A Guide to Average Tax Preparation Costs

Tax season often conjures a sense of anticipation, anxiety, and sometimes dread for many individuals and businesses. As the deadlines approach, so does the inevitable task of preparing and filing taxes. However, one aspect that often takes center stage is the cost associated with tax preparation.

Understanding the average cost of tax preparation can provide valuable insights into what individuals and businesses can expect, and how to make informed decisions when seeking professional assistance.

The Landscape of Tax Preparation

The realm of tax preparation encompasses a broad spectrum of services and providers, each with its own unique pricing structure. From do-it-yourself software to certified public accountants (CPAs) and tax professionals, the choices are diverse and cater to varying needs and complexities.

DIY Software: Many individuals opt for do-it-yourself software, which can range from free versions to more advanced paid options. These software solutions often provide step-by-step guidance and offer a cost-effective approach for those with straightforward tax situations.

Tax Professionals: On the other end of the spectrum, tax professionals, including CPAs and enrolled agents, offer personalized expertise and can handle more complex tax scenarios. The cost of their services can vary based on their experience, location, and the complexity of the tax return.

Factors Influencing Cost

Several key factors play a significant role in determining the cost of tax preparation

Complexity of the Tax Return: The more intricate the tax situation, the more time and expertise it requires to prepare the return accurately. Self-employed individuals, small business owners, and those with multiple sources of income may face a higher cost due to the complexity involved.

Geographical Location: The cost of tax preparation can vary depending on the region. Urban areas tend to have higher average costs due to the higher cost of living and increased demand for tax services.

Type of Service Provider: Different types of service providers offer varying price points. CPAs, tax attorneys, and enrolled agents typically charge more for their specialized knowledge, while tax preparers may offer more affordable rates.

Additional Services: Some tax professionals offer additional services, such as tax planning or representation in case of an audit. These supplementary services can impact the overall cost.

Timeliness: Rush services, especially as the tax deadline approaches, might come at a premium. Planning ahead and seeking assistance early could help mitigate this cost.

Average Cost Ranges

It’s important to note that average costs can vary widely depending on the factors mentioned earlier. As of my last update in September 2021, the following ranges were observed:

DIY Software: Free versions and basic paid versions ranged from $0 to $100.

Tax Professionals: The cost for a professional’s services could start at around $100 for simpler returns and extend to several hundred or even over a thousand dollars for more complex situations.

The average cost of tax preparation is not a one-size-fits-all figure, but rather a reflection of the multifaceted landscape of tax services. Understanding the nuances that contribute to the cost can empower individuals and businesses to make informed decisions.

Whether opting for DIY software or seeking the expertise of a tax professional, careful consideration of one’s tax situation, needs, and budget is key. As tax laws and regulations evolve, it’s advisable to seek up-to-date information and guidance from reputable sources before making any decisions.

Read Also: Exploring the Benefits of Online Tax Preparation

Average Cost of Tax Preparation Services

The average cost of tax preparation services is a multifaceted consideration influenced by an array of variables. Understanding these factors can help you gauge what you might expect to pay and make informed choices.

Remember that while cost is important, the expertise and peace of mind gained from a qualified tax professional can often outweigh the expenses in the long run. As tax laws continue to evolve, seeking professional guidance remains a crucial step in ensuring accurate and compliant tax filings.

Understanding the Variables

The cost of tax preparation services can vary widely based on several key factors:

Complexity of Tax Situation: The more intricate your financial situation, the more time and effort a tax professional will need to invest. Individuals with multiple sources of income, investments, and deductions may incur higher costs due to the additional complexity involved.

Type of Service Provider: The type of professional you hire significantly impacts the cost. Enrolled agents, certified public accountants (CPAs), and tax attorneys may charge differently for their services. CPAs and tax attorneys often command higher fees due to their specialized expertise.

Geographical Location: The cost of living and demand for tax services in your region play a pivotal role. Services in metropolitan areas generally cost more than those in rural locales.

Extent of Assistance: Some individuals only require assistance in preparing and filing their taxes, while others may seek additional services such as tax planning, audits, or consulting. Each of these services adds to the overall cost.

Type of Tax Return: Different types of tax returns, such as individual, business, or non-profit, come with varying complexities and requirements. Business tax returns, especially for corporations, tend to be more intricate and may result in higher costs.

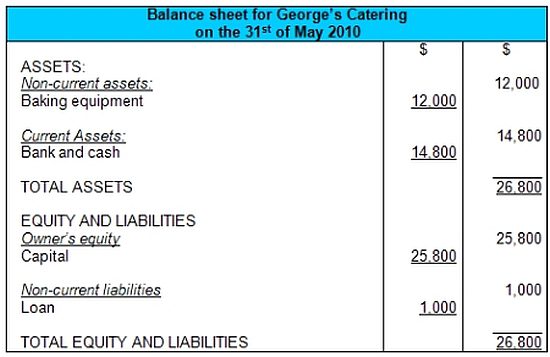

Average Costs: While pinpointing an exact average cost is challenging due to the numerous variables involved, it’s possible to provide a general range:

Basic Individual Returns: For straightforward individual tax returns with minimal deductions, you might find tax preparation services costing anywhere from $100 to $300.

Complex Individual Returns: Individuals with more complex tax situations, including itemized deductions, investments, or multiple sources of income, might expect to pay between $300 and $800 or more.

Business Returns: Business tax returns, which can encompass sole proprietorships, partnerships, corporations, and LLCs, can range from $500 to several thousand dollars depending on the complexity of the business and the services required.

Cost-Saving Strategies: Considering the potential expenses, it’s prudent to explore ways to minimize the cost of tax preparation services:

Organization: Provide all necessary documents and information in an organized manner to reduce the time spent by the tax professional, thereby potentially reducing the overall cost.

DIY Options: Individuals with simple tax situations might consider using tax preparation software or online platforms. However, this approach might not be suitable for everyone, especially those with complex finances.

Comparison Shopping: Obtain quotes from several tax professionals or firms to compare costs and services. Keep in mind that quality and expertise should also factor into your decision.

Tax season often triggers a mix of emotions – from relief to stress as individuals and businesses grapple with the intricate task of preparing and filing taxes. Amidst the complexity of tax codes and regulations, many seek the expertise of tax preparation services to navigate the process smoothly. One of the foremost considerations is the cost of these services.

Average Cost of Hiring a Tax Accountant

Hiring a tax accountant involves an investment that can lead to significant financial benefits. The average cost varies depending on factors such as complexity, location, and the nature of services required.

By understanding these dynamics and making informed choices, individuals and businesses can effectively manage their tax obligations and ensure compliance with confidence.

As individuals and businesses grapple with tax codes, deductions, and compliance requirements, the role of a tax accountant becomes invaluable. But what does it cost to secure the services of these financial guides?

Understanding the Role of a Tax Accountant

Before we delve into the cost aspect, it’s essential to grasp the significance of a tax accountant’s role. Tax accountants are professionals well-versed in tax laws, regulations, and accounting practices.

They offer specialized advice, help with tax planning, prepare tax returns, and ensure compliance with tax regulations. Their expertise can save individuals and businesses from potential pitfalls, optimize tax liabilities, and mitigate the risk of audits.

Factors Influencing the Cost

The cost of hiring a tax accountant can vary widely based on several factors:

Complexity of Tax Situation: The more complex your financial situation is, the more time and expertise a tax accountant will require. Business owners, individuals with multiple sources of income, investments, and intricate deductions might incur higher costs.

Geographical Location: The cost of living and prevailing market rates significantly impact the fees charged by tax accountants. Urban areas and regions with a higher cost of living tend to have higher fees.

Type of Firm: Choosing between a large accounting firm, a mid-sized practice, or an independent tax accountant can lead to varying price ranges. Larger firms often charge more due to the resources and reputation they bring to the table.

Nature of Service: Different services have different price points. Basic tax return preparation might cost less than complex tax planning or IRS audit representation.

Experience and Qualifications: Seasoned tax accountants with extensive experience and advanced certifications often charge higher fees due to their expertise and track record of successful tax management.

Engagement Timing: Last-minute requests or approaching tax deadlines might incur rush fees, as accountants need to manage their time and resources efficiently.

Average Costs Across Scenarios

On average, individuals might spend anywhere from $150 to $750 for basic tax return preparation, depending on the factors mentioned above.

Complex tax situations or business-related tax accounting could escalate the costs to $1,000 or more. For businesses, tax accounting services can range from $1,000 for small businesses to several thousand dollars for larger entities.

Saving Costs and Making Informed Decisions

While tax accountant fees can seem substantial, their expertise often leads to substantial savings in terms of reduced tax liability and minimized chances of legal issues. To make informed decisions and potentially save on costs, consider the following:

Shop Around: Obtain quotes from multiple tax accountants to get a sense of prevailing market rates.

Evaluate Needs: Assess the complexity of your financial situation and choose services that align with your requirements.

Check Qualifications: Ensure the tax accountant is qualified and experienced to handle your specific needs.

Plan Ahead: Engaging a tax accountant well before deadlines can help avoid rush fees.

Long-Term Benefits: Remember that the cost of hiring a tax accountant should be weighed against the potential savings and legal protection they provide.

Navigating the intricate landscape of taxes is a task that demands precision, expertise, and meticulous attention to detail.

Average Cost of Tax Filing Assistance

Navigating the world of tax filing assistance requires careful consideration of your tax situation, budget, and preferences. The average cost can vary depending on the type of service, complexity of your taxes, location, and professional credentials.

By understanding these factors and conducting thorough research, you can make an informed decision that ensures your financial well-being during tax season and beyond. However, the question that often arises is, “What is the average cost of tax filing assistance?”

Understanding the Variables

Type of Service: The cost of tax filing assistance can vary significantly based on the type of service you choose. Enlisting the help of a certified public accountant (CPA) typically comes with a higher price tag compared to utilizing tax preparation software or a tax preparation chain.

Complexity of Tax Situation: The more complex your tax situation, the more you might expect to pay for assistance. For individuals with simple W-2 income, the cost might be lower, while those with multiple sources of income, investments, businesses, or significant deductions may require more in-depth expertise.

Geographical Location: The cost of tax filing assistance can also vary based on where you live. Services in urban areas might be more expensive than in rural regions due to differences in living costs and competition among service providers.

Credentials and Expertise: The credentials and expertise of the tax professional you choose can significantly impact the cost. CPAs and tax attorneys, who have undergone rigorous training and possess specialized knowledge, often charge more than less-credentialed tax preparers.

Additional Services: Some tax professionals offer additional services beyond basic tax filing, such as tax planning, financial consulting, and representation in case of an audit. These services can contribute to an increase in the overall cost.

Method of Filing: The method you choose to file your taxes can also affect the cost. In-person assistance tends to be more expensive than using tax preparation software or online services.

Read Also: How to Find Investors for Real Estate Flipping

Average Costs

Tax Preparation Software: Using tax software like TurboTax or H&R Block can cost anywhere from $0 (for basic filings) to $100 or more (for more complex situations). These software options offer step-by-step guidance and are generally cost-effective for straightforward tax situations.

National Tax Preparation Chains: Well-known tax preparation chains like H&R Block and Jackson Hewitt offer in-person assistance at various price points. On average, you might expect to pay between $150 to $300 for their services.

Independent Tax Professionals: Enlisting the help of an independent tax professional, such as a CPA or enrolled agent, could range from $200 to $500 or more, depending on the complexity of your taxes and the geographic location.

Tax Attorneys: For individuals with complex tax situations or legal issues, the services of a tax attorney might be required. Tax attorney fees can vary widely but often start at $300 per hour.

Making an Informed Decision

When considering tax filing assistance, it’s crucial to weigh the cost against the potential benefits. While professional assistance can save you time, reduce the risk of errors, and maximize deductions, it’s essential to find a service that suits your needs and budget.

Before deciding, gather estimates from different service providers, inquire about their experience, and ask for references. Additionally, check for any hidden fees that might not be initially disclosed.

Tax season brings with it a flurry of paperwork, numbers, and forms that can leave even the savviest individuals feeling overwhelmed. For many, seeking professional tax filing assistance is the solution to avoid errors, optimize deductions, and ensure compliance with the complex tax code.

Read Also: Advantages of Cross-Breeding