A Guide to Short-Term Disability Insurance

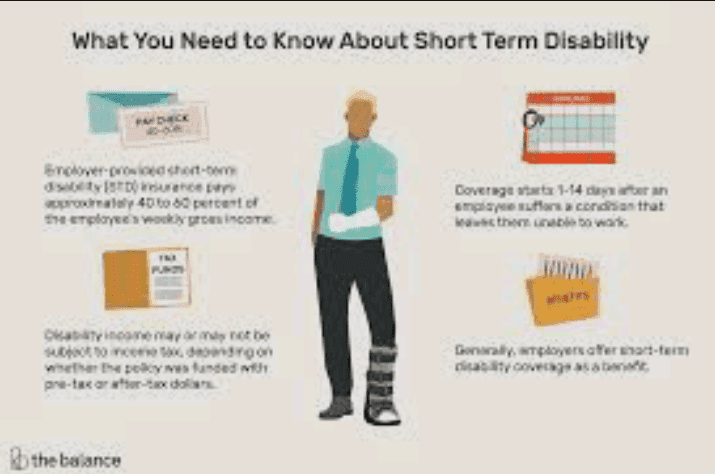

Short-term disability insurance is a type of insurance that provides income replacement for employees who are unable to work due to illness or injury. It is designed to provide a temporary source of income for those who are unable to work for a short period of time, typically up to six months.

In this article, we will explore what short-term disability is, how it works, and why it is important.

What is Short-Term Disability?

Short-term disability insurance is designed to provide a temporary source of income for employees who are unable to work due to a qualifying illness or injury. It is typically provided by employers as part of their benefits package or can be purchased by individuals.

The coverage typically begins after a waiting period, which can vary from a few days to a few weeks, depending on the policy.

How Does Short-Term Disability Work?

Short-term disability works by providing income replacement for a predetermined period of time. The amount of coverage and the duration of the benefits vary depending on the policy. In most cases, short-term disability benefits will cover a portion of the employee’s salary, typically between 50% and 100%, for a set period of time, usually up to six months.

To qualify for short-term disability benefits, an employee must meet certain eligibility requirements, such as being unable to work due to an illness or injury, and having worked for the employer for a certain period of time. The length of the waiting period, as well as the duration and amount of the benefits, will vary depending on the policy.

Why is Short-Term Disability Important?

Short-term disability is important for both employees and employers. For employees, it provides a safety net in case they are unable to work due to illness or injury.

Without short-term disability coverage, employees who are unable to work due to an illness or injury may have to rely on savings or other sources of income, which can be difficult to come by. Short-term disability provides a reliable source of income that can help cover living expenses and medical bills.

For employers, short-term disability is an important tool for retaining employees and keeping them productive. By providing short-term disability coverage, employers are demonstrating their commitment to the well-being of their employees.

In addition, short-term disability can help prevent employees from leaving their jobs due to a temporary disability, which can be costly and disruptive for employers.

Short-term disability is an important type of insurance that provides income replacement for employees who are unable to work due to illness or injury.

It is designed to provide a temporary source of income for those who are unable to work for a short period of time, typically up to six months. Short-term disability is important for both employees and employers, as it provides a safety net for employees and helps employers retain their valuable workforce.

Read Also: Why Liberty Mutual Insurance Is the Right Choice for You

Illness Insurance

Illness and injury leave insurance is a type of insurance that provides coverage for individuals who are unable to work due to illness or injury. This insurance provides financial assistance to policyholders during periods when they are unable to work due to an illness or injury.

The purpose of illness and injury leave insurance is to provide policyholders with financial security during times of unexpected illness or injury.

This type of insurance is particularly important for those who work in physically demanding jobs, where the risk of injury is high. It can also be important for those who are at risk for illnesses that may prevent them from working, such as those with chronic conditions.

Illness and injury leave insurance can provide coverage for a range of expenses, including medical bills, medication costs, and lost wages. Policyholders can choose the level of coverage that best meets their needs and budget. Some policies may also provide coverage for long-term illnesses or injuries, which may require extended periods of time away from work.

One of the benefits of illness and injury leave insurance is that it can provide peace of mind for policyholders, knowing that they have financial support in the event that they are unable to work due to illness or injury. This can help reduce stress and anxiety during difficult times, allowing policyholders to focus on their recovery.

Illness and injury leave insurance is typically offered through an employer as part of a benefits package. However, individuals can also purchase this type of insurance on their own. It is important to carefully review the terms and conditions of any policy before purchasing to ensure that it provides adequate coverage for your needs.

When purchasing illness and injury leave insurance, it is important to consider factors such as the waiting period before benefits begin, the maximum length of coverage, and any exclusions or limitations. It is also important to consider the cost of the insurance and whether it fits within your budget.

Illness and injury leave insurance is an important type of insurance that provides financial support to individuals who are unable to work due to illness or injury.

This type of insurance can provide peace of mind during difficult times, allowing policyholders to focus on their recovery. If you are considering purchasing illness and injury leave insurance, be sure to carefully review the terms and conditions of any policy to ensure that it provides the coverage you need.

Read Also: BTL Marketing: What it is and How it Works

Medical Leave Insurance

Medical leave insurance is a type of insurance that provides financial support to employees who are unable to work due to a medical condition. It is designed to protect employees from the financial hardships that can arise when they are unable to work due to illness or injury.

The importance of medical leave insurance cannot be overstated. Many employees are one illness or injury away from financial ruin.

Without medical leave insurance, employees who become ill or injured may be forced to rely on their savings, borrow money, or even go into debt to pay for their medical bills and daily living expenses. This can have a devastating impact on their financial health and overall well-being.

Medical leave insurance can provide employees with peace of mind, knowing that they will be able to take time off work if they need to recover from an illness or injury without worrying about their financial situation.

It can also provide employers with a way to attract and retain valuable employees by offering them a benefit that can help them maintain their financial stability in times of need.

There are two main types of medical leave insurance: short-term disability insurance and long-term disability insurance.

Short-term disability insurance typically provides benefits for a period of up to six months. It is designed to cover the initial period of recovery following an illness or injury.

Short-term disability insurance benefits can cover a portion of an employee’s salary or wages, usually ranging from 50% to 100% of their pre-disability earnings. The exact amount of benefits provided will depend on the policy purchased by the employer.

Long-term disability insurance, on the other hand, is designed to provide benefits for a longer period of time, typically ranging from several years to the rest of an employee’s life.

It is designed to cover more serious medical conditions or injuries that require an extended period of recovery. Long-term disability insurance benefits can also cover a portion of an employee’s salary or wages, usually ranging from 50% to 70% of their pre-disability earnings.

Both short-term and long-term disability insurance policies have a waiting period before benefits are paid out.

The waiting period is the period of time between when an employee becomes disabled and when they are eligible to receive benefits. Waiting periods can range from a few days to several months, depending on the policy purchased by the employer.

It is important for employers to offer medical leave insurance to their employees as part of their overall benefits package. It not only protects employees from financial hardship but also helps employers attract and retain valuable employees.

Offering medical leave insurance can also help to create a more positive work environment by demonstrating that the employer cares about the well-being of their employees.

Medical leave insurance is a vital component of any employee benefits package. It provides employees with financial protection in the event of illness or injury and helps employers attract and retain valuable employees.

Employers who offer medical leave insurance demonstrate their commitment to their employees’ well-being and create a more positive work environment.

Disability Claim Insurance

Disability claim insurance is a type of insurance that provides income replacement benefits to individuals who become disabled and are unable to work. The benefits can help cover essential expenses such as housing, food, and medical bills, and can be a lifeline for those who have lost their income due to a disability.

Types of Disability Claim Insurance

There are two main types of disability claim insurance: short-term disability insurance and long-term disability insurance.

Short-term disability insurance provides benefits for a limited period, typically up to six months, and is designed to provide income replacement for those who are temporarily unable to work due to an injury or illness.

Long-term disability insurance, on the other hand, provides benefits for a longer period, typically two years or more, and is designed to provide income replacement for those who are unable to work due to a permanent or long-term disability.

Who Needs Disability Claim Insurance?

Disability claim insurance is an important form of protection for anyone who relies on their income to cover their living expenses. If you become disabled and are unable to work, disability claim insurance can help ensure that you are still able to pay your bills and maintain your standard of living.

This type of insurance is particularly important for those who have dependents, as the loss of income can have a significant impact on their well-being as well.

Additionally, if you have a job that puts you at risk for injury or illness, such as a construction worker or healthcare professional, disability claim insurance can provide peace of mind knowing that you are protected in case of an accident.

How Disability Claim Insurance Works

To qualify for disability claim insurance, you typically need to meet certain eligibility requirements, such as having a certain level of income and working a minimum number of hours per week. Once you have met these requirements, you will be eligible to receive benefits if you become disabled and are unable to work.

The amount of benefits you receive will depend on the type of disability claim insurance you have, as well as the terms and conditions of your policy. Short-term disability insurance typically pays out a percentage of your income, while long-term disability insurance may provide a fixed monthly benefit.

It is important to note that there is usually a waiting period before benefits are paid out. This waiting period can range from a few days to several months, and is designed to ensure that the disability is not temporary and that the benefits are being paid to those who truly need them.

Disability claim insurance is an important form of protection for anyone who relies on their income to cover their living expenses.

Whether you are at risk for injury or illness, or simply want to ensure that you are protected in case of an accident, disability claim insurance can provide peace of mind knowing that you and your loved ones are covered in case of a disability.

When choosing disability claim insurance, it is important to carefully review the terms and conditions of the policy and to understand the waiting period and benefit amounts. By doing so, you can ensure that you have the protection you need in case of a disability.

Read Also: How Practicing Yoga Can Keep You in Shape and Relieve Stress