The Boston Matrix, also known as the Growth-Share Matrix, is a strategic planning tool that helps organizations assess their product portfolio and make informed decisions about resource allocation. The matrix was developed by the Boston Consulting Group (BCG) in the 1970s and remains a popular framework used by businesses today.

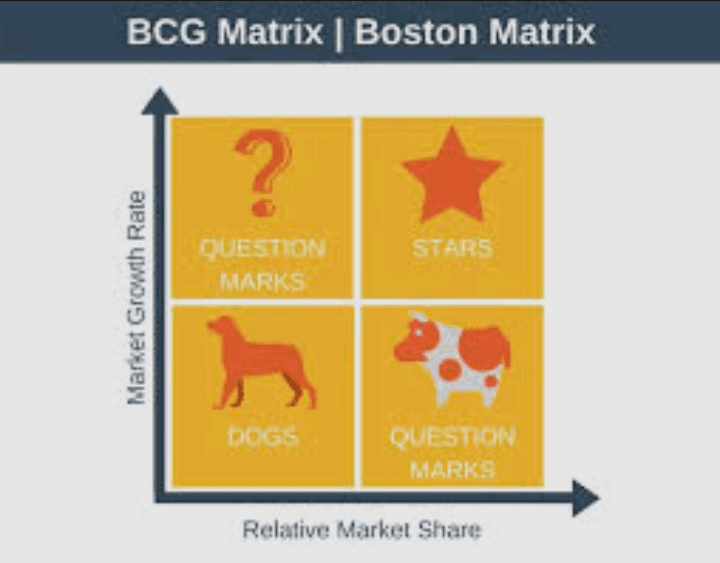

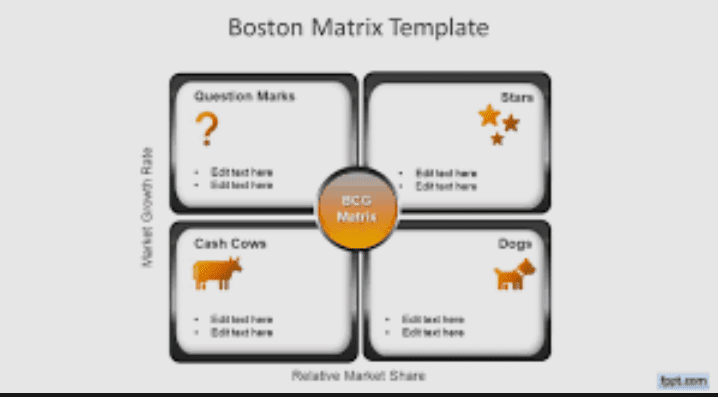

The matrix plots a company’s products or services on a two-dimensional grid, with the x-axis representing market share and the y-axis representing market growth rate. Each product or service is placed in one of four categories: Stars, Cash Cows, Dogs, and Question Marks.

Stars are products or services with a high market share in a high-growth market. These products require a lot of investment to maintain their position, but they have the potential to generate significant returns in the future. Companies should continue to invest in Stars to help them maintain or increase their market share.

Cash Cows are products or services with a high market share in a low-growth market. These products generate significant cash flow for the company, but they do not require a lot of investment to maintain their position. Companies should focus on maximizing the profitability of Cash Cows by reducing costs and increasing prices.

Dogs are products or services with a low market share in a low-growth market. These products are not generating significant returns for the company and may require a lot of investment to maintain their position. Companies should consider divesting or phasing out Dogs.

Question Marks are products or services with a low market share in a high-growth market. These products have the potential to become Stars if the company invests in them, but they require significant investment to do so.

Companies should carefully consider whether to invest in Question Marks, based on their potential for growth and the company’s ability to finance that growth.

The Boston Matrix is a useful tool for companies looking to manage their product portfolio strategically. It helps companies prioritize their investments and resources, and it provides a framework for making informed decisions about which products to focus on and which to divest.

However, there are some limitations to the Boston Matrix. For example, it does not take into account external factors that may affect a product’s market share or growth rate, such as changes in consumer behavior or technological advancements.

Additionally, it assumes that high market share and high growth are always desirable, which may not be the case in all situations.

The Boston Matrix is a useful tool for companies looking to manage their product portfolio strategically. It provides a framework for making informed decisions about resource allocation and can help companies prioritize their investments.

However, it is important to use the Boston Matrix in conjunction with other strategic planning tools and to consider external factors that may affect a product’s performance.

Read Also: How Interactive Marketing Enhances Customer Engagement

Growth Share Matrix

The growth share matrix, also known as the Boston Consulting Group (BCG) matrix, is a strategic management tool used to analyze the growth and market share of a company’s various business units or product lines. The matrix was developed by Bruce D. Henderson in the 1970s while he was working at the Boston Consulting Group.

The growth share matrix is based on two key dimensions: market growth rate and relative market share. The market growth rate refers to the rate at which the market for a particular product or service is growing, while relative market share measures the company’s market share in comparison to its competitors.

The matrix is divided into four quadrants, each representing a different type of business unit or product line:

Stars: These are business units or product lines that have a high relative market share and are operating in a high-growth market. Stars are typically viewed as being very attractive and represent the best opportunities for growth and investment.

Cash cows: These are business units or product lines that have a high relative market share but are operating in a low-growth market. Cash cows are typically viewed as being very profitable and generate a lot of cash, which can be used to fund other parts of the business.

Question marks: These are business units or product lines that have a low relative market share but are operating in a high-growth market. Question marks are typically viewed as being risky and uncertain, as they require a lot of investment to maintain their position in the market.

Dogs: These are business units or product lines that have a low relative market share and are operating in a low-growth market. Dogs are typically viewed as being unattractive and represent a drain on resources.

The growth share matrix can be a useful tool for companies to evaluate their various business units or product lines and determine which ones to invest in, maintain, or divest. For example, companies may choose to invest heavily in their stars to maximize growth opportunities, while also using cash cows to fund these investments.

Question marks may require additional investment to maintain or improve their position in the market, while dogs may be divested to free up resources for more promising areas of the business.

However, the growth share matrix has its limitations. For example, it assumes that high market share and high growth are always desirable, which may not be the case in all situations. It also does not take into account external factors such as changes in technology or the competitive landscape, which can have a significant impact on a company’s business units or product lines.

The growth share matrix is a useful tool for companies to evaluate their various business units or product lines and make strategic decisions about where to invest their resources. However, it should be used in conjunction with other strategic management tools and take into account external factors that may impact a company’s performance.

Resource Allocation Matrix

Resource allocation is a crucial process in project management. It involves determining the resources needed to complete a project and allocating them effectively to ensure that the project is completed on time and within budget. One tool that project managers use to aid in this process is the resource allocation matrix.

A resource allocation matrix is a document that outlines the resources required for a project and the availability of those resources. It is a visual representation of the project plan that helps project managers to assign tasks and allocate resources effectively. The matrix typically includes the following components:

Resource types: This refers to the different types of resources required for the project. These could be people, equipment, materials, or facilities.

Resource availability: This refers to the availability of each resource. It includes information on the number of resources available, their location, and their availability schedule.

Resource allocation: This refers to the allocation of resources to specific tasks within the project. It outlines which resources are assigned to which tasks and for how long.

Resource utilization: This refers to the actual use of resources during the project. It provides information on how much of each resource was used, how efficiently it was used, and how much of it is still available.

The resource allocation matrix is typically used in the planning phase of a project. It helps project managers to determine the resources required for each task and to identify any potential resource constraints. By doing this, project managers can develop a realistic project schedule and budget.

During the execution phase of the project, the resource allocation matrix is used to monitor the actual use of resources and to make adjustments if necessary. Project managers can use the matrix to identify any areas where resources are being underutilized or overutilized and make adjustments to ensure that resources are being used effectively.

There are several benefits to using a resource allocation matrix in project management. First, it helps project managers to identify potential resource constraints early in the planning process. By doing this, they can develop strategies to address these constraints before they become a problem.

Second, the resource allocation matrix helps project managers to allocate resources effectively. By assigning resources to specific tasks, project managers can ensure that each task has the resources it needs to be completed on time and within budget.

Finally, the resource allocation matrix helps project managers to monitor the actual use of resources during the project. By doing this, they can identify any areas where resources are being used inefficiently and make adjustments to ensure that resources are being used effectively.

The resource allocation matrix is a valuable tool in project management. It helps project managers to allocate resources effectively, identify potential resource constraints, and monitor the actual use of resources during the project.

By using this tool, project managers can ensure that their projects are completed on time, within budget, and to the satisfaction of stakeholders.

Read Also: A Look into Ambush Marketing Tactics

Market Share Matrix

The market share matrix is a tool used by businesses to evaluate their position in the market and determine their growth potential. It was first introduced by the Boston Consulting Group in the early 1970s and has since become a popular tool for analyzing and strategizing in the business world.

The matrix is a two-dimensional grid with market share on the x-axis and market growth rate on the y-axis.

The four quadrants created by the intersection of these two dimensions represent different strategic options for businesses. The four quadrants are: Stars, Cash Cows, Question Marks, and Dogs.

Stars are products or services with a high market share and high market growth rate. These products are often in their growth stage and require heavy investment to maintain their growth and market share.

Businesses should focus on maintaining their market share in this quadrant by investing in research and development, marketing, and production to stay ahead of competitors.

Cash Cows are products or services with a high market share but low market growth rate. These products are often in their maturity stage and generate significant cash flow for the business.

Businesses should focus on maximizing profits from cash cows by investing in cost-cutting measures and optimizing production processes to reduce costs while maintaining quality.

Question Marks are products or services with low market share but high market growth rate. These products are often in their introduction stage and require significant investment to grow market share.

Businesses should focus on increasing market share in this quadrant by investing in research and development, marketing, and production to gain a foothold in the market.

Dogs are products or services with low market share and low market growth rate. These products are often in their decline stage and generate little or no profits for the business. Businesses should consider divesting or discontinuing products in this quadrant to free up resources and focus on more profitable products.

The market share matrix can be a valuable tool for businesses to evaluate their position in the market and determine their growth potential. By understanding which products or services fall into each quadrant, businesses can develop targeted strategies for each quadrant and allocate resources accordingly.

The matrix can also help businesses identify potential opportunities for growth and areas where resources can be streamlined to maximize profitability.

However, it is important to note that the market share matrix is not a one-size-fits-all solution and should be used in conjunction with other market analysis tools.

Additionally, market growth rate and market share are not the only factors that should be considered when developing a business strategy. Other factors such as customer needs and preferences, technological advancements, and regulatory changes should also be taken into account.

In conclusion, the market share matrix is a valuable tool for businesses to evaluate their position in the market and develop targeted strategies for growth. However, it should be used in conjunction with other market analysis tools and factors beyond market growth rate and market share should also be considered when developing a business strategy.

Read Also: 10 Amazing Health Benefits of Cucumber Fruit