How to Start a Business in New Jersey

Are you interested on how to start a business in New Jersey? Starting a business in New Jersey requires careful planning, dedication, and a thorough understanding of the legal and operational aspects. By following these steps and seeking professional guidance when needed, you can lay a strong foundation for your business to thrive in the bustling business landscape of the Garden State.

Idea and Market Research: Begin with a solid business idea and conduct thorough market research. Identify your target audience, understand their needs, and analyze your competition. This step will help you refine your business concept and develop a unique value proposition.

Business Plan: Craft a well-structured business plan outlining your company’s mission, products or services, target market, marketing strategy, and financial projections. A detailed plan will not only guide your business but also attract potential investors or lenders.

Choose a Business Structure: Select the appropriate legal structure for your business, such as a sole proprietorship, partnership, LLC, or corporation. Each structure has its own advantages and implications for taxes, liability, and management.

Register Your Business: Register your business name with the New Jersey Division of Revenue and Enterprise Services. If your business operates under a name different from your legal name, you’ll need to file a “Doing Business As” (DBA) certificate.

Obtain Necessary Permits and Licenses: Research and obtain the necessary permits and licenses for your industry and location. New Jersey’s online Business Action Center provides a comprehensive resource for identifying the licenses and permits your business may require.

Secure Financing: Determine how much capital you’ll need to start and operate your business. Explore financing options, including personal savings, loans, grants, angel investors, and venture capitalists.

Location and Workspace: Decide on a suitable location for your business. Whether you need office space, a retail storefront, or a manufacturing facility, consider factors like foot traffic, accessibility, and local zoning regulations.

Develop Your Brand: Create a strong brand identity, including a logo, website, and marketing materials. Establishing a consistent brand image will help you stand out in a competitive market.

Set Up Financial Systems: Implement reliable accounting and financial systems to track income, expenses, and taxes. Consider hiring an accountant or using accounting software to manage your finances effectively.

Hiring and Employment: If your business requires staff, familiarize yourself with New Jersey’s labor laws, including minimum wage and employment regulations. Create a hiring process that complies with state and federal requirements.

Taxes and Insurance: Understand your tax obligations at the federal, state, and local levels. Obtain the necessary business insurance to protect against potential risks and liabilities.

Marketing and Promotion: Develop a comprehensive marketing strategy to promote your products or services. Utilize both online and offline channels, such as social media, SEO, content marketing, and networking events.

Grand Opening and Launch: Plan a successful grand opening or launch event to generate buzz and attract customers. Leverage your network and local media to maximize exposure.

Continuous Learning and Adaptation: Stay updated on industry trends and adapt your business strategies accordingly. Continuous learning and innovation will contribute to the long-term success of your venture.

Starting a business can be an exciting and rewarding venture, but navigating the legal and logistical requirements can be overwhelming. If you’re considering launching a business in the Garden State, New Jersey, this comprehensive guide will walk you through the essential steps to ensure a successful start.

Read Also: Top Tax Preparation Software for Professionals

Business Registration New Jersey

Registering a business in New Jersey is a pivotal step towards turning your entrepreneurial dreams into reality. While the process may seem intricate, the state offers valuable resources and online platforms to guide you through each stage.

By carefully following the steps listed in this article, you’ll be well on your way to establishing a legally compliant and successful business in the Garden State. Remember, meticulous preparation now can pave the way for smoother operations and growth in the future.

Choosing a Business Structure: The first step in the business registration process is choosing the right structure for your venture. New Jersey offers various options, including sole proprietorship, partnership, limited liability company (LLC), corporation, and more. Each structure comes with its own set of benefits and legal implications, so it’s crucial to carefully assess which one aligns best with your business goals and needs.

Selecting a Business Name: Selecting a unique and appropriate business name is not only important for branding but also for legal purposes. Before finalizing your business name, you need to ensure that it’s available and not already registered by another entity in New Jersey. Conducting a thorough search through the New Jersey Business Gateway Services’ database will help you avoid potential conflicts down the road.

Registering with the New Jersey Division of Revenue: Once you’ve settled on a business name, it’s time to officially register your business with the New Jersey Division of Revenue. This step involves obtaining your Federal Employer Identification Number (FEIN) from the IRS and a New Jersey state tax identification number. These numbers are essential for tax purposes and other legal obligations.

Obtaining Necessary Permits and Licenses: Depending on the nature of your business, you may need specific permits or licenses to operate legally in New Jersey. These could range from local zoning permits to industry-specific licenses issued by state agencies. It’s crucial to research and identify all the necessary permits applicable to your business and acquire them before you begin operations.

Registering for State Taxes: Businesses in New Jersey are subject to various state taxes, including sales tax, corporate business tax, and employee withholding taxes. Registering for these taxes is essential to ensure compliance with the law.

You can do this through the New Jersey Business Gateway Services, where you’ll also find resources to help you understand your tax obligations.

Understanding Employer Responsibilities: If your business will have employees, it’s important to understand your responsibilities as an employer. This includes registering with the New Jersey Department of Labor and Workforce Development, obtaining workers’ compensation insurance, and complying with wage and hour laws.

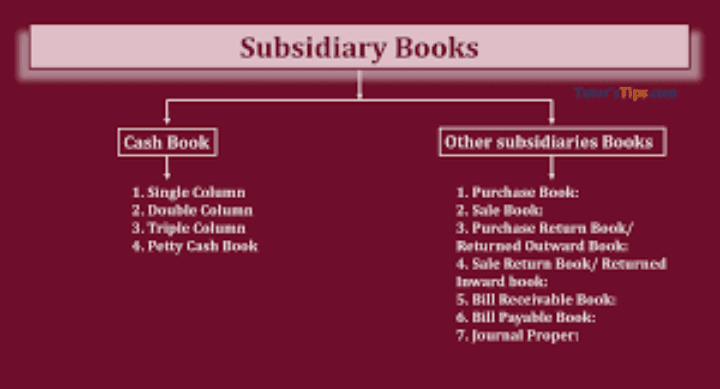

Building a Strong Financial Foundation: As you register your business, it’s wise to establish a solid financial foundation. Opening a business bank account, setting up an accounting system, and maintaining accurate financial records will not only help you manage your business effectively but also ensure transparency for tax purposes.

Setting up a business is an exciting venture that requires careful planning and execution. New Jersey, a state known for its bustling economy and strategic location, offers a promising landscape for entrepreneurs. However, before you can begin your journey towards success, you’ll need to navigate the process of business registration in the Garden State.

New Jersey Business License

Acquiring a New Jersey business license is a pivotal step toward establishing a legally compliant and successful business. By understanding the types of licenses, application procedures, and key considerations, entrepreneurs can navigate the process with confidence.

Remember, obtaining a business license isn’t just a legal requirement; it’s a testament to your commitment to running a business that’s in line with the regulations and standards set forth by the state.

Understanding the Importance of a Business License

A business license is more than just a piece of paper; it’s a formal authorization from the state that permits a business to operate within its jurisdiction. It signifies that a business has met specific requirements and regulations, ensuring that it’s operating in a manner that’s safe and lawful.

For business owners in New Jersey, obtaining the correct licenses is a demonstration of their commitment to adhering to state laws, building trust with customers, and avoiding potential legal complications.

Types of Business Licenses

New Jersey offers a diverse array of business licenses, ranging from general licenses applicable to most businesses to industry-specific licenses. These licenses cover various aspects, including health and safety regulations, professional qualifications, and local zoning ordinances. Some common types of business licenses in New Jersey include:

- General Business License

- Professional and Occupational Licenses (e.g., real estate agents, contractors, healthcare professionals)

- Home Occupation License

- Food Establishment License

- Alcohol Beverage License

- Environmental Permits (e.g., air quality, water discharge)

Application Procedures

The application process for a New Jersey business license can vary depending on the type of license and the specific industry. Generally, the steps involve:

Research: Determine the specific licenses required for your business type and location.

Documentation: Gather necessary documents, such as identification, tax information, and business entity details.

Application: Submit the required forms to the relevant state and local agencies, which might include the New Jersey Division of Revenue and the municipality where your business operates.

Fees: Pay any associated fees, which can vary depending on the license.

Inspections: Some licenses may require inspections to ensure compliance with regulations.

Key Considerations

When embarking on the journey to obtain a New Jersey business license, here are some essential considerations to keep in mind:

Research Thoroughly: Understand the licenses relevant to your industry and location to avoid unnecessary complications later.

Timelines: The application process may take time, so plan ahead and ensure you apply well in advance of your intended business launch.

Compliance: Familiarize yourself with the regulations and requirements specific to your license to ensure ongoing compliance.

Seek Professional Assistance: If the process seems overwhelming, consider seeking legal or professional guidance to navigate the complexities effectively.

Establishing a new business venture is an exciting journey, but it comes with a myriad of administrative responsibilities, including obtaining the necessary licenses and permits. In the state of New Jersey, acquiring a business license is a crucial step that ensures compliance with regulations and allows entrepreneurs to operate legally.

Read Also: How to Find Investors for your Business Idea

Business Plan for New Jersey Startup

Crafting a business plan for your New Jersey startup is not just a requirement for attracting investors; it’s a strategic tool that guides your business’s growth and success.

By addressing the unique characteristics of the state’s market, competition, and economic landscape, you’ll be better equipped to navigate the challenges and capitalize on the opportunities that come your way.

Remember, a well-prepared business plan demonstrates your commitment, vision, and readiness to make a meaningful impact in the Garden State’s entrepreneurial ecosystem.

Executive Summary: Your business plan’s executive summary should succinctly capture your startup’s essence. Outline your business idea, mission statement, market opportunity, and competitive advantage. Highlight your funding requirements and projected financial outcomes.

Company Description: Detail your startup’s history, its founders’ backgrounds, and the problem your business aims to solve. Discuss how your solution addresses a gap in the market and resonates with the needs of New Jersey residents or businesses.

Market Analysis: Conduct a thorough analysis of your target market within New Jersey. Identify your ideal customers, their demographics, behaviors, and pain points. Highlight the state’s economic trends and your business’s fit within them.

Competitive Landscape: Pinpoint your competitors, both direct and indirect, in the New Jersey region. Showcase your understanding of their strengths and weaknesses, and explain how your startup’s offering stands out.

Products or Services: Detail the products or services your startup will offer. Explain their features, benefits, and how they fulfill customer needs. Discuss any proprietary technology or intellectual property that gives you a competitive edge.

Marketing and Sales Strategy: Outline how you plan to reach and engage your target audience in New Jersey. Describe your marketing channels, such as social media, local advertising, and partnerships. Define your sales strategy and projected sales process.

Financial Projections: Present a detailed financial forecast that includes income statements, balance sheets, and cash flow projections for the next 3-5 years. Highlight key financial metrics and assumptions, such as revenue growth and customer acquisition costs.

Funding Request: If you’re seeking funding, clearly state the amount you need and how you plan to use it. Explain the potential return on investment for investors and the timeline for achieving profitability.

Management and Team: Introduce your core team members and their roles. Highlight their relevant experience and skills, emphasizing why they are the right fit to drive your startup’s success.

Implementation Timeline: Create a timeline that outlines key milestones, from product development to market entry and beyond. This timeline will serve as a roadmap for your team’s activities and investors’ expectations.

Starting a business in the diverse and vibrant state of New Jersey presents exciting opportunities, but it also requires careful planning and execution. A well-thought-out business plan serves as your roadmap, guiding you through the challenging terrain of entrepreneurship while helping you attract investors, secure funding, and stay focused on your goals.

Read Also: All You Need To Know About Dead Grass (Avena Mortua)