The three-column cash book is one of the subsidiary books of the account used to record cash and bank transactions in addition to discounts received any discounts allowed.

This type of cash book combines a discount column on both the debit and credit sides with the cash and bank columns.

Hence, each side of the cash book has three columns for cash, bank, and discount. The discount allowed column is on the debit side, while the discount received column is on the credit side. It is a cash discount that is recorded in the discount columns and not a trade discount.

A cash discount is an inducement given to debtors (credit customers) for paying their debt on time or promptly within the specified time frame or period. It means that a credit customer can enjoy both the trade discount and cash discount provided the terms for the discounts as specified by the seller are met.

The discount columns in a three-column cash book are not part of the double entry system, they are just a memorandum to make the book tidy in recording receipts and payments where cash discounts have been given and received.

The total of the discount received column will be transferred to the credit side of the discount received account in the ledger, while the discount allowed account in the ledger will be debited with the total discount allowed.

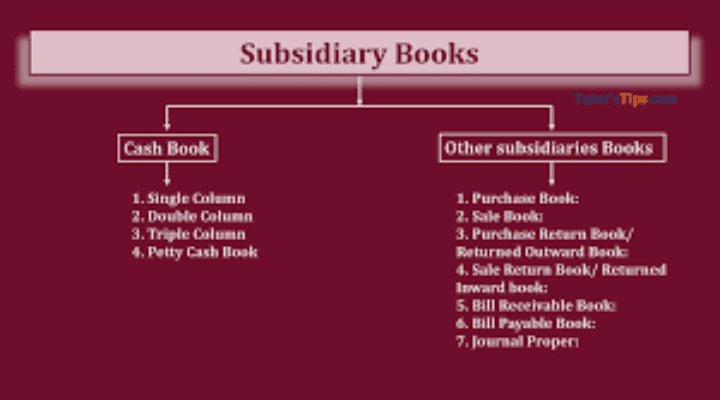

Read also: The Types and Uses of Subsidiary Books in Accounting

Petty Cash Book

Petty cash payments are small payments given out for some small expenses that occur almost on daily basis in an organization e.g. transportation, and fuel.

This arrangement is put in place to relieve the main cashier from attending to too numerous payments (big and small). Hence a junior cashier is usually designated as petty cashier to handle the payment of small expenses.

The cash provided for the petty cashier is called petty cash, while the book used to record the petty cash transactions is called petty cash book.

Petty Cash Imprest System

The petty cash imprest system operates when the main cashier gives the petty cashier enough money that is sufficient to cover petty expenses for a given time e.g. a week or a month.

At the end of the stated period, the petty cashier gives the details of how the money was used and gets a reimbursement or replenishment equal to the amount already spent from the main cashier.

By this system, the petty cashier will always have his imprest at any point in time made up of the amount already spent and the balance with him. With an imprest arrangement, the petty cashier balance at beginning of each period will always equal the imprest float.

The subsidiary book of accounts used to record cash and bank transactions in addition to discounts received and discount allowed is the three-column cash book.

It has both debit and credit sides which contains three columns for cash, bank, and discount on each side of the book. The petty cash book is used to record cash transactions that occur almost on daily basis such as fuel and transport.

In summary, the subsidiary books of accounts that are used to record cash and bank transactions including cash discount received and discount allowed, and the book used to record small payments that occur almost on daily basis were explained in this article.

The two subsidiary books namely three column cash book and the petty cash book were defined and discussed with appropriate questions including the relationship between petty cash and the imprest system.

Read also: The Types and Uses of Subsidiary Books in Accounting