states for drivers who have been deemed high-risk.

It is not actually a type of insurance policy, but rather a document that proves a driver has met the minimum liability insurance requirements for their state.

If you have been convicted of a serious driving offense or have had your license suspended or revoked, you may be required to have SR22 insurance in order to have your license reinstated. Contacting an insurance company that offers this type of coverage is the first step in obtaining SR22 insurance.

Read Also: The Benefits of Choosing Bluefire Insurance

Non-owner SR22 insurance

Non-owner SR22 insurance is a type of auto insurance policy that provides coverage for individuals who do not own a vehicle, but are required by law to carry an SR22 certificate.

An SR22 is a form filed by an insurance company on behalf of a policyholder, which serves as proof of financial responsibility for drivers who have had their driver’s license suspended or revoked due to a serious driving offense.

Non-owner SR22 insurance policies are designed for drivers who do not own a car but still need to maintain coverage in order to legally drive.

This type of policy provides liability coverage in case the policyholder is involved in an accident while driving a vehicle they do not own. It also provides coverage for any damages caused to other people or their property.

A non-owner SR22 insurance policy is typically less expensive than a standard auto insurance policy, as it only provides liability coverage and does not cover damages to the vehicle being driven.

This is because the policyholder is not responsible for the maintenance or repair of the vehicle, and therefore does not need coverage for damages to the vehicle itself.

Non-owner SR22 insurance policies are often required by the court or state Department of Motor Vehicles (DMV) as a condition of reinstating a driver’s license following a serious driving offense, such as a DUI or reckless driving.

The policyholder must maintain the policy for a set period of time, typically three years, to maintain their driving privileges.

It is important to note that non-owner SR22 insurance policies do not provide coverage for vehicles that the policyholder owns or regularly uses.

If the policyholder does own a vehicle or frequently uses someone else’s vehicle, they will need to purchase a standard auto insurance policy that includes an SR22 filing.

When shopping for non-owner SR22 insurance, it is important to compare quotes from multiple insurance providers to find the best rates and coverage options.

It is also important to ensure that the policy meets the requirements set forth by the court or DMV, as failure to maintain the policy could result in the suspension or revocation of the driver’s license.

Non-owner SR22 insurance provides a way for drivers who do not own a vehicle to meet the legal requirements for maintaining auto insurance coverage.

It is a cost-effective option for individuals who have had their driver’s license suspended or revoked due to a serious driving offense. By maintaining the policy for the required period of time, drivers can regain their driving privileges and get back on the road.

SR22 Filing

If you’ve been ordered by the court to file an SR22 form, it can be a confusing and stressful process. An SR22 is a certificate of financial responsibility that is required by some states for drivers who have been convicted of certain driving offenses, such as DUI or driving without insurance.

The purpose of an SR22 is to ensure that high-risk drivers maintain liability insurance coverage for a certain period of time, usually three years. If the driver fails to maintain this coverage, the insurance company will notify the state, and the driver’s license may be suspended again.

Filing an SR22 form can be done through an insurance company. Not all insurance companies offer SR22 coverage, so it’s important to shop around to find one that does. The insurance company will then file the SR22 form with the state on the driver’s behalf.

The cost of an SR22 varies depending on the insurance company and the state in which the driver lives. The cost is usually a one-time filing fee of around $20 to $50, and then an annual fee of around $25 to $50 for the duration of the requirement period.

It’s important to note that an SR22 requirement can also affect the driver’s car insurance rates. Since an SR22 indicates that the driver is high-risk, the insurance company may charge higher rates for coverage. It’s important to compare rates from multiple insurance companies to find the best deal.

Once the SR22 form has been filed, the driver should receive a copy of the form from the insurance company. This should be kept in a safe place, as it may need to be presented to law enforcement or the DMV if requested.

Overall, filing an SR22 form can be a complicated and stressful process, but it’s important for drivers who have been ordered to do so.

By working with an insurance company that offers SR22 coverage, drivers can ensure that they are meeting the state’s requirements and maintaining their driving privileges.

SR22 Insurance Requirement

If you’ve ever been convicted of a serious driving offense like a DUI, reckless driving, or driving without insurance, you may be required to obtain an SR22. An SR22 is a form that is filed by your insurance company to the state to prove that you have liability insurance coverage. Here’s what you need to know about the SR22 requirement.

What is an SR22?

An SR22 is not an insurance policy. Rather, it is a certificate that proves that you have insurance coverage that meets the state’s minimum requirements.

The SR22 is filed by your insurance company to the state on your behalf. If you cancel your insurance policy, your insurance company is required to notify the state, and your driving privileges could be suspended.

Why do I need an SR22?

If you have been convicted of a serious driving offense, your state’s department of motor vehicles may require you to obtain an SR22.

This requirement is put in place to ensure that high-risk drivers have the necessary insurance coverage to protect themselves and others on the road.

How long do I need an SR22?

The length of time you will need to maintain an SR22 varies depending on the state where you live and the offense for which you were convicted. In most cases, you will need to maintain an SR22 for three years.

However, some states may require you to maintain it for longer periods of time, and some may require you to maintain it indefinitely.

How much does an SR22 cost?

The cost of an SR22 varies depending on your state and your insurance provider. In general, you can expect to pay a one-time fee of around $25 to $50 for the filing of the SR22 form.

However, because an SR22 is typically required for high-risk drivers, you can also expect to pay higher insurance premiums than you would if you did not have an SR22.

What happens if I don’t get an SR22?

If you are required to obtain an SR22 and you fail to do so, your driving privileges could be suspended. If you are caught driving without an SR22, you could face fines, community service, and even jail time.

Additionally, if you are involved in an accident and you do not have an SR22, you could be held personally liable for any damages or injuries that occur.

If you have been convicted of a serious driving offense, you may be required to obtain an SR22. While the cost of an SR22 and the length of time you will need to maintain it can vary, it is important to understand that failing to obtain an SR22 can have serious consequences.

If you have questions about the SR22 requirement in your state, it’s best to contact your local department of motor vehicles or your insurance provider.

Read Also: Choosing HealthyPaws for Your Pet’s Health and Wellness

SR22 Insurance Quotes

If you have been involved in certain driving offenses, such as a DUI or a reckless driving conviction, you may be required to obtain SR22 insurance before you can legally drive again.

An SR22 is a form that certifies you have the minimum amount of liability insurance coverage required by your state. If you’re required to have SR22 insurance, you’ll need to get quotes from insurance companies that provide this coverage.

What is SR22 Insurance?

An SR22 is not actually insurance. It’s a form that your insurance company sends to the DMV to show that you have the required amount of liability insurance coverage.

The SR22 is required in many states when you have been convicted of certain driving offenses, such as a DUI or reckless driving, or if you’ve had a certain number of points added to your driving record.

The SR22 form is often required for a certain amount of time, depending on the state and the offense. During this time, you’ll need to maintain the minimum amount of liability insurance coverage required by your state.

If you fail to maintain your coverage or cancel your policy, your insurance company is required to notify the DMV, and your license will be suspended again.

How to Get SR22 Insurance Quotes

When you need SR22 insurance, you may find that not all insurance companies offer it. However, many larger insurance companies do offer SR22 coverage. Here are the steps to take to get SR22 insurance quotes:

Contact Your Current Insurance Company: If you already have an insurance policy, your current provider may offer SR22 coverage. Contact your insurance agent or representative and ask if they offer SR22 coverage. If they do, ask for a quote.

Research Other Insurance Companies: If your current provider does not offer SR22 coverage, or if you’re not satisfied with their quote, research other insurance companies that do. Look for insurance companies that specialize in high-risk drivers or those that offer non-standard auto insurance.

Get Multiple Quotes: Once you’ve found a few insurance companies that offer SR22 coverage, get quotes from each of them. Be sure to compare the coverage and costs of each policy to find the one that best fits your needs and budget.

Choose the Best Policy: After you’ve received quotes from several insurance companies, choose the policy that provides the coverage you need at a price you can afford. Keep in mind that the cheapest policy may not always be the best one, so be sure to review the policy carefully and ask any questions you may have before making a decision.

If you need SR22 insurance, it’s important to get quotes from several insurance companies to find the policy that best fits your needs and budget.

Be sure to maintain your coverage during the required period to avoid having your license suspended again. If you have any questions or concerns about SR22 insurance, talk to your insurance agent or representative.

Read Also: Health Benefits and Uses of Zobo Leaves