Defend the Importance of the Accounting Cycle to a Business

Inorder to Defend the Importance of the Accounting Cycle to a Business, the accounting cycle is a standard practice in financial accounting that allows an organization to record and calculate its financial activities.

The accounting cycle is a series of activities accountants use to record transactions, post to the general ledger, make adjustments, close the books and prepare financial documents.

The accounting cycle is a process by which a company identifies, analyzes and records its financial and accounting details.

For the purposes of a company’s financial records, all transactions are recorded, and those transactions are documented from the moment the transaction begins to the moment it’s finalized on the company’s financial statements.

The cycle consists of a number of steps, each of which relies on earlier steps to collect data and organize it in a meaningful way.

Small businesses, which lack full-time accounting departments, rely on the accounting cycle to establish methods for financial accounting that fit within their budgets and give owners clear views of their changing positions in competitive markets.

Organizations use accounting methods to track and analyze financial transactions and monitor the company’s money.

Managers use the financial information accounting provides to make decisions for the company.

The purpose of the accounting cycle is to generate reports known as financial statements. A business uses financial statements to analyze its performance over a fiscal period.

The accounting cycle works by a series of rules meant to ensure a uniform production of financial statements that are accurate and conform to industry standards.

In earlier periods, mathematical errors were common, but the introduction of computers throughout organizations reduced the likelihood of such errors.

See Also: The Importance of Business Continuity Plan you Need to Know About

In many cases, software automates the accounting cycle, creating even less error in the calculation of various accounting numbers.

The accounting cycle ensures that all accounts that have been debited and credited are documented and that the money going into accounts and the money leaving accounts is equal. It also makes it possible for businesses to compare their results with other businesses in their industry because there are accepted time frames for accounting purposes.

The quarter and year are two such accepted time frames.

Defend the Importance of the Accounting Cycle to a Business

Below are the four (4) basic importance of accounting cycle to a business as well as the four (4) reasons why accounting cycle is necessary to a business or the ways to Defend the Importance of the Accounting Cycle to a Business:

1. Compliance

An accounting cycle enables the financial accounting that businesses need to perform to be in compliance with federal regulations and tax codes. The government requires companies of all sizes to disclose their financial results and pay taxes on their profits, which they must calculate on their own.

The accounting cycle ensures accuracy and uniformity among companies, making the market fairer for competition and making information available to interested parties.

2. Efficiency

For any business with accounting needs, the accounting cycle provides a model for efficient accounting procedures and ongoing processes. The cycle consists of steps, meaning that it functions as a checklist.

As one step is completed, accountants use the cycle to determine which actions to perform next. This is of particular benefit to a small business, which may rely on its owner to handle much of the day-to-day accounting in addition to other duties.

3. Internal Analysis

Within a business, the need for an accounting cycle extends to the necessity of analyzing internal financial performance. Some steps of the accounting cycle, such as analyzing, journalizing and posting transactions, occur on an ongoing basis.

Others, such as preparing and adjusting trial balances, occur only at the end of the cycle and provide the financial statement data that a company’s leaders use to make decisions about future spending and financial strategies going forward.

See Also: The Importance of a Good Location for your Business

4. Time Management

Accounting cycles allow accountants to manage their time based on fiscal periods, such as years and quarters. By comparing the cycle to a calendar, an accounting team can set realistic goals for completing each step in the process in order to have financial statements ready on time.

The accounting cycle also perpetuates itself, ending with steps that prepare an accounting team to perform the same process again for the next fiscal period.

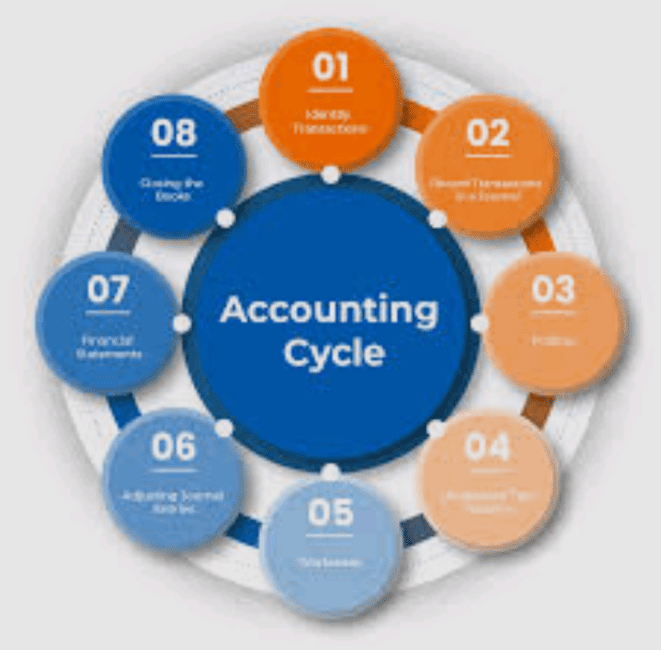

Like earlier mentioned, a common accounting cycle in any given business often has nine (9) or Ten (10) steps, depending on the procedures outlined by the given accounting department.

Each step in the accounting cycle plays an important role in creating accurate entries and managing the company’s finances each time a purchase is made or revenue is earned.

If a company decides to implement an accounting cycle, it is important that each step is followed in the right order.

Now let us discuss about the 9 or 10 steps of a common accounting cycle in any given business below:

Nine-Step Accounting Cycle

The nine-step accounting cycle has the same steps as the 10-step accounting cycle, except for the last step; whereas the nine-step cycle ends at closing the trial balance, the 10-step cycle includes a reversing step, if required. Since this last step is not a required step in each cycle, it is often left out of the cycle.

Common steps include analyzing transactions, journalizing the information, posting the transactions to the ledger, preparing an un-adjustable trial balance, adjusting any necessary trial balance data, preparing the final adjusted trial balance, preparing a list of financial statements, closing the accounts and preparing a post-closing trial balance.

See Also: Best Ways to Advertise your Business for Better Result

The Accounting Process and Steps

In the accounting process, daily transactions are posted in separate journals, such as a cash-receipt journal or a sales journal. Accountants transfer the information from daily journals into a general ledger for the organization in a series of debits and credits. The general ledger contains information such as accounts payable and accounts receivable as well as other accounts the organization uses to track and analyze financial data.

The process also includes adjustments to the general ledger that are not recorded in journals, such as taxes. The final stage in the accounting cycle, or process, is closing the books. The revenue and expenses for the organization are accounted for, and the profit is transferred to the owner’s equity account.

At the end of the accounting cycle, the accounts are brought to zero before beginning the next cycle. From this information, the organization can prepare financial statements. Financial statements provide a summary of all transactions and accounting activity during the accounting cycle.

The accounting cycle 10 steps include the following:

- Identify and analyze transactions.

- Record data in journals.

- Post data to the ledger.

- Unadjust trial balance.

- Adjust the accounting entries.

- Adjust the trial balance.

- Prepare financial statements.

- Close the entries.

- Enter post-closing trial balance.

- Reverse the entries.

Although the accounting cycle is typically broken up into these 10 steps, some models of the accounting cycle collapse this list into fewer steps to simplify the list or ease communication about how the cycle works.

Identify Transactions and Record Them

Any accounting cycle begins with identifying business transactions and analyzing which accounts are affected by the transactions. The process starts with the source documents where the company initially recorded the transactions. These transactions are recorded in a business journal. These journals contain, at minimum, debited and credited accounts.

Debited accounts are the accounts that increase with an influx of money, and credited accounts are the accounts that reduce due to the outflow of money. This is why at least two accounts are necessary for the journal because it must reflect the account the money is taken from and the account the money is deposited to.

See Also: How Lack of Working Capital Hurts your Business

Posting to Ledgers and Adjusting Trial Balances

A business ledger is also known as a book of final entry. This ledger is important because it shows the company’s accounts and the changes that happened to those accounts because of various transactions, along with the current balance on the account. With the balances of each account determined, it is time to unadjust the trial balance.

To unadjust the balance, all account balances are taken from the ledger and placed into a single report that contains all debit and credit balances. If the record-keeping is accurate, then the total debits and credits are equal. If not, then a company performs entry corrections to resolve where a debit or credit was not recorded.

Adjusting Entries and Trial Balances

After any errors are corrected, further adjustments may be necessary. These include cases in which income has been earned but not yet recorded or expenses accrued that have not been documented in the business journal.

The company makes entry adjustments before preparing the final financial statement, and these adjustments reflect any financial transactions that went unrecorded, including income, expenses, deferrals, prepayments, depreciation’s and allowances.

A second form of adjustment that takes place is an adjustment to the trial balance. After the entries are adjusted, a review of the report is made prior to finalization. This review is meant to verify that after all adjustments are accounted for, the debits and credits are equal to one another on the completed financial statement.

See Also: FaceBook: How to Advertise your Business on FaceBook for Better Results

Financial Statements and Closing Entries

After updating the accounts, adjusting entries, and verifying that the debits and credits are equal, the company can issue its financial statement. This statement describes the company’s income, equity, financial position and cash flow, and includes notes that provide any final details about the company’s operations.

After the financial statement is finalized, preparations for the next accounting period begins. Temporary accounts, which are characterized by accounts including income, expenses and withdrawals, need to be closed and posted to an income summary.

Only temporary accounts, not permanent accounts, are closed after the financial statement is finalized.

Post-Closing and Reversing Entries

The final step of the accounting cycle is the preparation of a post-closing trial balance. This is yet another review to see if the debits and credits are equal after the closing entries of temporary accounts has been made.

With temporary accounts closed, only permanent accounts, including their debits and credits, are reflected in the post-closing trial balance.

An optional 10th step, the reversal of entries, does not start during the accounting period. Instead, it begins during the new accounting period. When the new accounting period begins, adjusted entries of expenses, deferrals, income, and prepayments are reversed.

Entries are reversed because these accruals and prepayments are paid off during the new accounting period and are no longer recorded in accounts as either liabilities or assets.

Accounting Cycle Timing and Periods

An accounting cycle coincides to an accounting period. An accounting period is the range of time in which various accounting functions are completed. This period occurs within either a calendar or fiscal year. Accounting periods are necessary because they provide a set period within which stakeholders in the company can determine whether the company met expectations.

The accounting period most typically happens during an annual period. Regardless of whether the accounting cycle corresponds perfectly with the year or not, at the end of the cycle, all the company’s transactions must be accounted for. The final financial statement that the company produces at the end of the accounting cycle demonstrates whether the company was successful during the accounting cycle.

For public companies, financial statements are not optional at the end of the year. These statements, most often produced in the form of an annual report, not only demonstrate that company’s success over the previous fiscal year but also provide a picture into how the company is likely to perform the following fiscal year.

These statements are critical for investors, who use them to guide their decisions and investments in the following year. At the conclusion of the accounting cycle and the end of the fiscal year, these reports are available in the investor relations sections of a company’s website.

Am certain by now that you can confidently Defend the Importance of the Accounting Cycle to a Business when asked to do so after going through this article.

Read More: The 8 Importance of Business Intelligence