This article explains journal or journal proper, how it is used for other transactions excluding credit sales, credit purchase and returns. Journal or journal proper is one of the books of original entry that is used to record any transaction which cannot be conveniently recorded or classified into any of the other subsidiary books.

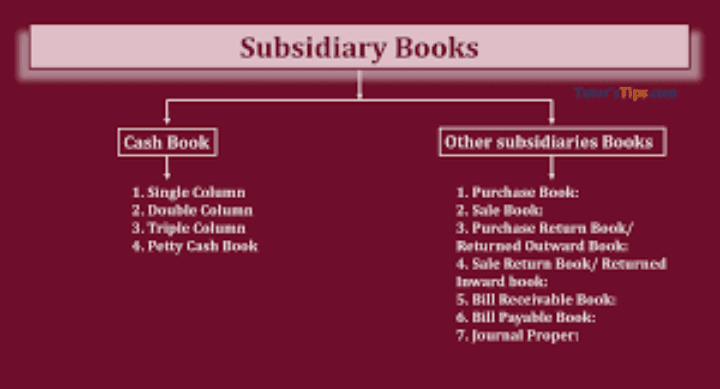

Transactions that cannot be recorded in the sales day book, purchases day book, returns inward day book, returns outwards day book, cash book, two column cash book, three column cash book and petty cash book due to their nature which must pass through the accounting books of original entries are recorded through the journal.

Any transaction that cannot be recorded in other books of original entry as a result of their nature will be recorded in the journal before they are posted to their relevant accounts in ledger.

Transactions that are recorded in the journal include:

Transfers from one account to another.

Purchase and sale of non-current assets on credit.

Adjustments to accounts.

Correction of accounting errors.

Transfer of personal property to a company.

Recording of opening and closing entries.

Recording of special transactions like revaluation of assets, creation of goodwill etc.

Read Also: 10 Values that Contribute to Business Success

The recording in the journal is a direction as to how each account will be treated in the ledger. Hence the journal tells us what to do in the ledger. i.e. a debit in the journal will also be a debit in the ledger. Each record in the journal is followed with a narration to explain the purpose of the posting.

Journal format is presented below.

International Business Limited

Journal

| Date | Particulars | Debit | Credit |

| xx/xx/xxxx | Account debited Account credited Narration | XXXX | XXXX |

Example 1: A company – Mercy Investment – bought a motor vehicle on credit for N850,000 from Peace Associates on August 24, 2012. Prepare Mercy Investment journal for this transaction.

Suggested Solution to Example 1

Mercy Investment

Journal

| Date | Particulars | Debit | Credit |

| 24/8/2012 | Motor vehicle account Peace Associates account Being motor vehicle bought on credit from Peace Associates. | 850,000 | 850,000 |

Note: The meaning of the above journal is that motor vehicle account should be debited with N850,000 in the ledger while the seller’s account – Peace Associates – will be credited with the same amount.

In summary, journal is very important because it serves as the book of original entry for recording accounting transactions that cannot be posted to other book of prime entries because of their nature.

Transactions such as recording of opening and closing entries, correction of accounting errors, purchase and sale of non-current assets on credit, adjustments to accounts, transfer of personal property to a company and recording of special transactions like revaluation of assets, creation of goodwill etc. are posted to the journal first before they are transferred to their relevant accounts in the ledger.

Read Also: Products that can be Derived from Biodegradable Wastes