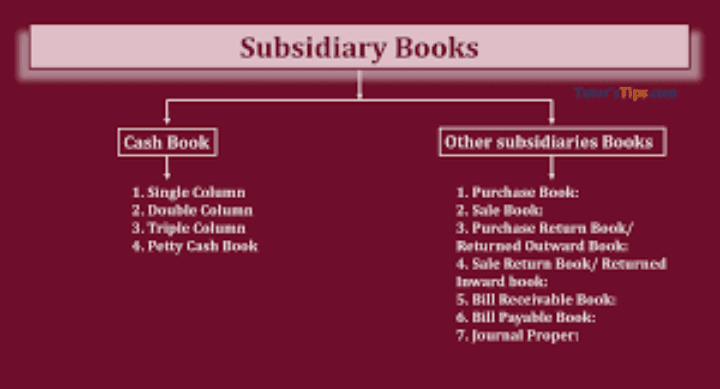

In addition to the day books and journal proper, some of the subsidiary books of accounts that are used to record only cash transactions including physical cash and transaction though the banks are considered in this article.

The four subsidiary books that fall into this category are the cash book, two column cash book, three column cash book and the petty cash book. However, this unit focuses on cash book and the two column cash book.

Cash Book

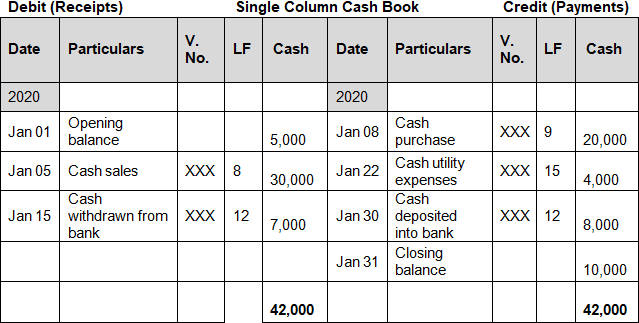

The cash book is a book of original entry used to record all cash transactions. The cash transactions recorded in the cash book can be for cash purchases, cash sales, receipt of cash from customers, payment of cash to supplier, acquisition of properties by cash and all other transactions that involved the receipt and payment of cash.

The cash book is divided into two sides, the left side records all cash receipts while the right side records all cash payments. The left side of a cash book is called debit side while the credit side is the right side.

At the end of a particular period e.g. daily, weekly, monthly, the postings on the debit side of the cash book is added together likewise the credit side. It is expected that the debit side (cash received) at the end of the period should be greater than the credit side (cash payment).

The difference will be the cash balance that will be used for the business for the next period. This cash balance is referred to as balance carried down or balance c/d in the current period and balance brought down or balance b/d for the next period.

Example 1: Prepare a cash book from the following information for the month of May, 2016.

| May 1. | Balance of cash in hand | |||

| 2. | Received cash from P. Ade a credit customer | |||

| 4. | Paid rent for the month | |||

| 5. | Paid cash to L. Lovelyn for goods bought on credit | |||

| 7. | Postage stamp by cash | |||

| 9. | Cash sales | |||

| 10. | Cash purchases | |||

| Paid O. Ayodele on account of credit purchases | ||||

| A credit customer Bonik Venture paid cash | ||||

| Paid wages to shop clerk | ||||

| Paid electricity bills | ||||

| Pay security man cash for the month | ||||

Suggested Solution to Example 1

Cash Book

Dr.For the month of May 2016 Cr.

| Date | Particulars Fol | io Am | ount Date | Particu | lars Folio | Amou | nt |

| May 1 | Balance | b/d | 14,130 | May 4 | Rent | 1,600 | |

| May 2 | P. Ade | 3,600 | May 5 | L. Lovelyn | 3,200 | ||

| May 9 | Sales | 22,110 | May 7 | Postage stamp | 150 | ||

| May 12 | D. Bright -loan | 10,000 | May 10 | Purchases | 15,235 | ||

| May 19 | Bonik Venture | 14,000 | May 18 | O. Ayodele | 6,250 | ||

| May 26 | Wages | 4,500 | |||||

| May 28 | Electricity | 1,200 | |||||

| May 29 | Security | 2,500 | |||||

| May 31 | Balance c/d | 29,20 | 5 | ||||

| 63,840 | 63,840 | ||||||

| June 1 | Balance | b/d | 29,205 |

Read Also: Uses and Importance of Subsidiary Books: Journals in Accounting

Two Column Cash Book

As a business grows, the owner(s) will realize the need to open a bank account where the organization’s money can be kept. To be able to monitor the movement of money to and from the bank, a two column or double column cash book will be prepared.

Two column cash book is, therefore, a form of cash book used in recording cash and bank transactions in the same book and in the order in which they occur.

The bank transactions are recorded under separate column likewise the cash transactions in a different column in a two column cash book.

Cash movement to and from bank

A distinguishing feature of double column cash book is that it shows at a glance the movement or transfer of cash or money from the company’s office to the bank on one side and withdrawal of cash from the bank to the office. These movements are treated in a special way in the two column cash book as follows:

When cash is withdrawn from the bank to the office Debit – The cash column

Credit – The bank column

This entry will reduce the cash in the bank and increase the cash in the office.

When cash is removed from the office and paid into the bank Debit – The bank column

Credit – The cash column

This entry will increase the money in the bank while the cash in the office will reduce.

Contra entry

When any of the above entries in 3.2.1 occurred, it will lead to “contra entry” and it is represented by letter “C” in the folio columns. A contra entry is any transaction that has been recorded twice in an account through a debit and a credit entry in the same account.

It means that ‘contra entry’ cannot be found in any of the journals and cash book, but it can be found in the two column cash book, three column cash book and the petty cash book. ‘Contra entry’ transactions are not posted to the ledgers again.

The format of a two column cash book is presented below.

ABC Limited

Two Column Cash Book

Dr For the month of October 2016 Cr

| Date | Particulars | Folio | Cash | Bank | Date | Particulars | Folio | Cash | Bank |

Example 2: You are to prepare a two column cash book from the information given below for Eno Investments for the month of November 2015.

N

| Nov. | 1. | Bank balance | 23,500 |

| 1. | Cash balance | 500 | |

| 2. | Cash sales | 3,000 | |

| 4. | Cheque from A. Bunmi | 2,500 | |

| 5. | Rent paid by cash | 1,000 | |

| 8. | Paid cash to bank | 1,200 | |

| 18. | Cash sales paid directly to bank | 4,000 | |

| 28. | Paid P. Peters by cheque | 5,500 | |

| 30. | Withdrawn cash from bank | 22,200 | |

| 30. | Paid wages in cash | 5,720 |

Suggested Solution to Example 2

Eno Investments Two Column Cash Book

Dr For the month of November 2015 Cr

| Date | Particulars | Folio | Cash | Bank | Date | Particulars | Folio | Cash | Bank |

| 1 | Balance | b/d | 500 | 23,500 | 5 | Rent | C C c/d | 1,000 | |

| 2 | Sales | 3,000 | 8 | Bank | 1,200 | ||||

| 4 | A. Bunmi | 2,500 | 28 | P. Peters | 5,500 | ||||

| 8 | Cash | C | 1,200 | 30 | Cash | 22,200 | |||

| 18 | Sales | 4,000 | 30 | Wages | 5,720 | ||||

| 30 | Bank | C | 22,200 | 30 | Balance | 17,780 | 3,500 | ||

| 25,700 | 31,200 | 25,700 | 31,200 | ||||||

| Dec 1 | Balance | b/d | 17,780 | 3,500 |

Read Also: Subsidiary Books: Returns Inwards and Outwards Day Book

In summary, two of the subsidiary books of accounts used to record cash and bank transactions excluding discounts are the cash book and the two column cash book.

The cash transactions recorded in the above subsidiary books can be for cash purchases, cash sales, receipt of cash from customers, payment of cash to supplier, acquisition of properties by cash and all other transactions that involved the receipt and payment of physical cash and transactions through the bank.

Two subsidiary books of accounts that are used to record only cash transactions including physical cash and transaction though the banks were explained in this article.

The subsidiary books that fall into this category namely the cash book and two column cash book were define and discussed with appropriate questions including the concept of contra entry.

Read Also: Why You Should Get Mini Drones For Your Kids