Dairyland Auto Insurance: Comprehensive Coverage for Your Peace of Mind

Dairyland Auto Insurance is a well-established insurance company that has been providing coverage to drivers for over 60 years. With a reputation for exceptional service and a wide range of coverage options, Dairyland Auto Insurance is a popular choice for drivers across the United States.

Auto insurance is a critical aspect of responsible vehicle ownership. It protects you, your passengers, and your vehicle from unforeseen accidents, damages, and liabilities. When it comes to reliable and comprehensive auto insurance, Dairyland Auto Insurance is a name that stands out.

History and Reputation

Dairyland Auto Insurance has a rich history that dates back to 1953 when it was founded in Wisconsin. Over the years, the company has expanded its operations and currently serves customers in 37 states across the country.

Dairyland Auto Insurance is a subsidiary of Sentry Insurance, a leading mutual insurance company based in Wisconsin, which further adds to its credibility and financial stability.

One of the reasons why Dairyland Auto Insurance has gained a strong reputation in the industry is its commitment to providing affordable coverage options for high-risk drivers.

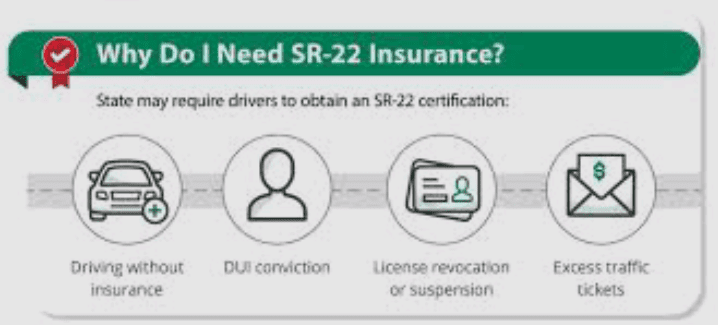

The company specializes in providing insurance for drivers with a less than perfect driving history, including those with DUIs, SR-22 requirements, or multiple violations. Dairyland Auto Insurance understands that everyone deserves a second chance, and they offer coverage options to meet the unique needs of high-risk drivers.

Coverage Options

Dairyland Auto Insurance offers a wide range of coverage options to protect you and your vehicle. Their policies include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Let’s take a closer look at these coverage options:

Liability coverage: This coverage protects you if you are responsible for causing an accident that results in injury or property damage to others. It helps cover the costs of medical bills, repair or replacement of the other party’s vehicle, and legal expenses if you are sued.

Collision coverage: This coverage pays for damages to your vehicle if you are involved in an accident with another vehicle or an object, regardless of fault. It helps cover the costs of repairing or replacing your vehicle.

Comprehensive coverage: This coverage protects your vehicle against damages from non-collision events such as theft, vandalism, fire, natural disasters, and falling objects. It provides additional peace of mind knowing that you are protected against a wide range of risks.

Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who has little or no insurance coverage. It helps cover your medical expenses, lost wages, and other damages that result from the accident.

Medical payments coverage: This coverage pays for your medical expenses and those of your passengers if you are injured in an accident, regardless of fault. It provides additional financial protection for medical bills that may arise after an accident.

Benefits of Dairyland Auto Insurance

There are several benefits to choosing Dairyland Auto Insurance for your auto insurance needs:

Specialization in high-risk drivers: Dairyland Auto Insurance specializes in providing coverage to high-risk drivers who may face challenges in finding affordable insurance elsewhere. If you have a less than perfect driving history, Dairyland Auto Insurance may be able to provide you with coverage options tailored to your needs.

Flexible payment options: Dairyland Auto Insurance offers flexible payment options to fit your budget. You can choose to pay your premiums monthly, quarterly, semi-annually, or annually, depending on what works best for you.

Read Also: Medigap: What You Need to Know About Medicare Supplement Insurance

Dairyland Insurance Rates Review

Car insurance is a necessity for drivers in most states, and finding the right insurance provider with competitive rates is essential. One such insurance company that has been serving customers for decades is Dairyland Insurance.

Dairyland Insurance: An Overview

Dairyland Insurance is a well-established insurance company that has been providing coverage for automobiles, motorcycles, and other specialty vehicles since 1953. They offer insurance options for high-risk drivers, non-standard drivers, and those who may have difficulty obtaining coverage from other insurers due to their driving history or other factors.

Dairyland Insurance is known for its commitment to providing affordable insurance options for drivers who may have challenges securing coverage from other providers. They understand that not all drivers have a perfect driving record, and they strive to offer solutions for those who may have had accidents, violations, or other issues that can impact their insurance rates.

Factors Affecting Dairyland Insurance Rates

Like other insurance companies, Dairyland Insurance takes several factors into consideration when determining the rates they offer to their customers. Some of the main factors that can affect Dairyland Insurance rates include:

Driving History: Your driving history is a significant factor that can impact your insurance rates. If you have a history of accidents, violations, or other driving infractions, you may be considered a higher risk by insurance companies, including Dairyland Insurance, which could result in higher rates.

Type of Vehicle: The type of vehicle you drive can also impact your insurance rates. Vehicles that are more expensive to repair or replace, or those that are considered high-performance or high-risk, may have higher insurance rates compared to more standard or safer vehicles.

Coverage Options: The type and amount of coverage you choose can also impact your Dairyland Insurance rates. If you opt for higher coverage limits or additional coverage options, such as comprehensive or collision coverage, your rates may be higher compared to choosing more basic coverage.

Location: Your location can also affect your insurance rates. If you live in an area with higher crime rates or higher incidents of accidents, your insurance rates may be higher compared to living in a safer area.

Age, Gender, and Marital Status: Other personal factors such as age, gender, and marital status can also impact your Dairyland Insurance rates. Younger drivers, male drivers, and single drivers may be considered higher risk by insurance companies, which could result in higher rates.

Credit History: Your credit history can also impact your insurance rates. Insurance companies, including Dairyland Insurance, may use your credit score as a factor in determining your rates. If you have a poor credit history, you may be charged higher rates.

Dairyland Insurance Rate Options

Dairyland Insurance offers a range of coverage options to suit the needs of different drivers. They offer liability coverage, which is the minimum coverage required by law in most states, as well as additional coverage options such as collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage.

Dairyland Insurance also offers SR-22 insurance, which is a type of insurance required for drivers who have had their license suspended or revoked, and non-owner insurance for drivers who do not own a vehicle but need coverage while driving a rented or borrowed vehicle.

Dairyland Insurance Rates: What to Expect

As with any insurance company, Dairyland Insurance rates can vary depending on your individual circumstances. However, Dairyland Insurance is known for offering competitive rates for drivers who may have challenges obtaining coverage from other providers due to their driving history or other factors.

Dairyland Auto Insurance Requirements

Auto insurance is a critical aspect of vehicle ownership, providing financial protection in case of accidents, damages, or other unexpected events. If you are considering Dairyland Auto Insurance as your insurance provider, it’s important to understand the requirements for coverage.

Minimum Coverage Requirements

Dairyland Auto Insurance, like other insurance providers, typically requires policyholders to carry minimum coverage as mandated by state laws. These requirements vary from state to state and usually include two types of coverage: liability coverage and uninsured/underinsured motorist coverage.

Liability Coverage: Liability coverage is designed to protect you if you cause an accident that results in injuries or damages to others. It includes two components:

Bodily Injury Liability: This coverage pays for medical expenses, lost wages, pain and suffering, and other damages to the other party involved in the accident if you are found at fault. Most states have a minimum requirement for bodily injury liability coverage per person and per accident.

Property Damage Liability: This coverage pays for damages to the property of others, such as vehicles, buildings, or other structures, caused by an accident for which you are at fault. Like bodily injury liability, property damage liability also has a minimum coverage requirement per accident.

Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has inadequate insurance coverage to pay for your damages. This coverage is also mandated in most states and typically has minimum coverage requirements.

Eligibility Criteria

To be eligible for Dairyland Auto Insurance, you must meet certain criteria, which may vary by state and insurance provider. Some common eligibility criteria include:

Valid Driver’s License: You must hold a valid driver’s license to be eligible for auto insurance coverage. The type of license required may depend on the state’s laws and the type of vehicle you own, such as a passenger car, motorcycle, or commercial vehicle.

Vehicle Information: You will need to provide accurate information about the vehicle you intend to insure, including its make, model, year, and usage (personal or commercial). The age, condition, and safety features of the vehicle may also affect your eligibility and premium rates.

Personal Information: You will be required to provide personal information, including your name, age, address, and contact details, to establish your identity and determine your premium rates. Your driving history, including any accidents, tickets, or violations, may also be considered.

Financial Responsibility: Dairyland Auto Insurance may require you to demonstrate financial responsibility, such as providing proof of ownership or lease agreement for the insured vehicle and proof of ability to pay premiums.

Additional Coverage Options

In addition to the minimum coverage requirements, Dairyland Auto Insurance offers various optional coverage options that you can choose to enhance your protection based on your needs and budget. These may include:

Comprehensive Coverage: This coverage pays for damages to your vehicle caused by incidents other than accidents, such as theft, vandalism, fire, or weather-related damages.

Collision Coverage: This coverage pays for damages to your vehicle caused by collision with another vehicle or object, regardless of fault.

Medical Payments Coverage: This coverage pays for medical expenses incurred by you and your passengers in case of an accident, regardless of fault.

Roadside Assistance: This coverage provides services such as towing, tire replacement, lockout assistance, and fuel delivery in case of a breakdown or emergency.

Read Also: The Rise of E-Agent Farmers: Embracing Technology for Sustainable Agriculture

Dairyland Auto Insurance Customer Service

When it comes to choosing an auto insurance provider, excellent customer service is often at the top of the list for many policyholders. After all, insurance is not just about protecting your vehicle, but also ensuring peace of mind during times of uncertainty. One insurance company that stands out for its exceptional customer service is Dairyland Auto Insurance.

Dairyland Auto Insurance has been a trusted name in the insurance industry for over 60 years. As a subsidiary of Sentry Insurance, Dairyland has earned a reputation for providing reliable coverage and going the extra mile for their policyholders.

Their commitment to customer service sets them apart from other insurers and has made them a popular choice among millions of drivers across the United States.

Prompt and Responsive Communication

One of the hallmarks of Dairyland Auto Insurance’s customer service is their prompt and responsive communication with their policyholders. Whether it’s filing a claim, updating coverage, or asking questions about policy details, Dairyland’s customer service representatives are known for their quick response times.

Policyholders can reach Dairyland’s customer service team through various channels, including phone, email, and online chat, making it easy and convenient to get the assistance they need.

Dairyland’s customer service representatives are trained to provide accurate and detailed information to policyholders, addressing their concerns and resolving issues efficiently.

They are also known for their friendly and professional demeanor, making policyholders feel valued and heard. Dairyland understands that dealing with insurance matters can be stressful, and their prompt and responsive communication helps alleviate that stress by providing timely assistance.

Customized Coverage Solutions

Another aspect of Dairyland Auto Insurance’s exceptional customer service is their commitment to providing customized coverage solutions. Dairyland understands that every policyholder is unique, with different insurance needs and budget constraints.

As such, their customer service team takes the time to understand each policyholder’s requirements and provides personalized coverage options accordingly.

Dairyland’s customer service representatives are well-versed in the various coverage options available, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage, among others.

They take the time to explain the nuances of each coverage type and help policyholders make informed decisions based on their specific needs. Dairyland’s goal is not just to sell policies, but to ensure that policyholders have the right coverage to protect their vehicles and assets, while also staying within their budget.

Efficient Claims Handling

Filing an insurance claim can be a daunting process, but Dairyland Auto Insurance’s customer service team is committed to making it as smooth and efficient as possible. Dairyland’s claims process is designed to be straightforward, with policyholders having the option to file claims online or through their customer service hotline.

Once a claim is filed, Dairyland’s customer service team takes proactive steps to keep policyholders updated on the progress and resolution of their claim.

Dairyland understands that policyholders rely on their insurance coverage during times of need, such as after an accident or a loss. As such, their claims handling process is aimed at providing timely and fair resolutions to policyholders’ claims.

Dairyland’s customer service representatives work diligently to process claims efficiently, ensuring that policyholders receive the coverage they are entitled to in a timely manner.

Proactive Policy Review

Dairyland Auto Insurance’s commitment to customer service goes beyond just selling policies and handling claims. They also take a proactive approach to policy review, ensuring that their policyholders have the appropriate coverage for their changing needs.

Dairyland’s customer service team periodically reviews policies and reaches out to policyholders to assess any changes in their circumstances that may require adjustments to their coverage.

Read Also: Furreal Friends: The Ultimate Companion for Kids and Animal Lovers Alike