How Do SBA Loans Works

Are you interested in knowing how do SBA Loans Works? Here is a guide, Small businesses often face challenges when it comes to accessing capital for growth or maintaining operations.

The Small Business Administration (SBA) in the United States offers an array of loan programs to help entrepreneurs and small business owners overcome these financial hurdles. In this article, we will delve into the workings of SBA loans, exploring their benefits, eligibility criteria, application process, and repayment terms.

What are SBA Loans?

SBA loans are financial products facilitated by the Small Business Administration, a government agency aimed at supporting the growth and development of small businesses.

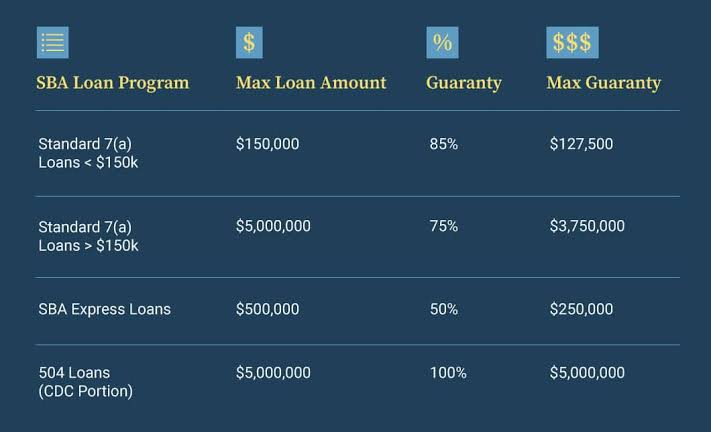

Although the SBA does not directly provide loans, it guarantees a portion of the loan amount, making it easier for lenders to extend credit to small businesses that may not meet traditional lending criteria.

Types of SBA Loans: The SBA offers various loan programs, including the 7(a) Loan Program, CDC/504 Loan Program, Microloan Program, and Disaster Loans. The 7(a) Loan Program is the most common and versatile, providing funding for a wide range of purposes, such as working capital, equipment purchase, and real estate acquisition.

The CDC/504 Loan Program focuses on long-term fixed-rate financing for major assets, while the Microloan Program offers smaller loans of up to $50,000. Disaster Loans, as the name suggests, assist businesses affected by natural disasters or emergencies.

Eligibility Criteria: To qualify for an SBA loan, businesses must meet certain criteria. Generally, they must operate for profit, be considered a small business according to SBA size standards, demonstrate a need for financing, have exhausted other financial options, and exhibit the ability to repay the loan.

Additionally, borrowers must have invested their own time and money in the business, have a good credit history, and provide collateral for loans above a certain threshold.

The Application Process: Obtaining an SBA loan involves several steps. First, the borrower must prepare a comprehensive business plan outlining their purpose for the loan, financial projections, and other pertinent information. The next step is to find a participating lender, such as a bank or credit union, that offers SBA loans.

The lender will evaluate the application, assess the creditworthiness of the business and its owners, and determine the loan terms. If approved, the lender submits the application to the SBA for guarantee approval. Once the loan receives final approval, funds are disbursed to the borrower.

Repayment Terms: SBA loans typically offer favorable repayment terms compared to conventional loans. The terms depend on the specific loan program and the purpose of the loan. Loan amounts can range from a few thousand dollars to several million.

The repayment period may vary from a few years to several decades, and interest rates are generally lower than those of traditional loans. The borrower is expected to make regular payments, including principal and interest, to repay the loan within the agreed-upon timeframe.

Benefits of SBA Loans: SBA loans provide several advantages to small businesses. The guarantee provided by the SBA reduces the risk for lenders, making it easier for businesses with less collateral or credit history to obtain financing.

Additionally, SBA loans often have lower down payment requirements and longer repayment terms, which help alleviate the financial burden on borrowers. These loans can also assist in establishing or improving creditworthiness and building a relationship with a financial institution.

SBA loans serve as a lifeline for countless small businesses, enabling them to secure the funding necessary for growth and stability. By understanding the workings of SBA loans, entrepreneurs can navigate the application process with confidence, potentially unlocking the financial resources needed to achieve their business goals.

If you are a small business owner in need of capital, exploring the options available through the Small Business Administration could be a game-changer.

Read Also: Tax Preparation: Simplifying the Process of Filing Your Taxes

SBA Loan Rates

SBA loans rates provide small businesses with access to capital at reasonable rates, enabling them to grow, expand, and thrive. By understanding the factors that influence SBA loan rates, exploring the various loan programs, and working diligently to improve creditworthiness, entrepreneurs can increase their chances of securing the most favorable loan terms.

Proper research, preparation, and collaboration with lenders will empower small business owners to make informed decisions and obtain the financing they need to achieve their goals.

Factors Affecting SBA Loan Rates

Loan Program: The SBA offers various loan programs, including the 7(a) program, CDC/504 program, and microloans, each with its own unique rate structure. The program you choose will determine the interest rate range you can expect.

Prime Rate: SBA loans are typically based on the Prime Rate, which is the interest rate banks charge their most creditworthy customers. The SBA sets a maximum interest rate that lenders can charge, usually a certain percentage above the Prime Rate.

Borrower’s Creditworthiness: Your personal and business credit history plays a significant role in determining the interest rate you’ll receive. Lenders will assess your creditworthiness, including factors such as credit score, financial statements, and debt-to-income ratio. A stronger credit profile generally leads to more favorable rates.

Loan Amount and Term: The loan amount and repayment term also impact the interest rate. Larger loans and longer terms may result in higher rates, as they increase the lender’s risk exposure over an extended period.

Securing Favorable SBA Loan Rates

Enhance Your Creditworthiness: To obtain the most favorable SBA loan rates, focus on improving your credit score and maintaining a healthy financial profile. Pay bills on time, reduce outstanding debt, and ensure your business financial statements are accurate and up to date.

Comparison Shopping: Different lenders may offer varying interest rates and terms for SBA loans. It is advisable to research multiple lenders, including banks, credit unions, and community development financial institutions (CDFIs), to find the most competitive rates for your specific business needs.

Prepare a Strong Loan Application: Presenting a well-prepared loan application that highlights your business’s strengths, including a solid business plan and financial projections, can positively impact the lender’s perception of risk and potentially lead to more favorable rates.

SBA loans offer small businesses a valuable source of financing with reasonable interest rates. When it comes to financing a small business, the Small Business Administration (SBA) loans have long been a popular choice for entrepreneurs. SBA loans provide favorable terms, flexible repayment options, and reasonable interest rates.

SBA Loans in Texas

SBA loans in Texas have proven to be an invaluable resource for small businesses seeking financing solutions to fuel their growth and success. With favorable interest rates, longer repayment terms, and lower down payment requirements, SBA loans provide a lifeline for entrepreneurs who may face challenges securing conventional loans.

These loans empower businesses to start, expand, acquire, or refinance, stimulating economic development and job creation in Texas.

Understanding SBA Loans

The SBA is a federal agency committed to assisting small businesses by providing them with access to financing options that may otherwise be challenging to obtain. SBA loans are not directly funded by the SBA; rather, the agency guarantees a portion of the loan provided by approved lenders.

This guarantee mitigates the risk for lenders, enabling them to offer more favorable terms to small business owners.

Benefits of SBA Loans in Texas

Favorable Interest Rates: SBA loans offer competitive interest rates that are often lower than traditional commercial loans. This reduced cost of borrowing allows businesses to allocate more resources to growth-oriented activities.

Longer Repayment Terms: SBA loans provide extended repayment periods, enabling businesses to manage their cash flow effectively. The longer terms reduce the monthly repayment burden, making it easier for small businesses to handle their loan obligations.

Lower Down Payments: SBA loans require smaller down payments compared to conventional loans. For instance, the SBA 7(a) program typically requires a down payment of 10% for new businesses and 5% for existing businesses. This lower down payment requirement preserves the business’s working capital and improves its financial flexibility.

Accessible Financing: The SBA loan programs are designed to support small businesses that may not qualify for conventional loans due to limited collateral or credit history. The SBA’s guarantee encourages lenders to extend financing to businesses with more lenient eligibility criteria, increasing access to capital for Texas entrepreneurs.

Considerations for SBA Loans

Application Process: While SBA loans offer numerous benefits, the application process can be more involved than traditional loans. Business owners should be prepared to provide comprehensive financial documentation, business plans, and collateral information to secure an SBA loan.

Collateral Requirements: Although SBA loans generally require collateral, the SBA may allow lenders to finance certain transactions without full collateral coverage. This flexibility eases the burden on business owners who may have limited assets to pledge as security.

Timeframe: The application and approval process for SBA loans may take longer compared to traditional loans. Business owners should plan accordingly and ensure they have adequate working capital during the loan processing period.

Small businesses play a crucial role in the economic landscape of Texas, and they often require financial support to thrive and expand. In this regard, the Small Business Administration (SBA) offers a range of loan programs designed to empower entrepreneurs and facilitate their success.

SBA loans in Texas have become a valuable resource for many business owners, providing them with access to affordable capital and essential support.

SBA Loan Types

SBA loans provide small businesses with invaluable opportunities to secure financing and achieve their growth objectives. The diverse range of loan programs available caters to various business needs, whether it’s starting a new venture, expanding operations, or recovering from a disaster.

Understanding the different types of SBA loans and their eligibility requirements can empower entrepreneurs to make informed decisions and leverage the resources provided by the SBA to fuel their success.

If you’re a small business owner in need of financial assistance, exploring SBA loan options could be a wise step toward realizing your entrepreneurial aspirations. The following are types of SBA loan;

7(a) Loan Program: The SBA’s 7(a) Loan Program is the most popular and versatile lending option. It provides financial assistance for a broad range of purposes, such as starting a new business, expanding an existing one, or purchasing real estate and equipment.

The maximum loan amount is $5 million, and the repayment terms can extend up to 25 years. Eligibility requirements include being a small business operating for profit, demonstrating a need for financing, and having reasonable owner equity to invest.

CDC/504 Loan Program: The CDC/504 Loan Program aims to facilitate long-term, fixed-rate financing for major fixed assets, including real estate and equipment. It is typically used for substantial expansion or modernization projects. This program involves a partnership between the SBA, Certified Development Companies (CDCs), and private sector lenders.

The loan is structured into three parts: a loan from a private lender (50% of the total project cost), a loan from a CDC (40% of the total), and a down payment from the borrower (at least 10%).

Microloan Program: For entrepreneurs seeking smaller loan amounts, the SBA’s Microloan Program is a great option. It offers loans up to $50,000, primarily intended for working capital, inventory purchase, equipment acquisition, or machinery financing.

The program utilizes intermediary lenders, such as nonprofit organizations and community-based organizations, to provide funds directly to small businesses. The repayment terms vary but typically range from six months to six years.

SBA Disaster Loans: During times of declared disasters, such as hurricanes, floods, or wildfires, the SBA provides disaster loans to assist affected businesses in their recovery efforts. These loans come in two forms: Economic Injury Disaster Loans (EIDL) and Physical Disaster Loans.

EIDL helps businesses meet their financial obligations when suffering substantial economic injury due to the disaster, while Physical Disaster Loans support the repair, replacement, or restoration of damaged property.

SBA Express Loan: SBA Express loans offer expedited processing and a simplified application for small businesses needing quick access to capital. Under this program, borrowers can receive loans up to $350,000, with a guarantee from the SBA for up to 50% of the loan amount. The loan terms may vary, and the approval process is typically faster than traditional SBA loans.

Small businesses are the backbone of the economy, and the U.S. Small Business Administration (SBA) plays a vital role in supporting their growth and development. One of the primary ways the SBA assists small businesses is by offering various loan programs tailored to their unique needs.

These loans provide access to affordable financing, often with favorable terms and conditions. In this article, we will explore the different types of SBA loans available to entrepreneurs, highlighting their features, eligibility criteria, and benefits.

Read Also: AARP Tax Preparation: Simplifying Tax Filing for Seniors

SBA Loans for Women

SBA loans for women play a pivotal role in fostering women’s entrepreneurship, leveling the playing field, and unlocking opportunities. By offering accessible financing options, favorable terms, and a supportive ecosystem, these loan programs empower women to turn their business visions into reality.

Women entrepreneurs are encouraged to explore the various SBA loan options, connect with approved lenders, and leverage the resources and support provided by the SBA to propel their businesses forward. Through these initiatives, we can collectively foster an environment of equality, inclusion, and prosperity in the entrepreneurial landscape.

Recognizing this disparity, the Small Business Administration (SBA) has introduced specialized loan programs designed to support and empower women-owned businesses. In this article, we will explore the SBA loans for women and highlight their benefits, eligibility criteria, and the avenues they open for female entrepreneurs.

The Significance of SBA Loans for Women

SBA loans for women play a vital role in bridging the financial gap for female entrepreneurs. These loans provide accessible and affordable financing options, empowering women to start, grow, and expand their businesses.

By reducing the traditional barriers to funding, SBA loans create a level playing field, allowing women-owned businesses to flourish and contribute to economic growth and job creation.

Eligibility Criteria for SBA Loans

To qualify for SBA loans, women entrepreneurs must meet certain eligibility criteria. While the requirements may vary depending on the specific loan program, here are some general guidelines:

Business Ownership: The business must be at least 51% owned and controlled by one or more women who are U.S. citizens or legal permanent residents.

Business Size: The business should meet the SBA’s definition of a small business based on industry standards.

Good Character and Credit History: The business owner should demonstrate good character and have a credit history that reflects their ability to repay the loan.

Collateral and Personal Guarantee: Depending on the loan amount and program, collateral may be required. Additionally, personal guarantees from the business owner(s) are usually necessary.

Business Plan: A comprehensive business plan outlining the company’s objectives, financial projections, and strategies is often required to support the loan application.

Benefits of SBA Loans for Women

Accessible Financing: SBA loans offer women entrepreneurs access to affordable financing options that may not be available through traditional lenders. The partial guarantee provided by the SBA makes lenders more willing to extend credit to women-owned businesses.

Favorable Terms: SBA loans often feature lower down payments, longer repayment terms, and competitive interest rates, reducing the financial burden on women entrepreneurs and enabling them to invest in business growth.

Networking and Support: The SBA provides extensive resources and support to women-owned businesses, including mentoring programs, workshops, and networking opportunities. Women entrepreneurs can connect with other like-minded individuals, access valuable guidance, and tap into a supportive community.

Business Development Assistance: The SBA offers specialized assistance programs tailored to the needs of women-owned businesses. These programs provide training, counseling, and technical assistance to help women entrepreneurs strengthen their skills, enhance their business operations, and increase their chances of success.

Building Credit History: By securing an SBA loan and making timely repayments, women entrepreneurs can establish or improve their credit history. This, in turn, can open doors to additional funding opportunities in the future and enhance their overall financial standing.

The impact of SBA loans for women can be witnessed through numerous success stories. Many women-owned businesses have thrived and achieved remarkable milestones with the support of SBA loans. These success stories serve as inspiration and proof that these loan programs can make a significant difference in empowering women entrepreneurs.

In recent years, women have made significant strides in the business world, breaking barriers and creating successful enterprises across various industries. Despite their achievements, women entrepreneurs often face unique challenges when it comes to accessing financial resources.

Read Also: Top 5 Principles of Breeding in Poultry Production