Big O Tires SNAP Financing: A Comprehensive Guide

Maintaining a car can be a bit like juggling. There are so many things to consider, from fuel costs to regular maintenance. But one aspect that often catches us off guard is tire expenses. We rely on our tires every day, yet replacing them or getting necessary repairs can put a dent in our wallets.

That’s where Big O Tires SNAP Financing steps in to make life easier.Imagine being able to spread the cost of new tires or unexpected tire repairs over time, just like breaking down a big task into smaller, manageable steps.

That’s the essence of Big O Tires SNAP Financing. It’s not a loan from a bank or a credit card; it’s a simple way to pay for your tires and automotive services without the stress of a lump-sum payment.

In this article, we’ll take you through the basics of Big O Tires SNAP Financing in plain language. We’ll explain how it works, why it can be a smart choice, who can benefit from it, and how to get started.

By the end, you’ll have a clear picture of how this financing option can help you keep your car safe on the road without breaking the bank. So, let’s explore and demystify Big O Tires SNAP Financing, making your tire expenses a breeze to manage.

Read also: 5 Barriers to Small Business Growth

Big O Tires SNAP Financing

1. What is Big O Tires SNAP Financing?

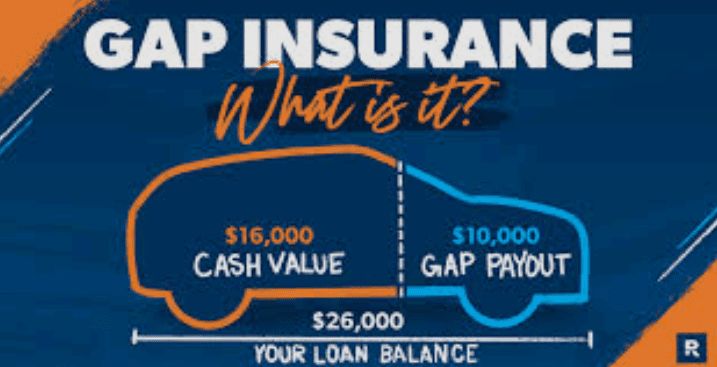

Big O Tires SNAP Financing is a financing program that has been specifically designed to help individuals manage their tire-related expenses. It offers a convenient and flexible payment plan, allowing customers to spread the cost of new tires, tire repairs, and other automotive services over a period of time. This can be a lifesaver when you’re faced with unexpected tire-related issues or when you simply want to upgrade to high-quality tires without draining your savings all at once.

1. How Does Big O Tires SNAP Financing Work?

The fundamental principle behind Big O Tires SNAP Financing is to make automotive expenses more manageable. Here’s how it typically works:

a. Application: To avail of this financing option, you’ll need to apply for credit through the program. This application is generally a straightforward process and can often be completed at a Big O Tires store or online through their website.

b. Credit Approval: Your credit application will be reviewed, and your creditworthiness will be assessed. This evaluation helps determine the financing terms you are eligible for, including the loan amount, interest rate, and the duration of the financing plan.

c. Selection of Tires and Services: Once your credit is approved, you can choose the tires and automotive services you need from Big O Tires. You have the flexibility to select the best products and services that fit your budget and vehicle requirements.

d. Payment Plan: With Big O Tires SNAP Financing, you’ll agree to a payment plan. This plan will outline the monthly payments you need to make over a specified period, which can range from a few months to several years, depending on the terms of your financing agreement.

e. Enjoy Your Tires and Services: After selecting your tires and services and agreeing to the payment plan, you can get your tires installed or services performed at the Big O Tires store. You can enjoy the benefits of your new tires or repaired ones without the immediate financial burden.

f. Monthly Payments: You will make monthly payments according to the terms of your financing plan until the balance is paid in full.

2. Benefits of Big O Tires SNAP Financing

Big O Tires SNAP Financing offers numerous benefits for individuals seeking convenient and flexible ways to manage their tire and automotive expenses:

a. Flexible Payment Options: One of the most significant advantages of this financing program is its flexibility. It allows you to spread the cost of your tires and services over time, reducing the strain on your monthly budget.

b. Quick and Easy Application: Applying for Big O Tires SNAP Financing is a streamlined process, often requiring minimal documentation and quick credit approval.

c. Immediate Access to Tires and Services: Once approved, you can immediately get the tires you need or have your vehicle serviced. This is particularly useful in emergency situations when you can’t afford to wait.

d. Competitive Interest Rates: The program typically offers competitive interest rates, making it an attractive option for individuals looking for affordable financing solutions.

e. Preserve Savings: By using financing, you can preserve your savings for other essential expenses or investments, rather than depleting your funds for immediate tire-related costs.

f. Access to High-Quality Tires: Big O Tires offers a wide range of high-quality tires, and with financing, you can opt for the best tires that suit your vehicle’s needs without compromising on safety and performance.

2. Eligibility Criteria for Big O Tires SNAP Financing

To benefit from Big O Tires SNAP Financing, you’ll need to meet certain eligibility criteria. While these criteria may vary slightly depending on the specific financing program offered at your local Big O Tires store, here are some common requirements:

1. Credit Score: Your creditworthiness plays a significant role in determining your eligibility for Big O Tires SNAP Financing. A higher credit score typically results in more favorable financing terms. However, even if you have a lower credit score, you may still be eligible for financing, albeit with less favorable terms.

2. Income Verification: You will likely be required to provide proof of income. This helps ensure that you have the financial means to make the monthly payments outlined in the financing plan. The specific income requirements can vary, so it’s essential to check with your local Big O Tires store for details.

3. Age Requirement: In most cases, you must be at least 18 years old to apply for Big O Tires SNAP Financing. This is the legal age at which individuals can enter into contractual agreements.

4. Citizenship and Residency: You will need to be a U.S. citizen or a legal resident with a valid Social Security number to be eligible for this financing program.

5. Valid Identification: You’ll need to provide valid government-issued identification, such as a driver’s license, to confirm your identity during the application process.

6. Existing Debts and Financial Obligations: Your existing debts and financial obligations, such as other loans and credit card balances, may be considered when determining your eligibility for financing. Lenders want to ensure that you have the capacity to manage additional financial commitments.

It’s important to note that meeting these eligibility criteria doesn’t guarantee approval for Big O Tires SNAP Financing. The final decision will depend on the lender’s assessment of your creditworthiness and financial stability.

Read also: The Five Stages of Small Business Growth

3. Tips for Making the Most of Big O Tires SNAP Financing

Now that you have a better understanding of what Big O Tires SNAP Financing is and how it works, let’s explore some valuable tips to help you maximize the benefits of this financing option:

1. Review Your Financial Situation: Before applying for Big O Tires SNAP Financing, take a close look at your financial situation. Assess your monthly income, expenses, and existing financial obligations. This evaluation will help you determine how much you can comfortably afford to allocate towards your monthly payments.

2. Compare Financing Terms: Different financing programs may offer varying terms, including interest rates and repayment periods. It’s advisable to compare the terms offered by different lenders or financing options to find the one that suits your budget and preferences best. Look for competitive interest rates and flexible repayment plans.

3. Read the Fine Print: Before signing any financing agreement, carefully read the terms and conditions. Pay attention to details such as interest rates, fees, penalties for late payments, and any special clauses. Understanding the fine print will prevent any surprises down the road.

4. Stick to Your Budget: Once you have a financing plan in place, stick to your budget. Make your monthly payments on time to avoid late fees or penalties. Deviating from your budget can lead to unnecessary financial stress.

5. Use Financing for Necessary Expenses: While Big O Tires SNAP Financing can provide flexibility, it’s important to use it for necessary expenses, such as tire replacements, repairs, or essential automotive services. Avoid using financing for non-essential items or services that can be delayed.

6. Maintain Good Credit: Consistently making on-time payments towards your financing plan can positively impact your credit score. A good credit score opens doors to more favorable financing terms in the future. Conversely, missing payments can harm your credit score and make it more challenging to secure credit in the future.

7. Consider Extended Warranties and Maintenance Plans: When purchasing new tires or services, inquire about extended warranties and maintenance plans. While these may add to your overall costs, they can provide long-term benefits by covering future tire repairs and replacements, reducing the need for unexpected expenses.

8. Keep Records: Maintain detailed records of your financing agreement, payments, and receipts for all tire-related expenses. This documentation can be valuable in case of any disputes or inquiries in the future.

Read also: The Promotion Budget in Marketing