Why Term Insurance Could Be the Right Choice for You

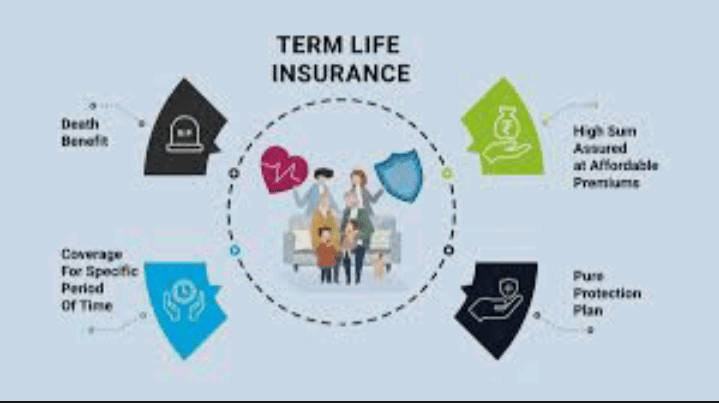

Term insurance is a type of life insurance that provides financial protection to the family members or beneficiaries of the insured person in case of their untimely demise during the policy term.

Unlike other types of life insurance policies, term insurance offers coverage for a specific period of time, ranging from one year to 30 years or more, depending on the policy term selected by the insured.

The key feature of term insurance is that it provides a large amount of coverage at a relatively low cost compared to other types of life insurance policies. This is because term insurance only pays out a death benefit if the insured dies within the policy term. If the policyholder survives the term, there is no payout.

The amount of coverage provided by term insurance depends on the premium paid by the insured and the policy term selected. The higher the premium paid, the higher the coverage amount. Similarly, the longer the policy term, the higher the coverage amount.

Term insurance policies are of different types such as level term insurance, decreasing term insurance, and increasing term insurance. Level term insurance provides a fixed amount of coverage throughout the policy term, whereas decreasing term insurance provides decreasing coverage over time. Increasing term insurance provides increasing coverage over time.

One of the benefits of term insurance is that it can be purchased online, making it easy for people to get the coverage they need without the hassle of visiting an insurance agent. Additionally, term insurance policies do not have any investment or savings component, which makes them a simple and straightforward form of life insurance.

Another advantage of term insurance is that it can be used to cover various financial obligations such as mortgages, education loans, and other debts. The death benefit paid out by the policy can be used to pay off these debts, relieving the burden from the insured’s family members.

Term insurance is a cost-effective way to provide financial protection to your family in case of your untimely death. It is a straightforward type of life insurance that can be purchased online and can be customized to meet your specific needs. If you are looking for a simple and affordable way to secure your family’s future, term insurance is definitely worth considering.

Read Also: All You Need To Know About Trade Insurance

Term Life Insurance

Life insurance is an essential financial tool that provides financial protection and security for your loved ones in case of your untimely death. It ensures that your family can continue to meet their financial obligations, such as mortgage payments, education expenses, and other everyday living costs, even if you are not around.

There are various types of life insurance policies, and one of the most popular is term life insurance.

What is Term Life Insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specified period, known as the term. If you pass away during the term, your beneficiaries will receive the death benefit specified in the policy. If you outlive the term, the policy expires, and there is no payout.

Term life insurance is typically less expensive than other types of life insurance, such as whole life insurance or universal life insurance. This is because term life insurance policies do not build cash value and only provide death benefit protection.

How Does Term Life Insurance Work?

When you purchase a term life insurance policy, you select the term or the length of time for which you want the coverage to remain in effect. Common term lengths are 10, 20, or 30 years. You also select the amount of the death benefit, which is the amount of money that will be paid to your beneficiaries if you pass away during the term.

The premiums you pay for term life insurance are typically level, meaning they stay the same throughout the term. This makes it easy to budget for your life insurance premiums because you know exactly how much you will need to pay each year.

If you pass away during the term, your beneficiaries will receive the death benefit tax-free. They can use the funds to pay for expenses such as funeral costs, outstanding debts, or daily living expenses.

Advantages of Term Life Insurance

There are several advantages of term life insurance, including:

Affordability: Term life insurance is typically less expensive than other types of life insurance because it only provides death benefit protection and does not accumulate cash value.

Flexibility: You can select the term length and the amount of the death benefit that best suits your needs and budget.

Temporary Coverage: Term life insurance can provide coverage for a specific period, such as while you have a mortgage or while your children are still dependents.

Easy to Understand: Term life insurance is straightforward and easy to understand. You pay premiums for a specific term, and if you pass away during the term, your beneficiaries receive the death benefit.

Disadvantages of Term Life Insurance

There are also a few disadvantages of term life insurance, including:

No Cash Value: Unlike other types of life insurance, term life insurance policies do not build cash value, so you cannot borrow or withdraw money from the policy.

Limited Term: Term life insurance only provides coverage for a specific period, and if you outlive the term, the policy expires, and you do not receive a payout.

No Investment Component: Unlike permanent life insurance policies, which have an investment component, term life insurance policies only provide death benefit protection.

Term life insurance is a popular type of life insurance that provides affordable, temporary coverage for a specified period. It is an excellent option for individuals who want to ensure their loved ones are protected financially in case of their untimely death.

When selecting a life insurance policy, it is important to consider your needs and budget carefully. If you are unsure which type of life insurance policy is right for you, consult a financial professional.

Read Also: The Basics of Landlord Insurance

Term Life Policy Benefits

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from one to thirty years. The policy pays out a death benefit to the policyholder’s beneficiaries if the policyholder passes away during the term of the policy.

Term life insurance is popular because it offers affordable coverage for a set period. The premiums for term life insurance policies are generally lower than those for permanent life insurance policies, which makes term life insurance an attractive option for people who want to ensure that their loved ones are financially protected in the event of their death.

Term life insurance policies are renewable and convertible, which means that policyholders have the option to renew their policy at the end of the term or convert their policy into a permanent life insurance policy.

Renewing a policy typically means that the policyholder will pay higher premiums, as they will be older and may have health issues that make them riskier to insure. Converting a policy into a permanent life insurance policy allows the policyholder to maintain coverage for life, but the premiums will be higher than those for a term life insurance policy.

One of the advantages of term life insurance policies is their flexibility. Policyholders can choose the length of the term that best suits their needs, whether it’s ten years, twenty years, or thirty years. This allows policyholders to tailor their coverage to their specific circumstances.

For example, if a policyholder has young children, they may opt for a twenty-year term policy to ensure that their children are financially protected until they are adults.

Another advantage of term life insurance policies is their simplicity. Unlike permanent life insurance policies, which can be complex and involve investment components, term life insurance policies are straightforward.

They provide coverage for a set period, and if the policyholder passes away during that period, their beneficiaries receive the death benefit. This simplicity makes it easier for people to understand what they’re buying and ensures that there are no surprises when it comes to policy payouts.

While term life insurance policies offer many benefits, they do have some limitations. For example, once the term of the policy has expired, the policyholder no longer has coverage. If the policyholder wants to maintain coverage, they will need to renew the policy or convert it to a permanent life insurance policy, which can be expensive.

Additionally, term life insurance policies do not build cash value, which means that policyholders cannot borrow against the policy or use it as an investment.

In conclusion, term life insurance policies provide affordable and flexible coverage for a set period. They are a popular option for people who want to ensure that their loved ones are financially protected in the event of their death.

However, term life insurance policies do have some limitations, and policyholders should carefully consider their options before purchasing a policy.

Read Also: Determination of Body Weight in Small Ruminants