CBN bans sale of Forex to Bureau De Changes operators

The Central Bank of Nigeria says it has ended the sales of forex to Bureau De Change operators, saying the parallel market has become a conduit for illicit forex flows and graft.

The bank said it will also no longer process applications for BDC licences in the country.

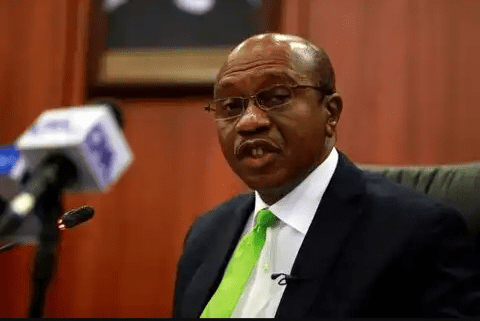

Weekly sales of foreign exchange by the CBN will henceforth go directly to commercial banks, the CBN governor, Godwin Emefiele, said Tuesday in a live TV broadcast after announcing that the bank has retained its benchmark policy rate.

“We are concerned that BDCs have allowed themselves to be used for graft,” Mr Emefiele said,.

He said international bodies, including some embassies and donor agencies, have been complicit in illegal forex transactions that have hindered the flow of foreign exchange into the country.

He said the organisations have chosen to channel forex through the black market than use the official Investors and Exporters (I&E) window, called Nafex.

Mr Emefiele said the regulator will “deal ruthlessly” with banks allowing illegal forex dealers to use their platforms and will report the defaulting international organisations to their regulators.

“We will deal with them ruthlessly and we will report the international bodies,” he said.

Read Also: FG gives new deadline for NIN-SIM verification